There have been a lot of predictions already for 2015. The Chartered Institute for Personnel and Development predicts employment in the UK increasing by half a million, GDP growth of 2.4% and earnings growth of between 1% and 2%, ie keeping its predictions reasonably close to what happened in 2014 and/or what the OBR, OECD and IMF are predicting. The annual FT economists’ survey resulted in an average conclusion amongst 90 economists that GDP growth would increase from 2.4% pa to 2.5% pa around election time and then on to 2.6% pa soon after. I could go on but I think you get the general idea – small changes around current economic statistics with a remarkable level of agreement amongst the experts. It’s enough to make you want to use these predictions to populate your models with, which is of course the general idea.

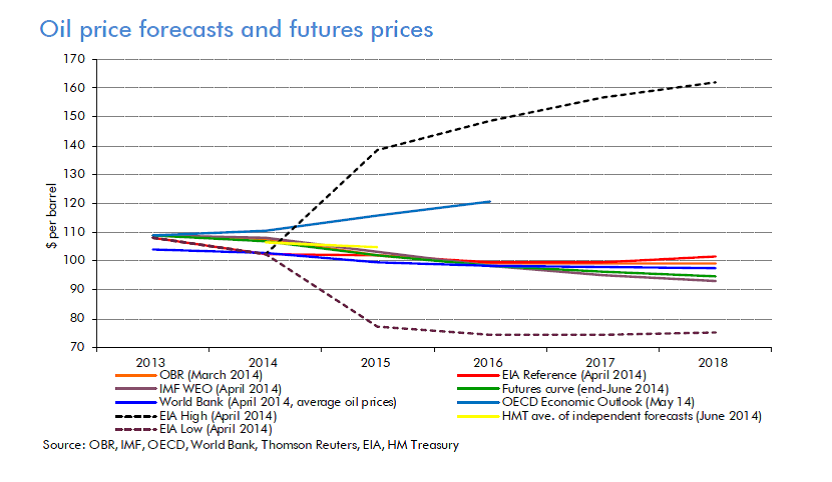

But before you get any idea that these people know more about 2015 than you do, consider what was being said about the oil price only 6 months ago in the Office for Budget Responsibility’s Fiscal sustainability report. Here is the graph:

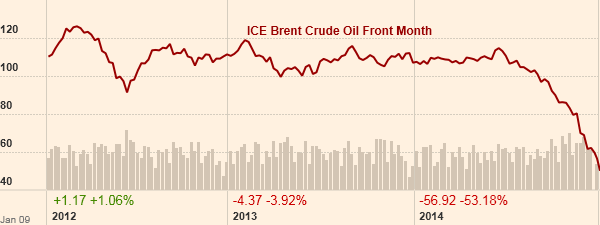

Once again, there was a trend of projecting a price rather similar to the current one and a remarkable level of agreement amongst the experts. Here is what has actually happened subsequently:

Now I don’t want to pick on these forecasters in particular, after all the futures prices indicated that these views were the overwhelming consensus. But the oil price is a fundamental indicator in most economic models – Gavyn Davies details how the latest fall in oil prices has changed his economic forecasts here – with implications for inflation and GDP growth, and dependent upon predictions about many other areas of the political economy of the world which impact supply (eg OPEC activity, war in oil-producing areas) and demand (eg global economic activity). So an ability to see a big move in oil prices coming would seem to be a clear prerequisite for being able to make accurate economic forecasts. It seems equally clear that that ability does not exist.

Economic forecasts generally tell us that things are not going to change very much, which is fine as long as things are not changing very much but catastrophic over the short periods when they are. Despite the sensitivity testing that goes on in the background, most economic and business decisions are taken on the basis that things are not going to change very much. This puts most business leaders in the individualist camp described here, ie a philosophical position which encourages risk taking. Indeed even if some of the people advising business leaders are in the hierarchist camp, ie believing that the world is not predictable but manageable, to anyone with little mathematical education this is indistinguishable from an individualist position.

The early shots of the election campaign have so far been dominated by the Conservative Party branding Labour’s spending plans (which to the extent they are known appear to involve quite severe fiscal tightening, although not as drastically severe as Conservative ones) as likely to cause “chaos”, while the Labour Party wants to wrap itself in the supposed respectability of OBR endorsement of their economic policies. Neither of them has a plan for another economic crisis, which concerns me.

What are desperately needed are policies which are aimed at reducing our vulnerability to the sudden movements in economic variables which we never see coming. We should stop trying to predict them because we can’t. We should stop employing our brightest and best in positions which implicitly endorse the assumption that things won’t change very much because they will.

What sort of an economy would it have to be for us not to care about the oil price? That’s what we need to start thinking about.