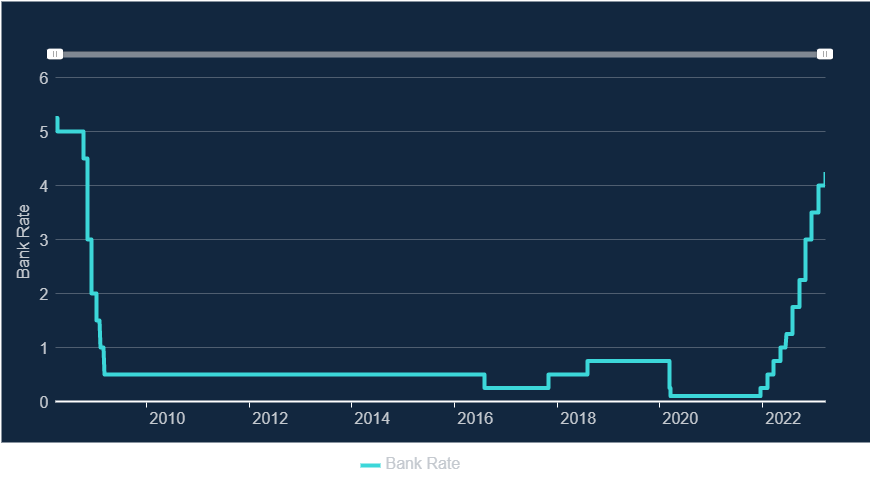

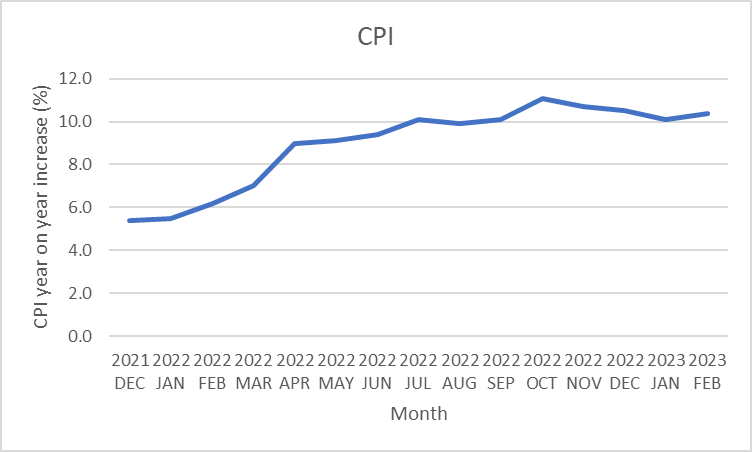

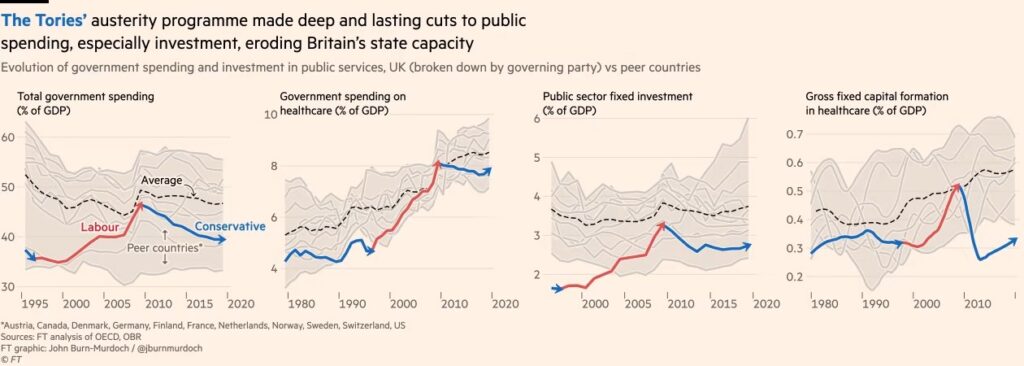

OK I am talking about satisfaction with the NHS a little bit, as it was all over the media yesterday. Just 29% satisfaction compared to 70% in 2010, with the chart above helpfully showing the precipitous decline since then. Does that remind you of another set of graphs I put up not too long ago?

In fact this was only a headline as the Kings Fund and Nuffield Trust had just issued their analysis of the NHS-related bits of British Social Attitudes Survey Number 39, which had originally been published in October, and was itself based on data collected between September and October 2021. However it is an impressive survey overall, with 44,000 households taking part (you can find the full technical details of the survey here).

What is very clear is that the nation is changing fast. Some things are not – a slender majority in favour of increasing taxes and spending more on health, education and social benefits has remained almost static since pre pandemic and all of the averages conceal very polarised views between Brexiteers and Remainers, the different communities in Scotland and Northern Ireland, and particularly between Londoners and the rest of the UK.

This looks like it is beginning to be recognised, with a big increase in the proportion agreeing that working people do not get their fair share of the nation’s wealth (up to 67% compared to 57% in 2019) and, for the first time, a slim majority in favour of moving to proportional representation.

Only 17% say it is very important for being truly British to have been born in Britain, which is down from 48% in 1995, which feels like a sea change in attitudes towards immigration to me.

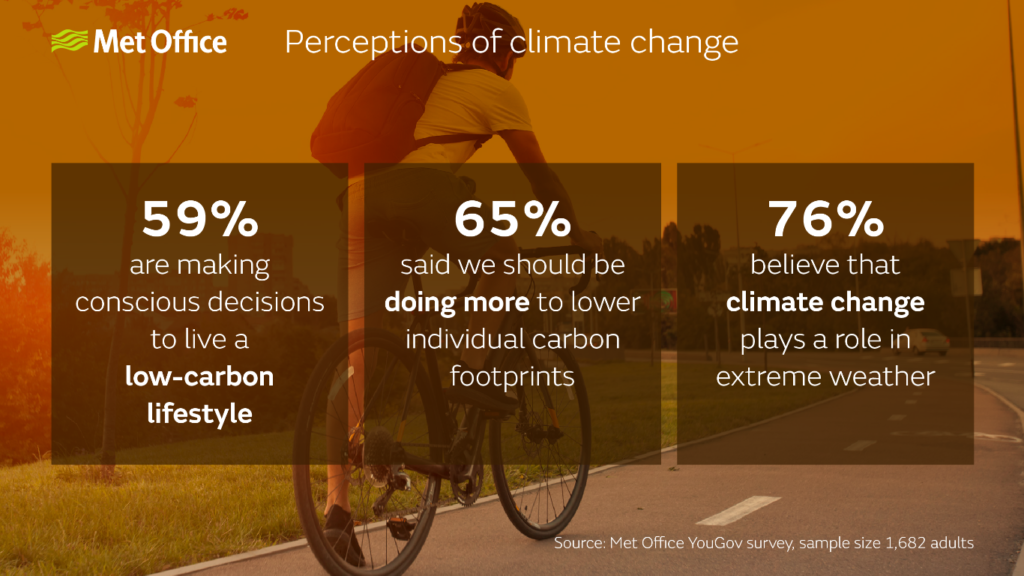

And then we turn to the environment. Rather echoing the Met Office research I highlighted recently, 45% view climate change as the most important environmental issue, compared with only 19% in 2010, with 40% of the population very concerned about the environment, compared with 22% in 2010.

Which brings us to two climate stories in quick succession.

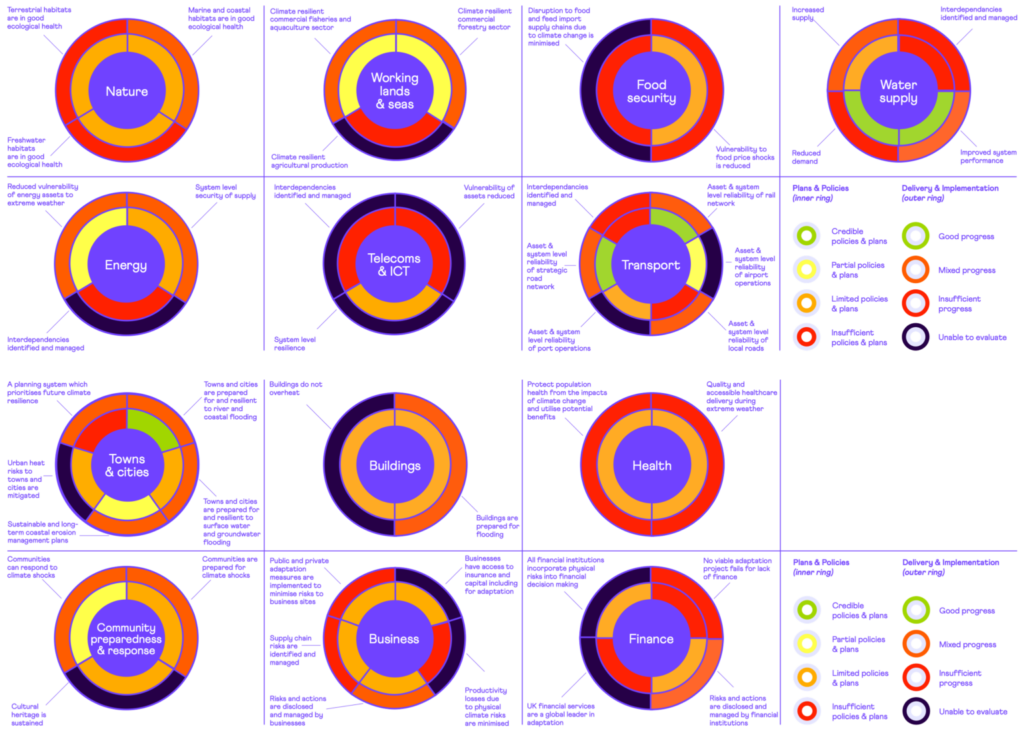

The first was yesterday, when the Committee for Climate Change, appointed to assess the Government’s progress against its own commitments on climate change, gave its 2023 report to Parliament on England’s progress in building climate resilience across the economy – and the extent of policies and delivery to meet them. It was not a positive assessment.

What they found was:

There is a striking lack of climate preparation from Government:

- Policies and plans. Despite some evidence of improved sectoral planning by Government for key climate risks, ‘fully credible’ planning for climate change – where nearly all required policy milestones are in place – is only found for five of the 45 adaptation outcomes examined in this report.

- Delivery and implementation. In none of the 45 adaptation outcomes was their sufficient evidence that reductions in climate exposure and vulnerability are happening at the rates required to manage risks appropriately. For around one-quarter of outcomes, available indicators show insufficient evidence of progress.

Baroness Brown, Chair of the Adaptation Committee, went further:

The Government’s lack of urgency on climate resilience is in sharp contrast to the recent experience of people in this country. People, nature and infrastructure face damaging impacts as climate change takes hold. These impacts will only intensify in the coming decades.

This has been a lost decade in preparing for and adapting to the known risks that we face from climate change. Each month that passes without action locks in more damaging impacts and threatens the delivery of other key Government objectives, including Net Zero. We have laid out a clear path for Government to improve the country’s climate resilience. They must step up.

By coincidence, today is the Government’s Energy Security Day, backed by a report called Powering Up Britain. This follows a High Court ruling last October which found that, when they signed off their carbon strategy, they didn’t have the legally required information on how carbon budgets would be met. The article went on to say:

Ten million tonnes of carbon could be illegally unleashed in the mid-2030s as a result. Doubt was also shed on the 95 per cent of the sixth carbon budget that was accounted for in the government’s estimates.

Mr Justice Holgate also ruled that the strategy breached the Climate Change Act by failing to provide enough detail on the emissions savings, leaving parliament and the public in the dark.

Originally called Green Day, but presumably dropped after Jeremy Hunt’s comments about not wanting to be an American Idiot, the Energy Security Day has highlighted the following Government priorities:

- Energy security: setting the UK on a path to greater energy independence.

- Consumer security: bringing bills down, and keeping them affordable, and making

wholesale electricity prices among the cheapest in Europe. - Climate security: supporting industry to move away from expensive and dirty fossil

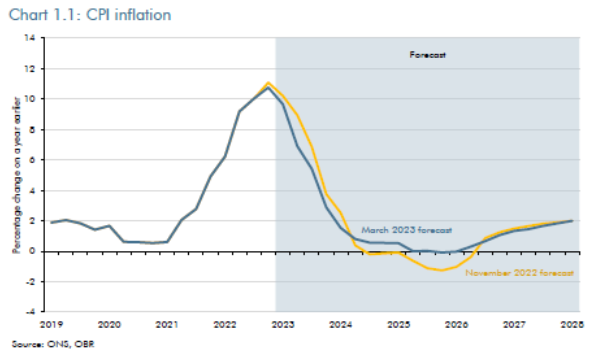

fuels. - Economic security: playing our part in reducing inflation and boosting growth,

delivering high skilled jobs for the future.

Further analysis at this stage has not been made easy by the way that the Government has released details. Chris Stark, the Chief Executive of the Committee for Climate Change has described it on Twitter as “government by press release”, ie

The government now adopts this communications strategy regularly: press release the night before – published documents later. It gives them two bites of the press coverage.

But it makes it hard for a statutory organisation like @theCCCuk, with legal duties, to comment.

Others have been less constrained in their response. The main criticisms are that many of the policies presented in the report have been announced previously, that there is no significant increase in support for home insulation and that the focus on carbon capture and storage (CCS) is out of all proportion given the long-standing difficulties of scaling up the technology.

The BBC quote Bob Ward, policy director at the Grantham Research Institute on Climate Change at LSE:

What does not make sense is to carry on with further development of new fossil fuel reserves on the assumption CCS will be available to mop up all the additional emissions.

I had an initial skim of the report looking for what was planned for heat pumps, which regular readers of this blog will know I have some history with. I found this:

The Government has an ambition to phase out all new and replacement natural gas boilers by 2035 at the latest and will further consider the recommendation from the Independent Review of Net Zero in relation to this. People’s homes will be heated by British electricity, not imported gas. The Heat Pump Investment Accelerator will mean heat pumps are manufactured in the UK at a scale never seen before. We want to make it as cheap to buy and run a heat pump as a gas boiler by extending the Boiler Upgrade Scheme by three years, and by rebalancing the costs of electricity and gas.

So reading between the hype, they are going to invest £30 million in heat pump manufacture in the UK, which they claim will attract £270 million of “private investment into manufacturing and associated supply chains”.

The other parts are:

- Committing to extending the £5,000 grant for another three years (which is less than the difference between the cost of installing a heat pump and a gas boiler currently in many cases, although this may change if schemes like the recently announced Octopus pilot become more widely adopted).

- The “Clean Heat Market Mechanism” which is supposed to encourage the installation of low carbon heating appliances.

- A consultation to shift green levies off electricity and on to gas bills.

The country is changing fast. The Government needs to be more transformational than this to keep up. Or, in Baroness Brown’s words, step up!