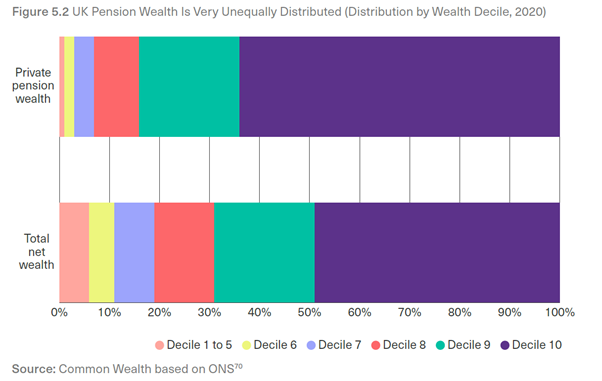

An excellent report came out in August this year from Common Wealth entitled Undefined Benefit: Fixing the UK Pensions System on the problems and potential alternatives for the UK pension system. One of the most eye catching points made in the report was that, despite pension gains since 2010 in terms of average pensions, the overall coverage of pensions remains very patchy and uneven, particularly towards the bottom end. This graph in particular caught my eye:

The bottom half have very little total net wealth and virtually no private pension wealth at all. This makes them almost entirely dependant on the State Pension and any other income-related (in the absence of a full pension) or other benefits they may be entitled to.

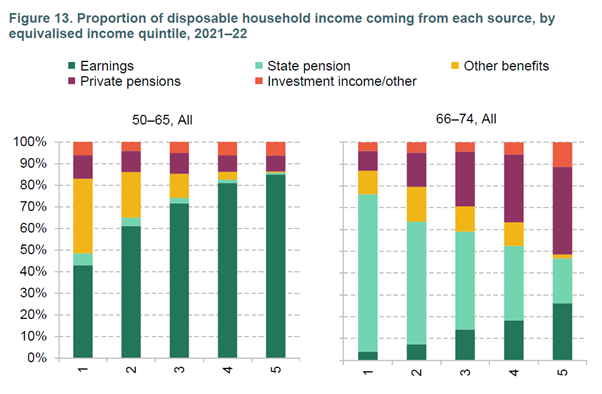

Coincidentally, the IFS have also produced a paper on pensions recently, including this graph (note the cut off at age 74):

The new State Pension (nSP as the Government refer to it) came into effect in April 2016 and currently stands at £203.85 per week or £10,600 pa. This compares with the Pensions and Lifetime Savings Association’s (PLSA) moderate level of retirement living standards which require £23,300 for a single pensioner and £34,000 for a couple. The moderate level includes such things as:

- Some help with maintenance and decorating each year.

- £74 a week on food (including food away from the home).

- 3-year old car replaced every 10 years.

- 2 weeks in Europe and a long weekend in the UK every year.

- Up to £791 for clothing and footwear each year.

- £34 for each birthday present.

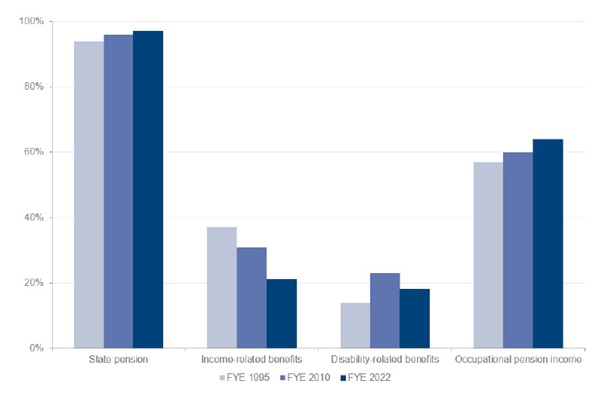

The plan for closing the gap between these two levels of income has historically relied on occupational pensions in the UK, to a much greater extent than in most countries. However there are problems with this approach. First of all, not everyone has an occupational pension:

This is the current situation with pensions in payment, which is supposed to be being addressed by automatically enrolling employees into workplace pensions. However, the TUC noted as recently as 2020 that, due to the way the rules operated around low-paid and young workers, 6.3 million employees were still without a workplace pension. A survey of 2,000 employees by Unbiased and Opinium, also in 2020, similarly concluded that 17% of over 55s were still without any pension savings.

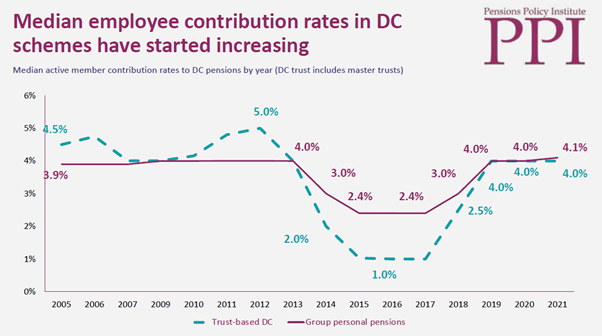

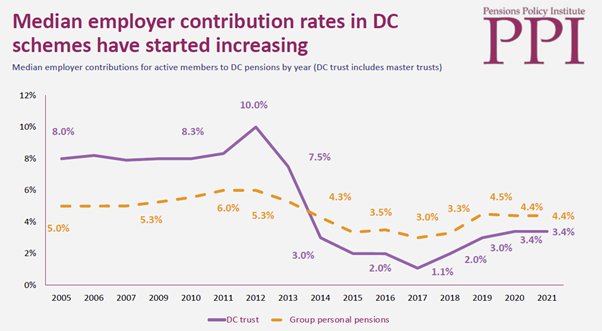

Secondly, as defined benefit occupational pension membership has fallen, the amounts which will be provided by the defined contribution arrangements which have replaced them are comparatively uncertain. The Pensions Policy Institute’s (PPI) DC Future Book 2023 has looked at the average employee and employer contribution rates under auto-enrolment:

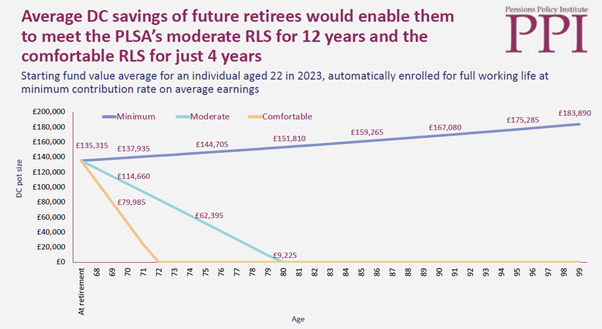

They then projected whether this combined minimum contribution of 8% (on top of the full new State Pension) would be sufficient to meet any of the PLSA’s retirement living standards:

The combination of pension freedoms and not enough in your pot does of course allow crash paths like these, and perhaps explains the slightly more positive pension position shown in the chart from the IFS report compared to the first chart. By cutting off at 74, the IFS could well be surveying people on the steep descents above while they are still depleting their pots to maintain a slightly higher income.

Of course many other models are available – these projections used the PPI economic scenario generator developed by King’s College with many of the economic assumptions taken from the OBR and there are further details at the end of the report – but that seems beside the key point to me here.

Irina Dunn famously daubed the phrase “a woman needs a man like a fish needs a bicycle” on the back of a toilet door in the University of Sydney in 1970. The pension industry has been very successful in attracting funds and innovative in developing products, and occupational pensions coverage overall at some level has clearly increased substantially as a result of auto-enrolment. But none of the bells, gear arrangements, lightweight alloys or any of the other innovations can change the fact that a state-of-the-art defined contribution investment bicycle can never guarantee to float a goldfish to the water level it needs to thrive. You need the state to fill the tank.

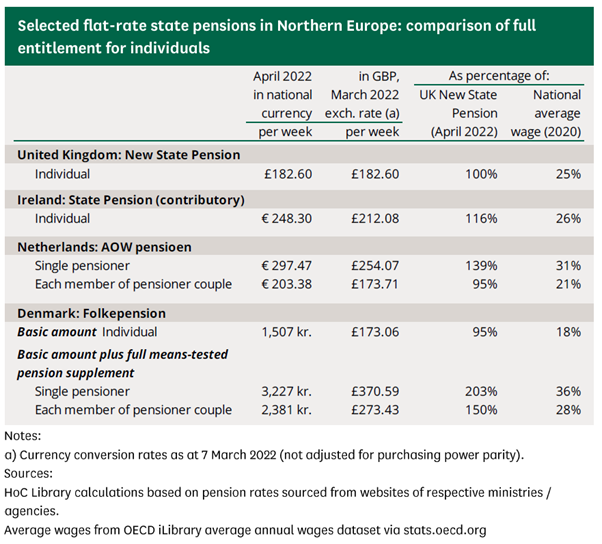

This means raising the State Pension, not by some arbitrary formula involving price inflation, earnings inflation and the number you first thought of, but to what we regard as a reasonable level to live on and which we want to be able to guarantee noone falls below. Comparing the UK with other comparable flat rate state pension pillars in Europe we find the following (from March 2022):

This would suggest an increase of somewhere between 40% and 100% to the current State Pension level to reset the balance between a guaranteed income and that based on the lottery of the markets to European levels.

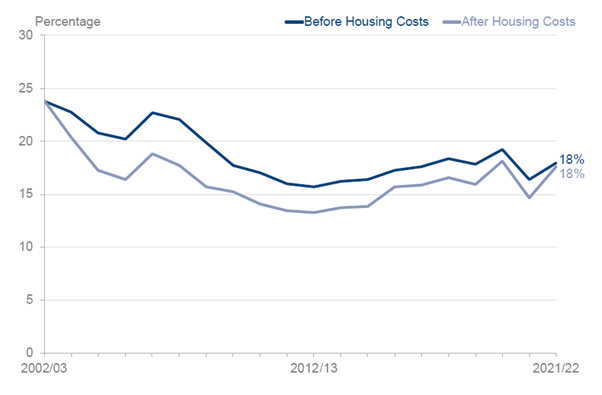

Many people talked about the need to increase societal resilience as we emerged from the pandemic, instead we appear to be moving in the opposite direction, with no clear idea yet about how to deal with NHS waiting lists, even less idea of how to deal with rough sleepers. And on pensioner poverty we have this:

After a concerted attempt to reduce the percentage of pensioners in relative low income during the pandemic, the curve is upwards again, as it has been since at least 2012.

Things have got so bad that Olivier De Schutter, the UN’s special rapporteur on extreme poverty and human rights, has described the UK’s main welfare system as “a leaking bucket” and said that our poverty levels violate international law.

This cannot go on. We can certainly afford to have a welfare system which does not violate international law. And we can afford a much less leaky bucket when it comes to pensions too. I will provide some ideas on how in my next post.