On 23 March 2018, Universities UK (UUK), the universities’ employer body, issued an offer to the University and College Union (UCU) to end the Universities Superannuation Scheme (USS) pensions dispute. The UCU agreed to put it to their members and, on 13 April, announced that the proposals had been accepted by a margin of around 2 to 1. The main proposals, as summarised by Sally Hunt the UCU general secretary, revolved around the setting up of a Joint Expert Panel (JEP).

On 23 March 2018, Universities UK (UUK), the universities’ employer body, issued an offer to the University and College Union (UCU) to end the Universities Superannuation Scheme (USS) pensions dispute. The UCU agreed to put it to their members and, on 13 April, announced that the proposals had been accepted by a margin of around 2 to 1. The main proposals, as summarised by Sally Hunt the UCU general secretary, revolved around the setting up of a Joint Expert Panel (JEP).

The JEP’s members were proposed by UUK and UCU – Ronnie Bowie, Sally Bridgeland and Chris Curry were proposed by UUK (two actuaries and the Director of the Pensions Policy Institute respectively). UCU proposed Saul Jacka (professor of statistics at the University of Warwick and a Turing fellow at the Alan Turing Institute), Deborah Mabbett (professor of public policy at Birkbeck) and Catherine Donnelly (associate professor at Heriot-Watt University, where she heads up a unit focusing on pensions, investment and insurance research). The Chair is Joanne Segars, a well respected and very experienced former CEO of the Pensions and Lifetime Savings Association (PLSA) who had most recently been working with the Local Government Pension Scheme.

The Terms of Reference of the JEP were also published, which stated that the purpose of the panel was to:

- make an assessment of the 2017 valuation;

- focus in particular on reviewing the basis of the scheme valuation, assumptions and associated tests; and

- agree key principles to underpin the future joint approach of UUK and UCU to the valuation of the USS fund.

They also stated that the panel would take into account:

- the unique nature of the HE sector, intergenerational fairness and equality considerations;

- the clear wish of staff to have a guaranteed pension comparable with current provision whilst meeting the affordability challenges for all parties; and

- the current regulatory framework.

All of the bits relating to the 2017 valuation were reported on in September 2018, with recommendations from the JEP on ways of bringing the total contribution rate below 30% of pensionable pay.

In response to this, the USS Trustee made a proposal for concluding the 2017 valuation and preparing a 2018 valuation which could more fully take account of the JEP recommendations. This was accepted by UUK after a reduction in deficit reduction contributions from 6% to 5% was made and finally by the Pensions Regulator here, which noted that the proposal for the 2017 valuation is at the very limit of what TPR finds acceptable as it would see the Scheme carry higher levels of risk than we would consider manageable for a ‘tending to strong’ covenant.

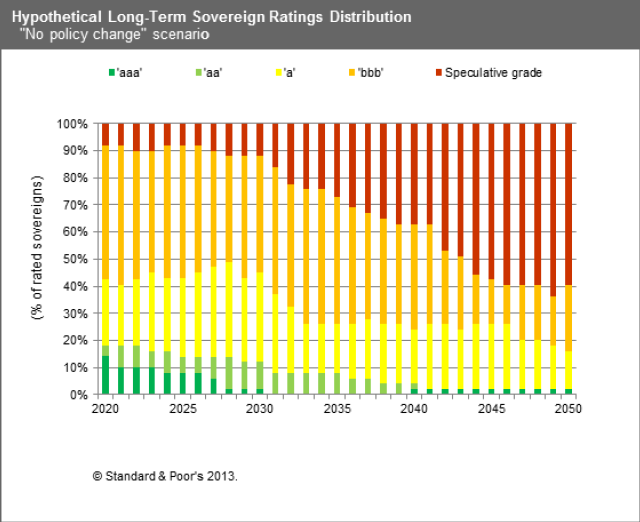

The 2018 valuation process has been proceeding at pace, with the USS Trustee proposal following the consultation response from UUK of 3 options for future contribution patterns leading to indicative agreement from UUK for the third option of a total contribution rate of 30.7% from October 2019 and a further valuation in 2020. Following the September 2018 report, the JEP is working on a follow up report for September 2019 in relation to the USS valuation process in general. The second phase of work on the USS valuation has two parts; the first is concerned with the valuation process and governance, the second with the long-term sustainability of the scheme.

UCU have rejected all 3 options and set out a timetable for ballots on industrial action from 9 September in the event of any agreement which does not represent no detriment to members, ie no reduction in benefits or increase in employee contributions from the 8% level they were at before 1 April 2019. The JEP have suggested (while accepting that their numbers are indicative only, without detailed modelling) that, if all the measures they propose were adopted, the contribution rate could be reduced to 29.2%, split 20.1% employer and 9.1% employee in accordance with the cost sharing agreement. This compares with the USS Option 3 proposal of a split of 21.1% employer and 9.6% employee.

The UCU position looks a long way from the one that the Trustee and UUK appear to be edging towards, and I fear that a strike ballot may therefore be inevitable.

However, I think there is an equally important area mentioned in the JEP report where USS can radically improve how its members engage with a scheme which will be, for most, their major source of income in retirement.

How USS engages with its members

In their report the JEP, rightly I think, devoted several pages to member involvement in the valuation process, information and transparency and building trust and confidence, matters which will be a particular focus of their second report. They observed that:

- longer consultation periods, initiated at an earlier stage, could facilitate member involvement via universities’ internal processes, which might help to build confidence in the valuation and a shared sense of ownership – helping to avoid future, damaging, industrial disputes.

- there is no formal, scheme-wide mechanism for involving members in the valuation process or for assessing their appetite for changes to the Scheme

- for future valuation cycles it will be important that the Trustee and Scheme Actuary interact more, at an earlier stage, with all stakeholders, particularly with regard to setting valuation assumptions and expectations

- lack of understanding is likely to have contributed to falling levels of member confidence in the Scheme. It might be helpful for the Scheme to provide simple-to-understand guides which use clearly defined terminology to aid the understanding of the majority of Scheme members

- the lack of trust in the valuation process and the Scheme has given rise to a view, albeit not a universal one, that USS is not being as open as it could be with stakeholders….whilst observing the need for confidentiality…the Panel suggests the Trustee may wish to consider how to share more of the information currently deemed confidential, eg on a redacted basis or in a summarised form. This would aid understanding of the valuation process…and, importantly, help rebuild confidence in the Scheme and its governance.

I would take such suggestions a step further, as I believe much of this communication would be wasted within the current adversarial environment, and indeed would be likely to be “spun” by one side or the other. It is clear that there is little trust in the USS Trustee on the part of the UCU officers. However, the ability of the 21,685 (out of 24,707 total votes) who voted to strike and then the 21,683 (out of 33,973 total votes) who voted to end the strike to determine what could or could not happen to a scheme with 396,278 members (as at 31 March 2017, 190,546 of them active) was, I think, unhelpful to the process of achieving a consensus more generally. Engagement needs to go much further than negotiations between UUK and UCU during valuation processes. USS does need to do far far more, in conjunction with the UCU and others, to engage members to help them understand their finances first before launching into what can be fairly abstract pensions discussions even for university professors.

The good news is that the membership have become much more aware of their pension scheme, mainly as a result of last year’s industrial action, and, being the inquisitive people they are, will I am sure now be looking for a higher degree of information (and education) from their pension provider about their benefit provision in future.

As the Pensions Policy Institute and many others have been saying for years, the decisions we are asking people to make are complex and subject to many different influences and biases. These decisions can be helped enormously if more care is taken in the nature and timing of how members are communicated with. Members will not value benefits they don’t understand and ultimately this scheme is only going to work in the long term if the people in it are trusted to be part of the decisions about its future.

I applaud the use of an open blog but it’s obvious that there’s a bit of a problem here! Perhaps, to avoid this becoming sidetracked, you could introduce a drop-down in the comment section so that people could select what aspect of DA reform or the consultation their comment relates to – and if their comment relates instead to concerns about their accrued benefits, you could redirect them to a separate specialised member queries page?