Disclaimer: I support Liverpool FC, so it is entirely possible that the following may be a slightly skewed account of recent football history and its implications.

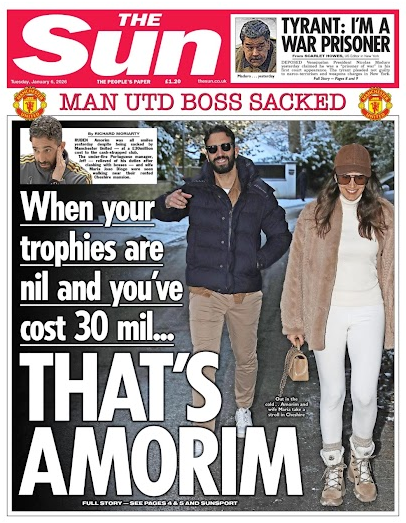

Last week Manchester United sacked their manager after 14 months. Since Alex Ferguson left in the summer of 2013, United have now had 10 different managers (it was announced this week that Michael Carrick was coming back for a second bash at caretaker manager).

This is despite the fact that it is very difficult to establish whether changing managers helps, with most studies citing how many different factors are at play. One masters dissertation concludes that, although it may produce a short term boost, it is generally not enough to save a club from relegation from the Premier League. So why do it?

Surprisingly this leads us into something called Ritual Scapegoating Theory, first cited at least 60 years ago as a possible explanation for managerial succession in baseball. So changing manager may or may not make much difference to performance, but it does make everyone feel better.

And it may be that the catharsis of sacking a Special One every season or so is making Manchester United supporters feel better than the two FA Cups, two League Cups and a Europa League win (that they have managed in the 13 years since Ferguson left) have. In that time Liverpool, with just three managers, have won two Premier League titles and a Champions League, UEFA Super Cup and Club World Cup as well as an FA Cup and two League Cups. Manchester City, with just two managers in that time, have won seven Premier League titles, a Champions League, UEFA Super Cup and Club World Cup as well as two FA Cups and six League Cups.

In the previous 27 years when Manchester United had just one manager, they won 13 League titles, two Champions Leagues, five FA Cups, four League Cups, and the UEFA Europa League, Super Cup and Cup Winners’ Cup, and the FIFA Club World Cup and the Intercontinental Cup. The lesson Manchester United have learned from this apparently is not that they need to minimise manager turnover.

Chelsea are even worse. They have had 13 different managers over the same period. They sacked the current England manager Thomas Tuchel after just 20 months despite him winning them the UEFA Champions League, Super Cup and Club World Cup. They sacked Enzo Maresca after just 18 months despite him winning them the UEFA Conference League and the Club World Cup. That appears to be catharsis on steroids.

Now this doesn’t matter very much when it is just about baseball or football. Despite what Bill Shankly said, life and death and our politics more generally are much more important than football. My fear is that the view that we need to sack someone whenever we don’t get the result we want immediately is leaching out of football into everything else.

Nigel Farage’s favourite phrase appears to be that “Heads must roll”. He has deployed it about the head of children’s services in Rotherham over three children being removed from their foster families in 2012, the whole of the NatWest board when he was refused a Coutts account in 2023, unspecified individuals from Essex Police managing the demonstrations outside an Epping hotel last year, and also last year again feeling that some head rolling was in order in response to the Government’s national inquiry into grooming gangs.

Meanwhile Kemi Badenoch said in 2024 of civil servants “There is about 5 per cent to 10 per cent of them who are very, very bad. You know, ‘should be in prison’ bad”. Last week she called for the Chief Constable of West Midlands Police to go over the decision to ban fans of Maccabi Tel Aviv from the Aston Villa ground for their Champions League match in November (which, hilariously, now appears to have been, at least partly, influenced by how badly Maccabi Tel Aviv supporters behaved at an entirely fictional game against West Ham United). Also in November, she called for the people involved in making the Panorama documentary about the Capitol Riots, to be sacked (another “heads should roll” headline). Also in November, she decided other BBC “heads must roll” over the decision to uphold complaints and reprimand a newsreader for altering her script from “pregnant people” to “pregnant women” on camera in a piece about groups most at risk during UK heatwaves.

It feels like the footballisation of public life. Farage and Badenoch are routinely reported as furious about something or other, in addition to the frequent demands for sackings, nearly always of public servants. They can clearly see there are votes in it, but the effects of this continuous vilification of public services and the people running them go way beyond that.

The immediate effect is often to make someone’s job untenable. So both the NatWest and Coutts CEOs left after the Farage complaint. The BBC’s Director General and BBC News Chief Executive both left soon after the Badenoch complaint. Now these are all comfortably off individuals who will no doubt be fine, but the impact on an organisation of the idea that any of its leaders could be hounded out at any moment, not through any regulatory process or indeed any process at all, but by someone in politics with a big mouth can be seen increasingly in our public institutions.

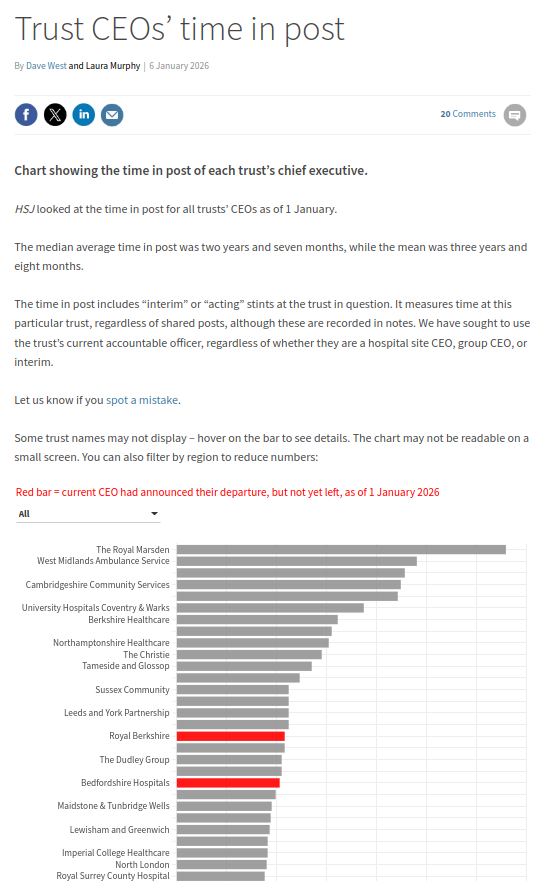

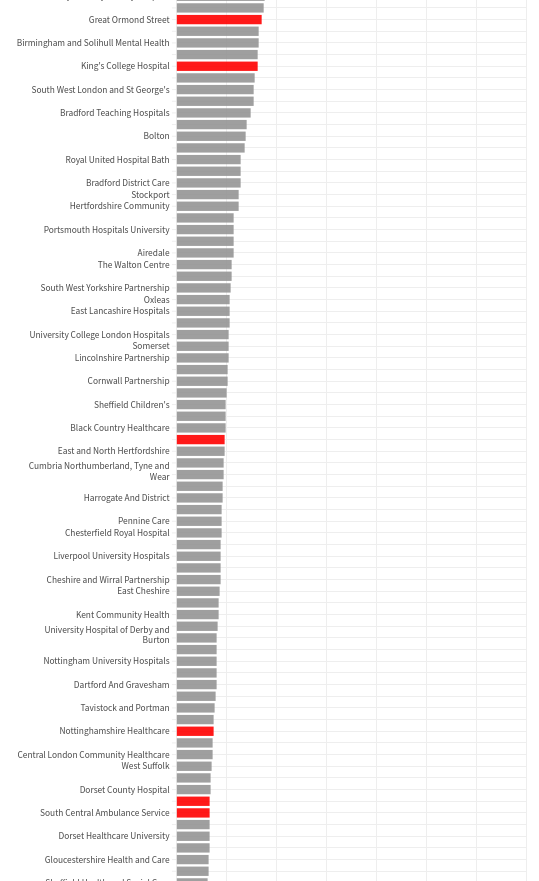

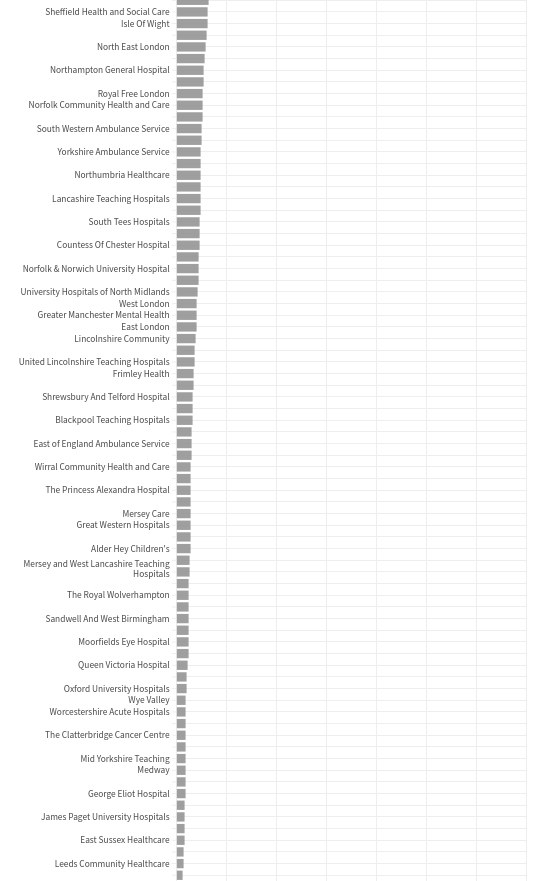

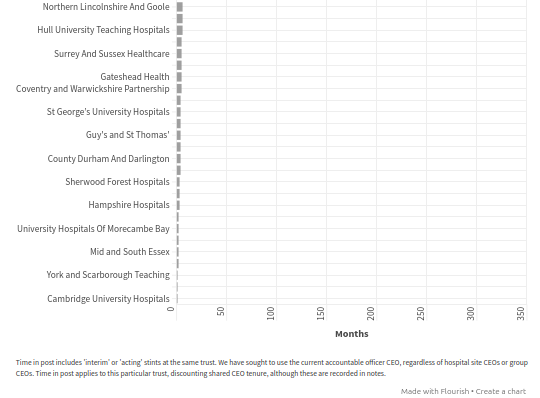

One example would be in the NHS. The HSJ recently published an article on the distribution of tenure of trust chief executives (it required four screenshots to show you just how long a tail can be!). Notice how it is not until half way up the 3rd screenshot (counting up from the bottom) that you find a CEO who has been in post for 50 months, and four of them are about to leave.

As Roy Lilley says:

Public reporting over the last eighteen months points to exits by:

- NHS England CEO, plus

- a cluster of senior national directors exiting.

- At least 10 ICB chief executives stepping down or being replaced.

- Trust CEO turnover approaching a quarter of posts;

- implying 50 or more trust-level departures, including permanent and unplanned exits.

Taken together, a guesstimate is between 60 and 80 chief executives and equivalent senior leaders have left their roles across the NHS in the last eighteen months.

As he goes on to say:

High turnover at the top tells the rest of the system that leadership is temporary. Risk is unrewarded and survival matters more than stewardship.

Authority is put at question.

That encourages short-term-ism, compliance and caution. Precisely the opposite of what complex service reform needs.

For those fans of Manchester United’s way of running things who seem to be running things at the moment, that is a hell of a lot of catharsis. Evidence suggests that it is unlikely to achieve much else.

The catharsis never lasts, as at some point the music has to stop, and someone needs to actually be sitting in actual chairs, actually managing the thing. Just ask Chelsea and Manchester United.