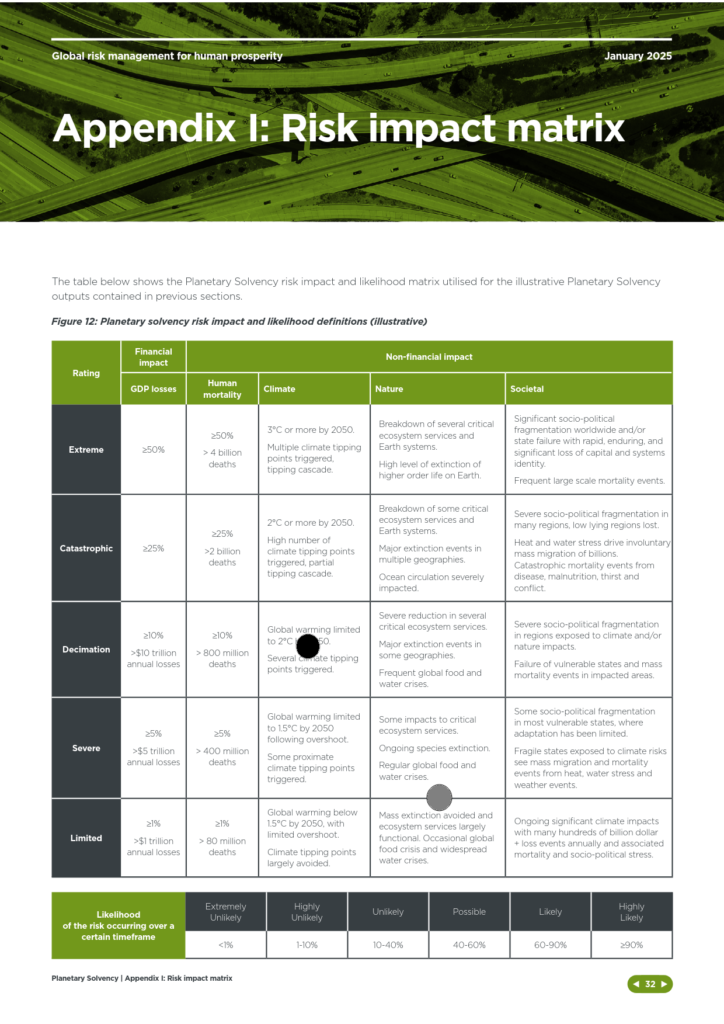

The excellent report from the Institute and Faculty of Actuaries and the University of Exeter Planetary Solvency – finding our balance with nature splits the risk trajectories into four sections: Climate, Nature, Society and Economy. I have focused on the Society one above as, in my view, this is the reason we are interested in all of the other ones. According to the Planetary Solvency report, we are on track for a society in 2050 described as follows:

Nature and climate risk trajectories will drive further biophysical constraints including stresses on water supply, further food supply impacts, heat stress, increased disease vectors, likely to drive migration and conflict. Possible to Likely risk of Severe to Decimation level societal impacts, with increasingly severe direct and indirect consequences of climate and nature risks driving socio-political fragmentation in exposed and vulnerable regions.

So what are we doing about it? Well the United States has just voted in Donald Trump as President. There was a flurry of executive orders issued in his first week (with the appropriate caveats about how many of these might actually be implemented), the climate-related ones of which are neatly summarised here by Bill McKibben:

The attacks on sensible energy policy have been swift and savage. We exited the Paris climate accords, paused IRA spending, halted wind and solar projects, gutted the effort to help us transition to electric vehicles, lifted the pause on new LNG export projects, canceled the Climate Corps just as it was getting off the ground, and closed the various government agencies dedicated to environmental justice. Oh, and we declared an “energy emergency” to make it easier to do all of the above.

Timothy Snyder has written about how to respond to tyranny in your own country. What is happening currently in the United States is threatening tyranny for many (as Robert Reich lists here):

The government now recognizes only two “immutable” genders, male and female. Migrants (now referred to as “aliens”) are being turned away at the border. Immigration agents are freed to target hospitals, schools, and churches in search of people to deport. Diversity efforts in the federal government have been dismantled and employees turned into snitches. Federal money will be barred from paying for many abortions.

The first thing you should do, according to Timothy Snyder, is to not obey in advance.

Most of the power of authoritarianism is freely given. In times like these, individuals think ahead about what a more repressive government will want, and then offer themselves without being asked. A citizen who adapts in this way is teaching power what it can do.

And how did we respond to all of this in the UK? Well Keir Starmer was keen to tell The Donald that we were deregulating to boost growth in their first phone call. His reward for this was the story that Trump thought he was doing a good job. Supposedly an endorsement from the “Drill Baby Drill” guy is the proper corrective from being told he should be locked up by the Nazi salute guy.

And then there were the actions on the environment. From the talking out of the Climate and Nature Bill which sought to meet new legally binding targets on climate change and protect nature. To a housing policy which will be both hugely environmentally destructive and fail to make houses more affordable. To announcing the intention to overhaul the planning rules, in the upcoming Planning and Infrastructure Bill, to reduce the power of people to object (and, as the Conservatives’ restrictions on protest have not been lifted, subsequently bang them up for years on end if we subsequently demonstrate about it) so that global firms would think that the UK was a “great place to invest” .

And then today we had Rachel Reeves’ big speech. Approval for developing the third runway at Heathrow, as had been extensively trailed, and the creation of “Europe’s Silicon Valley” between Oxford and Cambridge were the main announcements. There was quite a lot of talk about investment in sustainable aviation fuel (which means biofuels, the benefits of which have already been shown to be wiped out by rising demand).

And as for the Silicon Valley idea, I am not sure we want one. First there is the lack of real innovation despite the excellent game they talk. And second, is it going to be the authoritarian nightmare that the Californian one is turning into? The early signs are not good. Just last week Marcus Bokkerink, the Chair of the Competition and Markets Authority (CMA), was replaced by Doug Gurr, until recently Jeff Bezos’ head of Amazon UK. So not exactly standing up to Technofeudalism then.

According to Cory Doctorow:

Marcus Bokkerink, the outgoing head of the CMA, was amazing, and he had charge over the CMA’s Digital Markets Unit, the largest, best-staffed technical body of any competition regulator, anywhere in the world. The DMU uses its investigatory powers to dig deep into complex monopolistic businesses like Amazon, and just last year, the DMU was given new enforcement powers that would let it custom-craft regulations to address tech monopolization (again, like Amazon’s).

But it’s even worse. The CMA and DMU are the headwaters of a global system of super-effective Big Tech regulation. The CMA’s deeply investigated reports on tech monopolists are used as the basis for EU regulations and enforcement actions, and these actions are then re-run by other world governments, like South Korea and Japan.

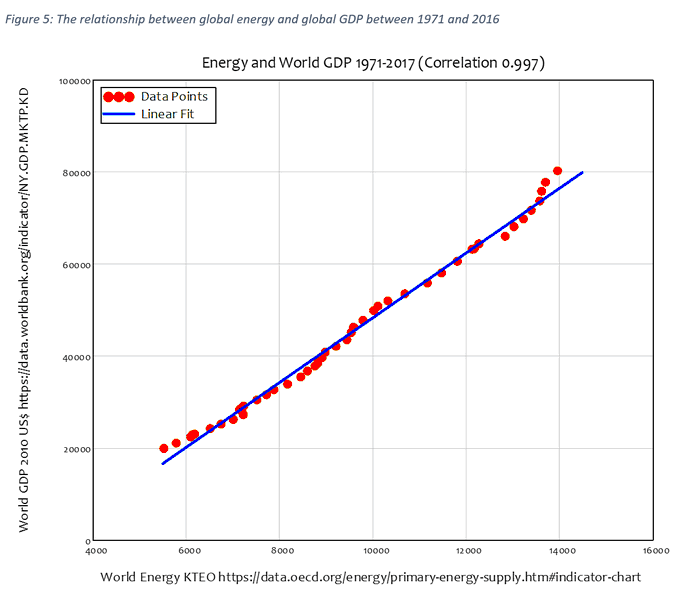

When you see Trump flanked by Bezos and the other Tech Bros at his inauguration, it certainly feels like we are obeying in advance. Rachel Reeves’ speech had an enormous increase in energy demand implicit in pretty much every measure announced, which is expected because, GDP (the thing she is looking to boost) and energy consumption have been in lockstep forever. This is the implication of prioritising GDP growth over everything else.

What were missing were both a compensatory increase in renewable energy capacity and/or a reorganisation of our economy away from energy intensity. The problem for the government is that the latter would not increase GDP, so instead we get into the absurd position of the Business Secretary saying we “cannot afford to not build runways”.

However it seems that when the motivation is big enough (in this case to dispute the assertion that the Russian economy is doing well in wartime despite the official statistics, which the EU really needs to do in order to continue to make the case for sanctions) alternative ways to measure the economy can be found. In section 3.2 we find this:

The general assumption of connecting GDP growth to making people better off is not relevant in this situation, which should be included in any discussion of how the Russian economy is doing.

What is interesting about this analysis is that:

a. It is carried out by the kind of orthodox economists (the Stockholm Institute of Transition Economics) who believe GDP would be a good index to use in normal circumstances; and

b. They are saying this even if the GDP figures published by Russia are technically accurate. As they go on to say:

What this analysis suggests is that if we believe in official Russian statistics, then Russia has economic capacity to sustain current policies in the short run, a conclusion shared with many other observers. We also find, though, that beyond the GDP numbers, the redirection into a war economy is already putting pressure on all sectors not directly involved in the war, causing internal macroeconomic imbalances, increasing risks in the financial sector, and eroding export revenues and existing reserves. Short term growth is kept up by a massive fiscal stimulus, but the impact is mitigated by necessary monetary contraction to deal with inflationary pressures, and structural factors (demographics, weak property rights) limiting the possible economic response to the stimulus.

Some of which sound familiar closer to home – “necessary monetary contraction” (things we cannot afford) and “increasing risks in the financial sector” anyone?

We are currently facilitating a world where the only capacity we are increasing is to fly over the climate-ravaged areas of the globe and their fleeing populations. Fly Baby Fly is not going to get us anywhere we want to go.