Sometimes an idea comes along that seems so obviously good that you wonder why it hasn’t been done a long time ago.

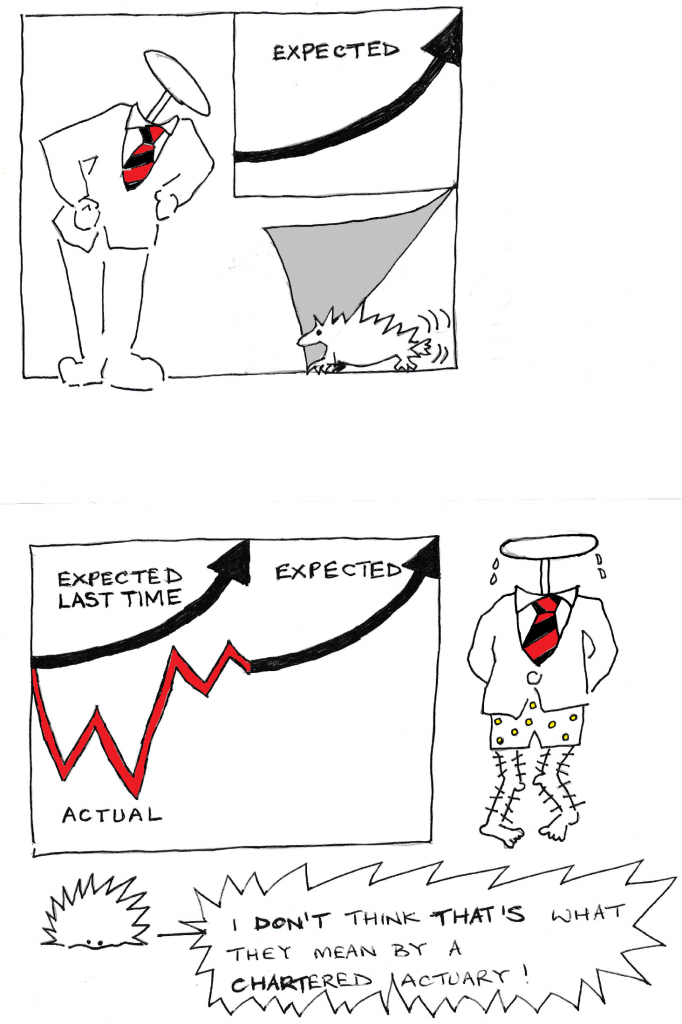

The Institute and Faculty of Actuaries (IFoA) are currently consulting on just such an idea in my view: the Chartered Actuary (CAct). Currently someone is a qualified actuary when they get to the associate level, however you wouldn’t know it. There are very few qualified roles available for associates and most firms assume hardly anyone will stay at that point but instead continue to fellowship. Indeed many actuaries leave the CA3 subject (soon to become CP3 under Curriculum 2019) in Communications until last currently, and therefore qualify at both levels simultaneously.

This will happen no more. CAct will be a distinct qualification, and a required qualification point for all student actuaries to reach before going any further. It will be globally recognised as the generalist actuarial qualification from the IFoA, as well as also possibly the final purely actuarial stage of an actuary’s qualification journey in future. The specialisation in actuarial subjects, via the specialist principles and specialist advanced modules, will still be taken by many, particularly those aiming for practising certificates, but there will be time and space for other specialisations: in data science, business management and many other areas. The hope (and I think this is a realistic hope) is that this will massively expand the range of areas where actuaries will be able to make a difference in the future.

Why do we need to? Well, as Derek Cribb, the IFoA’s Chief Executive wrote in the December issue of The Actuary:

Globally, there are around 70,000 qualified actuaries, but more than five million qualified accountants and a similar number of lawyers…Why is this relevant? Bluntly, numbers matter. Whether we are concerned about operational economies of scale, and the consequent impact on membership costs, or whether it’s about building external awareness of the value the profession brings, there is strength in numbers.

Now of course it can be argued that this is what every corporate leader always wants, and that some not-for-profit organisations could usefully benefit from considering alternative structures (particularly relevant currently in the university sector which I inhabit), but in this case, when our regulatory body the Financial Reporting Council is primarily concerned with another, much larger, profession, the existential threat is real. If you believe as I do that actuaries have a unique skill set, which is likely to be lost to a wide range of businesses and other sectors if it is unable to meet the demand for those skills due to a simple lack of numbers, then the need to take any perceived barrier to practise away from our emerging young professionals is clear.

Whatever your views on this idea, please respond to the consultation, which is open until Wednesday (28 February) and can be found here. I have found widespread support amongst the students I speak to as an actuary working in higher education, both in the UK and also notably in my discussions with Mumbai students earlier this month. I feel it is our responsibility as Fellows not to stand in their way as we in turn hand them the responsibility of taking our profession into a new generation.

The future may be highly uncertain, but I am very confident that this is a good idea.