For a brief period this week, before the Panama leaks brought everyone back in the room, one of the BBC’s main headlines was that a change to the UK State Pension was projected to make around three-quarters of people currently in their 20s and two-thirds of those currently in their 30s worse off than under the current arrangements. Figures of £19,000 and £17,000 “over the course of their retirement” were bandied around.

The reason the analysis had been carried out by the Pensions Policy Institute (PPI) was that the Department of Work and Pensions (DWP) is required to carry out an impact assessment of such proposed changes and had given the PPI the task.

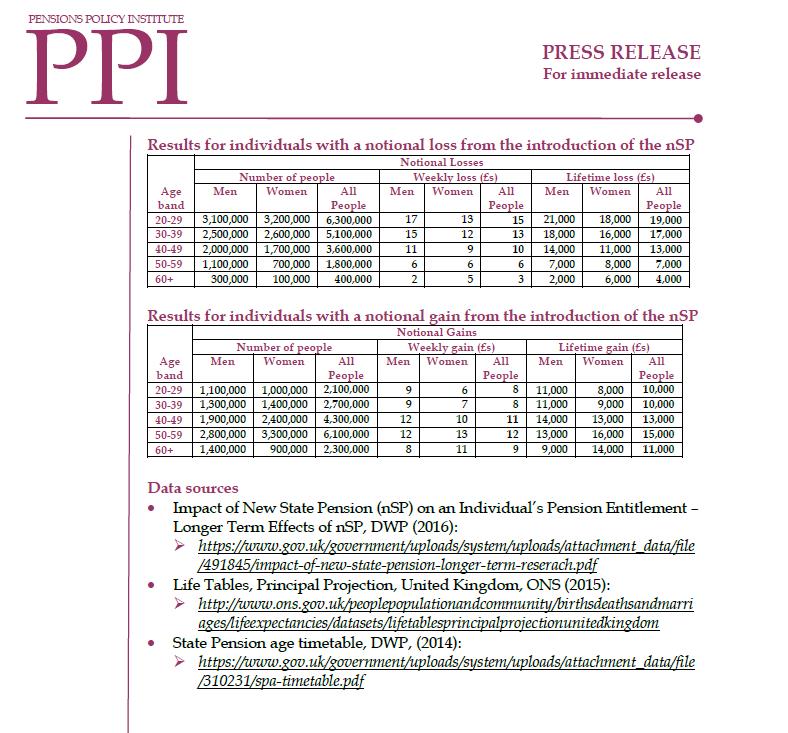

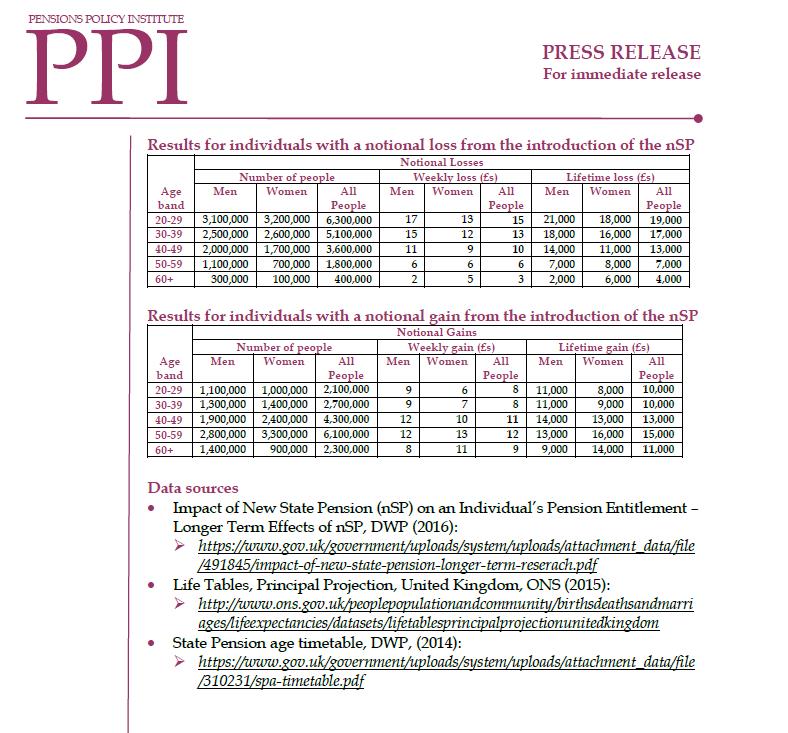

First of all, the full summary of the analysis, coverage of which on the BBC has at least started to become a little more measured by today, is as follows:

As you can see, the numbers that came out were weekly losses of up to £17 per week for some groups and weekly gains of up to £13 per week for others. These numbers were themselves based on complicated projections about how benefit changes would be phased in and also how much the State Second Pension would pay people many decades into the future (the DWP paper can be found here). They were then aggregated by multiplying by the number of weeks in retirement until the pensioner was expected to die, based on the current State Pension Age timetable and the principal projections from the ONS 2015 Life Tables. The total amounts expected to be paid to people in retirement, however, were not (for those in their 20s this would be around 24 x 52 x 155.65 (the start rate for the new State Pension) as a minimum = £194,250 in 2015 terms). Neither was any explanation made of just how many years people were being projected to live. For £17 a week to translate into £21,000, the person currently in their 20s will need to be in retirement for nearly 24 years. It is not clear exactly when this person is expected to retire: the current tables only go up to a date of birth of 6 April 1978 (when State Pension Age is expected to be 68) with a vague intention to increase it to 69 by the late 2040s. An assumption of a retirement age of 69 looks consistent with the projections, which indicate a life expectancy at that age of 22.95 years for males and 24.81 years for females born in 1995.

And that last bit leads me on to why this particular news story is in my view just foolish. I tend to get a bit crotchety whenever anyone projects anything as a fact to a date beyond my personal life expectancy (less than 33 more years, according to the ONS). We are talking about people being worse off in the 2050s and 2060s. Here are a few more projections for you with those kinds of timelines:

- World population will be 9 billion by 2050 (UN – currently it’s 7 billion)

- Total energy demand in CO2 equivalent doubles from current levels by 2060 (IPCC)

- Banking assets in London exceed 9 times UK GDP by 2050 (Mark Carney, Governor of the Bank of England)

- 60% of government bonds across all countries will be classified as junk by 2050 (Standard & Poors)

The vast majority of people are going to be better off who retire in the next 15 years (at least in terms of their State Pension), as will most people retiring in the decade after that. Beyond that we are in the region of the unknowable – almost certainly a very different-looking world which will have required several further adjustments to state pensions before we get there. So please let’s not waste time having foolish arguments about made up winners and losers.