So this is my 42nd blog post of the year and the 8th where I have referenced Cory Doctorow. Thought it was more to be honest, so influential has he been on my thought, particularly as I have delved deeper into what, how and why the AI Rush is proceeding and what it means for the people exiting universities over the next few years.

Yesterday Cory published a reminder of his book reviews this year. He is an amazing book reviewer. There are 24 on the list this year, and I want to read every one of them on the strength of his reviews alone.

I would like to repay the compliment by reviewing his latest book: Enshittification (the other publication this year – Picks and Shovels – is also well worth your time by the way). Can’t believe this wasn’t the word of the year rather than rage bait, as it explains considerably more about the times we are living in.

I have been a fan of Doctorow for a couple of years now. I had had Walkaway sat on my shelves for a few years before I read it and was immediately enthralled by his tale of a post scarcity future which had still somehow descended into an inter-generational power struggle hellscape. I moved on to the Little Brother books, now being reenacted by Trump with his ICE force in one major US city after another. Followed those up with The Lost Cause, where the teenagers try desperately to bridge the gap across the generations with MAGA people, with tragic results along the way but a grim determination at the end “the surest way to lose is to stop running”. From there I migrated to the Marty Hench thrillers, his non-fiction The Internet Con (which details the argument for interoperability, ie the ability of any platform to interact with another) and his short fiction (I loved Radicalised, not just for the grimly prophetic Radicalised novella in the collection, but also the gleeful insanity of Unauthorised Bread). I highly recommend them all.

I came to Enshittification after reading his Pluralistic blog most days for the last year and a half, so was initially disappointed to find very little new as I started working my way through it. However what the first two parts – The Natural History and The Pathology – are is a patient explanation of the concept of enshittification and how it operates assuming no previous engagement with the term, all in one place.

Enshittifcation, as defined by Cory Doctorow, proceeds as follows:

- First, platforms are good to their users.

- Then they abuse their users to make things better for their business customers.

- Next, they abuse those business customers to claw back all the value for themselves.

- Finally, they have become a giant pile of shit.

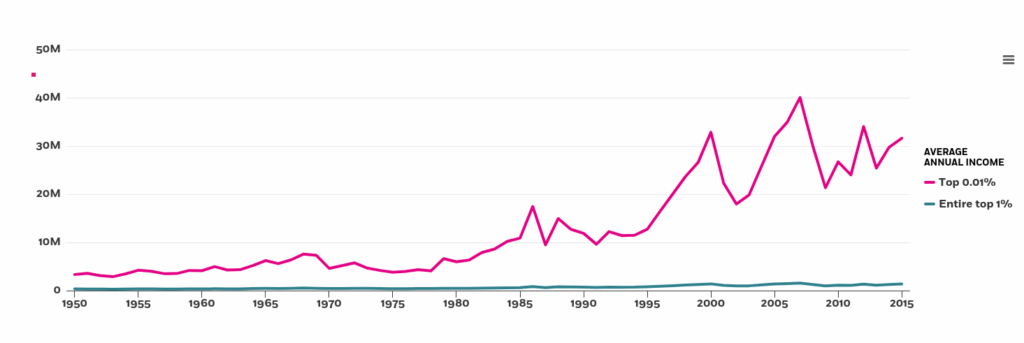

So far, so familiar. But then I got to Part Three, explaining The Epidemiology of enshittification, and the book took off for me. The erosion of antitrust (what we would call competition) law since Carter. “Antitrust’s Vietnam” (how Robert Bork described the 12 years IBM fought and outspent the US Department of Justice year after year defending their monopolisation case) until Reagan became President. How this led to an opening to develop the operating system for IBM when it entered the personal computer market. How this led to Microsoft, etc. Then how the death of competition also killed Big Tech regulation ( regulating a competitive market which acts against collusion is much easier than regulating one with a small number of big players which absolutely will collude with each other).

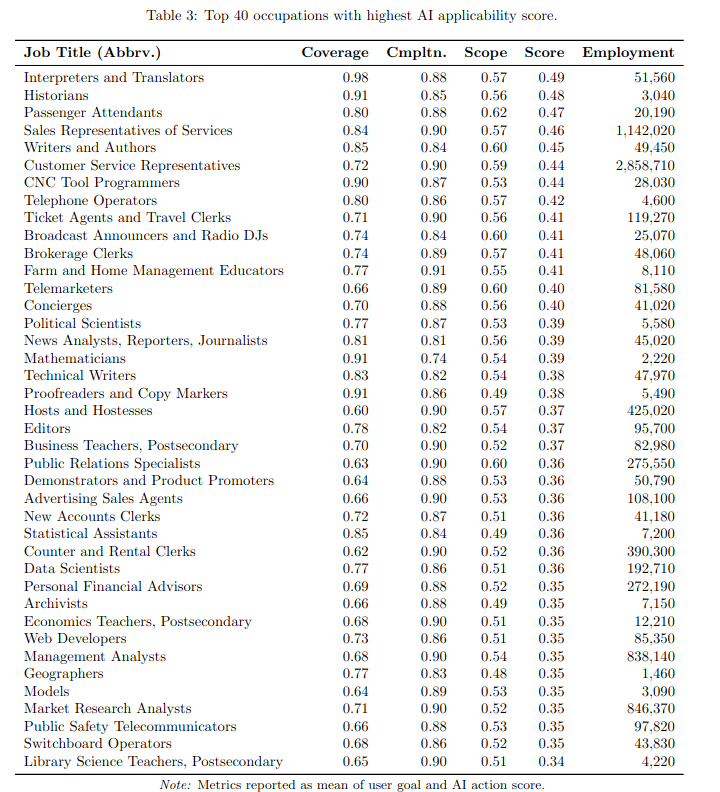

And then we get to my favourite chapter of the book “Reverse-Centaurs and Chickenisation”. Any regular reader of this blog will already be familiar with what a reverse centaur is, although Cory has developed a snappy definition in the process of writing this book:

A reverse-centaur is a machine that uses a human to accomplish more than the machine could manage on its own.

And if that isn’t chilling enough for you, the description of the practices of poultry packers and how they control the lives of the nominally self-employed chicken farmers of the US, and how these have now been exported to companies like Amazon and Arise and Uber, should certainly be. The prankster who collected up the bottled piss of the Amazon drivers who weren’t allowed a loo break and resold it on Amazon‘s own platform as “a bitter lemon drink” called Release Energy, which Amazon then recategorised as a beverage without asking for any documentation to prove it was fit to drink and then, when it was so successful it topped their sales chart, rang the prankster up to discuss using Amazon for shipping and fulfillment – this was a rare moment of hilarity in a generally sordid tale of utter exploitation. My favourite bit is when he gets on to the production of his own digital rights management (DRM) free audio versions of his own books.

The central point of the DRM issue is, as Cory puts it, “how perverse DMCA 1201 is”:

If I, as the author, narrator, and investor in an audiobook, allow Amazon to sell you that book and later want to provide you with a tool so you can take your book to a rival platform, I will be committing a felony punishable by a five-year prison sentence and a $500,000 fine.

To put this in perspective: If you were to simply locate this book on a pirate torrent site and download it without paying for it, your penalty under copyright law is substantially less punitive than the penalty I would face for helping you remove the audiobook I made from Amazon’s walled garden. What’s more, if you were to visit a truck stop and shoplift my audiobook on CD from a spinner rack, you would face a significantly lighter penalty for stealing a physical item than I would for providing you with the means to take a copyrighted work that I created and financed out of the Amazon ecosystem. Finally, if you were to hijack the truck that delivers that CD to the truck stop and steal an entire fifty-three-foot trailer full of audiobooks, you would likely face a shorter prison sentence than I would for helping you break the DRM on a title I own.

DMCA1201 is the big break on interoperability. It is the reason, if you have a HP printer, you have to pay $10,000 a gallon for ink or risk committing a criminal offence by “circumventing an access control” (which is the software HP have installed on their printers to stop you using anyone else’s printer cartridges). And the reason for the increasing insistence on computer chips in everything from toasters (see “Unauthorised Bread” for where this could lead) to wheelchairs – so that using them in ways the manufacturer and its shareholders disapprove of becomes illegal.

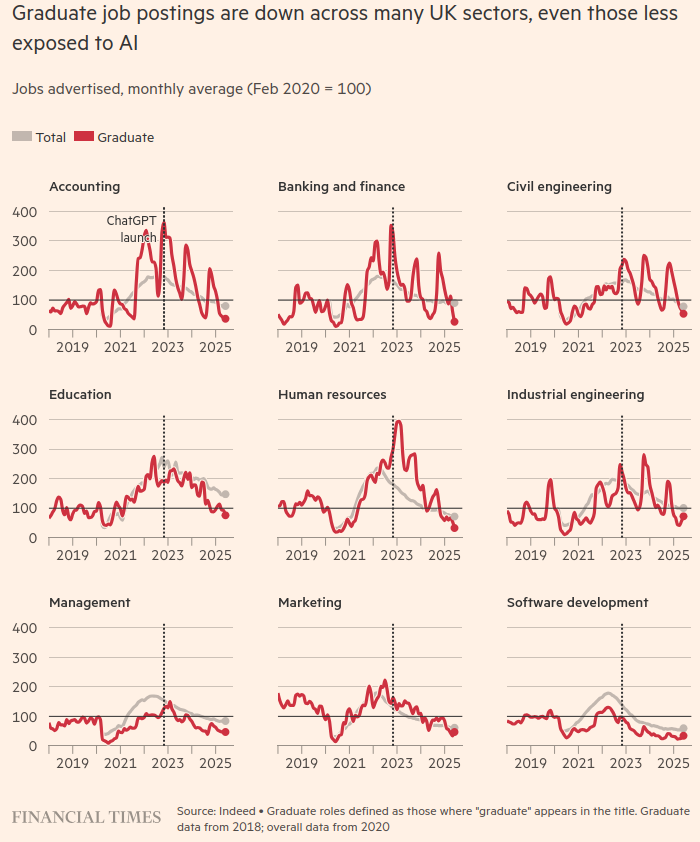

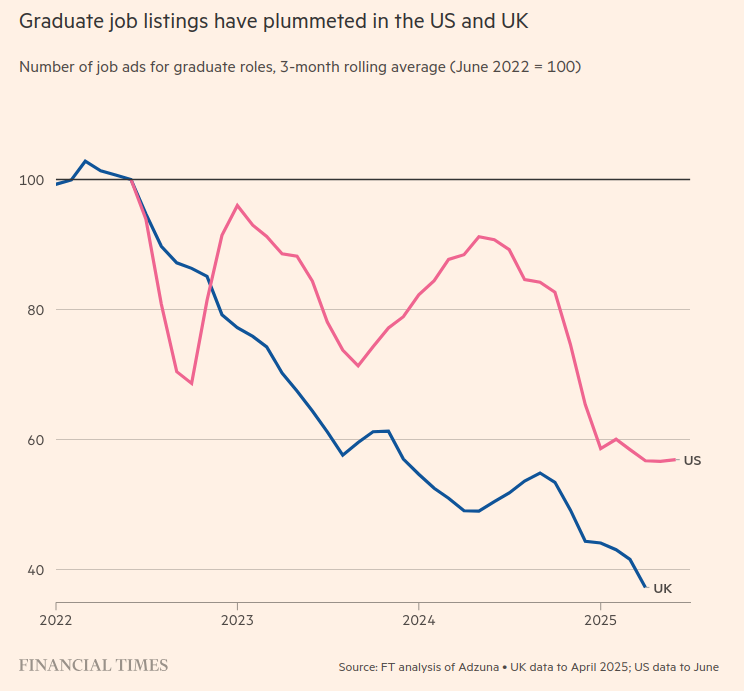

The one last bastion against enshittification by Big Tech was the tech workers themselves. Then the US tech sector laid off 260,000 workers in 2023 and a further 100,000 in the first half of 2024.

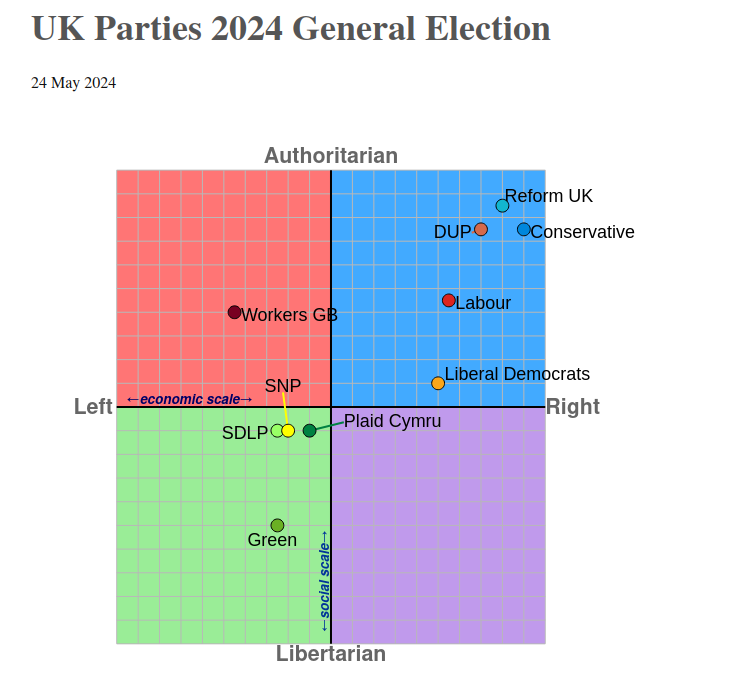

In case you are feeling a little depressed (and hopefully very angry too) at this stage, Part 4 is called The Cure. This details the four forces that can discipline Big Tech and how they can all be revived, namely:

- Competition

- Regulation

- Interoperability

- Tech worker power

As Cory concludes the book:

Martin Luther King Jr once said, “It may be true that the law cannot make a man love me, but it can stop him lynching me, and I think that’s pretty important, also.”

And it may be true that the law can’t force corporate sociopaths to conceive of you as a human being entitled to dignity and fair treatment, and not just an ambulatory wallet, a supply of gut bacteria for the immortal colony organism that is a limited liability corporation.

But it can make that exec fear you enough to treat you fairly and afford you dignity, even if he doesn’t think you deserve it.

And I think that’s pretty important.

I was reading Enshittification on the train journey back from Hereford after visiting the Hay Winter Weekend, where I had listened to, amongst others, the oh-I’m-totally-not-working-for-Meta-any-more-but-somehow-haven’t-got-a-single-critical-word-to-say-about-them former Deputy Prime Minister Nick Clegg. While I was on the train, a man across the aisle had taken the decision to conduct a conversation with first Google and then Apple on speaker phone. A particular highlight was him just shouting “no, no, no!” at Google‘s bot trying to give him options. He had already been to the Vodaphone shop that morning and was on his way to an appointment which he couldn’t get at the Apple Store on New Street in Birmingham. He spotted the title of my book and, when I told him what enshittification meant, and how it might make some sense out of the predicament he found himself in, took a photo of the cover.

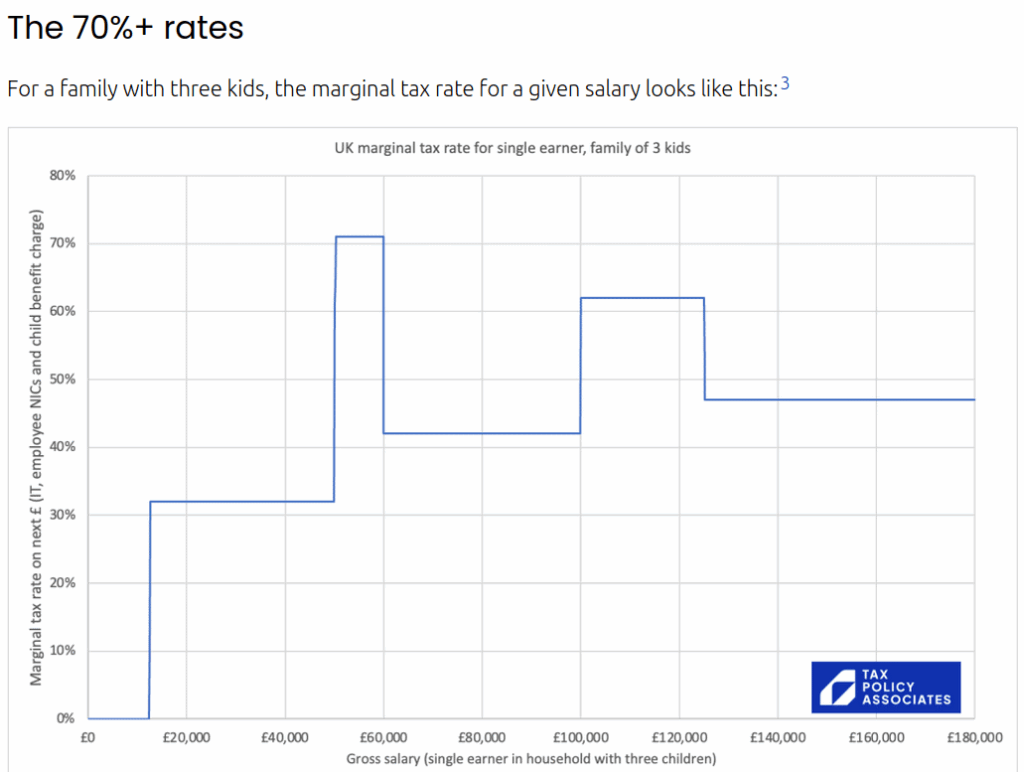

My feeling is that enshittification goes beyond Big Tech. It is the defining industrial battle of our times. We shouldn’t primarily worry about whether it is coming from the private or the public sector, as enshittification can happen in both places: from hollowing out justice to “paying more for medicines… at the exact moment we can’t afford to pay enough doctors to prescribe them” in the public sector, where we already reside within the Government’s walled garden, to all of the outrages mentioned above and more in the private sector.

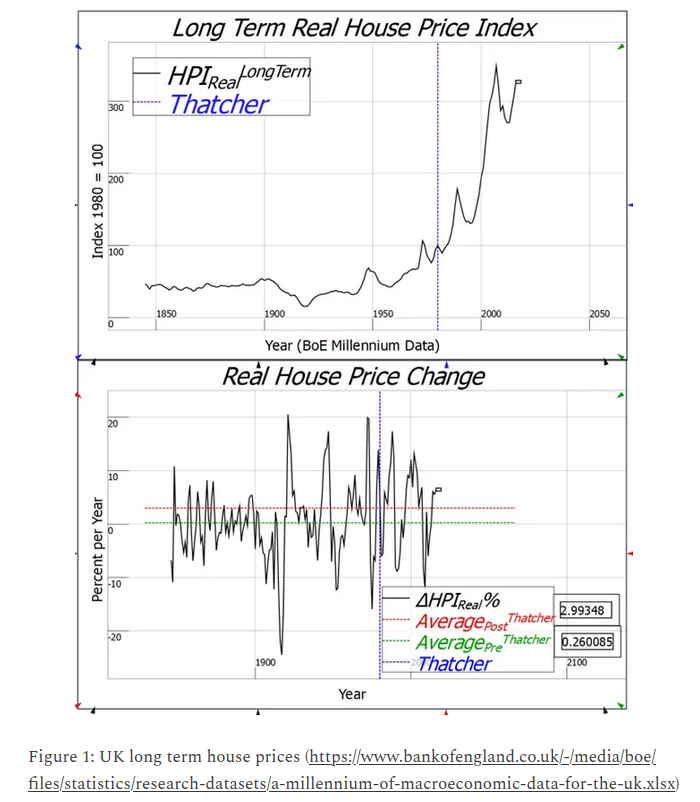

The PFI local health hubs set out in last week’s budget take us back to perhaps the ultimate enshittificatory contracts the Government ever entered into, certainly before the pandemic. The Government got locked into 40 year contracts, took all the risk, and all the profit was privatised. The turbo-charging of the original PFI came out of the Blair-Brown government’s mania for keeping capital spending off the balance sheet in defence of Gordon Brown’s “Golden Rule” which has now been replaced by Rachel Reeves’ equally enshittifying fiscal rules. All the profits (or, increasingly, rents, as Doctorow discusses in the chapter on Varoufakis’ concept of Technofeudalism) from turning the offer to shit always seem to end up in the private sector. The battle is against enshittification from both private and, by proxy, via public monopolies.

Enshittification is, ultimately, a positive and empowering book which I strongly recommend you buy, avoiding Amazon if you can. We can have a better internet than this. We can strike a better deal with Big Tech over how we run our lives. But the surest way to lose is to stop running.

And next time a dead-eyed Amazon driver turns up at your door, be nice, they are probably having a worse day than you are.