I was introduced to a great piece of research by Tim Jenkinson, Howard Jones and Jose Vicente Martinez this week (Tim was speaking at the Workplace Pensions Live event in Birmingham). It looked at the performance of US active equity products recommended by investment consultants (a large sample covering 90% of the investment consulting market worldwide) compared to those not recommended by them over the period 1999-2011.

What they found was that:

- Investment consultants’ recommendations seem less heavily influenced by return-chasing strategies than by more intangible personal assessments, eg of the capabilities of fund managers, the consistency of their philosophies and the usefulness of their reports (any of those explanations for recommendations sound familiar?);

- People tend to follow the recommendations they are given; and

- There is no evidence that investment consultants’ recommendations add value to plan sponsors.

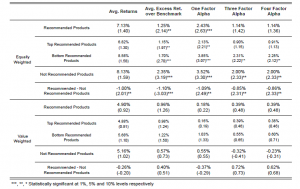

The underperformance of recommended funds compared to unrecommended was 1% pa on average when all funds were given an equal weighting, falling to an underperformance of 0.26% pa when weighted by the size of fund recommended. This suggests that when investment consultants move away from recommending larger funds they are doing even worse.

The underperformance of recommended funds compared to unrecommended was 1% pa on average when all funds were given an equal weighting, falling to an underperformance of 0.26% pa when weighted by the size of fund recommended. This suggests that when investment consultants move away from recommending larger funds they are doing even worse.

There may be other reasons for using an investment consultant other than higher returns of course. People may appreciate “a narrative that provides comfort” (similar to the placebo effect in financial advice I previously discussed here) and which gives them ready-made explanations for their own stakeholders. However, bearing in mind the consistent underperformance, why do they follow the recommendations they are given?

One reason may be that the recommendations provide cover for decisions made. Another may be regulatory pressures, eg the Pensions Regulator in the UK requires pension scheme trustees to take professional investment advice (a requirement Tim Jenkinson believes is unhelpful) and it may be viewed as odd to then ignore it.

But the report concludes that a more likely reason is that people are generally unaware of how little value is being added. Certainly studies like this one that set the problem out in such stark terms are fairly thin on the ground. The investment consultants’ world is a very concentrated one (of the $25 trillion funds under management: $4.4 trillion are managed by Aon Hewitt, $4 trillion by Mercer and $2.1 trillion by Towers Watson) and the necessary information can be difficult to get hold of.

Another reason that the underperformance may be less obvious is the impact of the recommendation itself. As John Allen Paulos explains in his classic A Mathematician Plays the Market, for an over or underperforming stock you both need the performance itself and for someone to pick it. If you always pick what the investment consultant recommends the second condition is automatically met. Sometimes that will be the lucky stock and sometimes it won’t, but you will always choose it when it is, whereas a random choice of stocks will choose it in its lucky weeks less frequently.

What all this tells us is that you cannot assume that the additional complexity investment consultants’ appear to be biased towards is adding any value to your pension scheme or business. Tim Jenkinson suggests there should be a presumption of passive investment unless a very persuasive argument for active management can be advanced. And at the small end, as he says: “if you’re not big, be simple”.