The Telegraph thinks the shareholders are to blame. The Guardian has the Australian investment bank Macquarie in its sights. Martin Bradley’s (the European Head of Infrastructure at Macquarie Asset Management) attempts in Infrastructure Investor at justifying their actions only seem to be making things worse. The FT is using it as an excuse to have a go at the Capital Asset Pricing Model. Count Binface has included in his manifesto for the London Mayoral election a requirement for the company’s management to “take a dip in the Thames, to see how they like it”.

I am talking of course about Thames Water, which really does appear to be everywhere at the moment. But how did we get here?

The management of water works by private companies was originally a legacy of the Victorians – most of the water supply and all waste water services moved into local government control from the late 19th and early 20th centuries. Control then passed from 165 different water supply bodies to 10 regional water authorities in 1974 before these were sold back to private companies in 1989.

Water is obviously a resource vital to all of us, as well as being what economists call a natural monopoly. There have been debates for quite some time now about renationalising the water industry – some arguing that it is too expensive and that a Welsh Water not-for-profit model is the answer, others saying that water, electricity and Royal Mail together would cost less than £50 billion to nationalise and would pay for themselves within 7 years if investors were just repaid what they had invested in the businesses, others saying that water is a failed business and could be acquired without compensation for shareholders as happened with Northern Rock.

What none of these appear to be arguing is that private monopolies should not exist as a reason for renationalising water. We have become so used to monopoly or oligopoly profits in everything from utilities to transport to mobile phones to supermarkets, that we sometimes forget that it has not always been like this.

This point was made to me powerfully in Cory Doctorow’s excellent The Internet Con – How to Seize the Means of Computation. The 19th century debate in the US Senate about monopolies was impassioned. Senator John Sherman of the 1890 Sherman Act effectively put the war against monopolies on an equivalent footing with the War of Independence from the British Crown:

If we will not endure a King as a political power we should not endure a King over the production, transportation, and sale of the necessaries of life. If we would not submit to an emperor we should not submit to an autocrat of trade with power to prevent competition and to fix the price of any commodity.

It’s stirring stuff. The “harmful dominance” theory of antitrust (ie the idea that companies which dominate an industry are potentially harmful just because they are dominant, before they even start to abuse their dominant positions) led to the dismantling of several “empires”, including that of Rockefeller’s Standard Oil Company in the early 20th century.

But then enter Robert Bork. Famous amongst other things for having an extremely dull taste in video rentals, Bork was Solicitor General of the US between 1973 and 1977, under Presidents Nixon and Ford, and Acting US Attorney General from 1982 to 1988 under President Reagan. Bork developed what he called a “consumer welfare” theory of antitrust. This allowed mergers and monopolies to proceed provided prices were lowered and/or quality improved, or even if they weren’t as long as some “exogenous factors” could be blamed for the price hikes or reduction in quality.

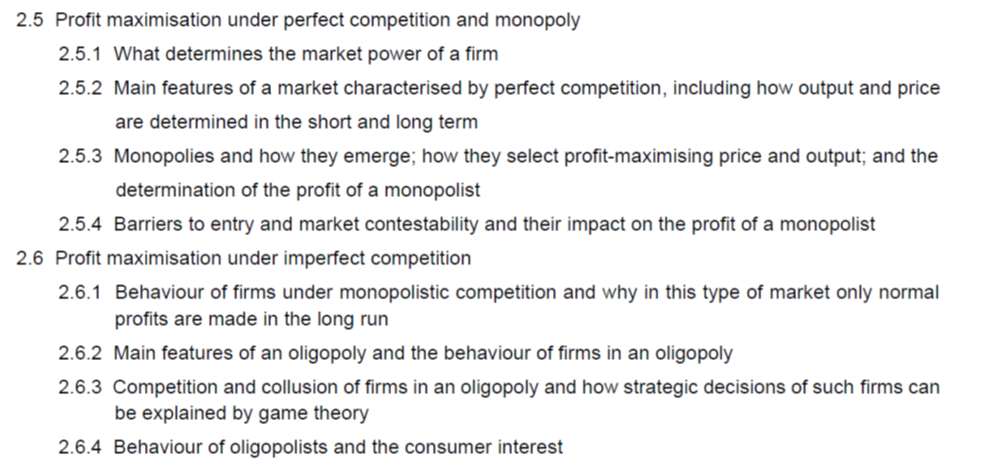

Sound familiar? It should, as we all still live in Bork’s world. For example, the microeconomics part of the Institute and Faculty of Actuaries’ Business Economics syllabus relating to imperfect markets reads as follows:

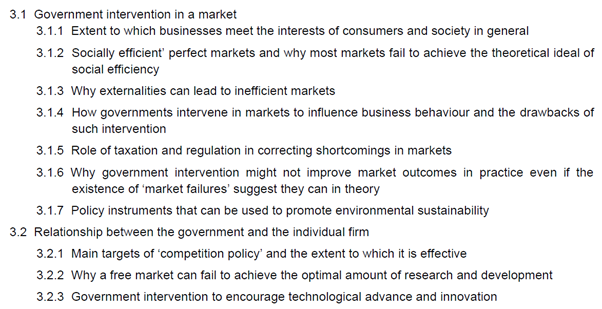

Note the focus on the different ways firms supposedly maximise profits (this approach is fairly thoroughly debunked by Steve Keen here) rather than on the market power they wield. The part which should include the regulation of monopolies reads as follows:

Note the lowering of expectations in 3.1.6: “Why government intervention might not improve market outcomes in practice even if the existence of ‘market failures’ suggest they can in theory”. However the real limitations are laid bare in 3.2. The main targets of “competition policy” in the text book (Economics by Sloman et al) you are pointed to by the core reading turn out to be what are referred to as “exclusionary abuses”, ie where businesses actively prevent effective competition from actual or potential competitors. As the preamble on competition policy in Sloman says:

Competition policy could ban various structures. For example, there could be restrictions on mergers leading to market share of more than a certain amount. (This is the harmful dominant approach, about which no more is said) Most countries, however, focus on whether the practices of particular monopolists or oligopolists are anti-competitive. Some practices may be made illegal, such as price fixing by oligopolists; others may be assessed on a case-by-case basis. Such an approach does not presume that the existence of power is against the public interest, but rather that certain uses of that power may be.

So, in other words, we will leave monopolistic businesses with the power and attempt to detect abuses of that power on a case-by case basis via overworked and under-resourced regulators. Sherman could have never cut Standard Oil down to size with this approach.

Yanis Varoufakis’ contention, in Technofeudalism, is that capitalism now only operates within the framework provided by the most extreme monopolists of Big Tech, with most of us either “cloud proles” (ie wage slaves working for Big Tech under feudal conditions) or “cloud serfs” (ie the rest of us working for Big Tech for free by creating content and sharing our data on their platforms). Big Tech’s size massively increased as a result of the bank bail out of 2008 and additional money pumped through them and the corporations working for them coupled with austerity for everyone else, which was therefore almost totally financialised – leading to the “everything rally” for asset owners.

As Varoufakis says:

When an activist state makes fabulously wealthier the same bankers whose quasi-criminal activities brought misery to the majority, while they are punished with self-defeating austerity, two new calamities beckon: poisoned politics and permanent stagnation.

Again, sound familiar?

It is not too late to push back against the monopolies which control our lives. Doctorow’s big idea in The Internet Con is interoperability, the ability of new technologies to plug into Big Tech’s services, systems and platforms, which Big Tech tends to resist with all of the power at its disposal. He makes a convincing case for how this simple change could reduce the size of Big Tech companies quickly and bring them within the scope of democratic control once more.

And for those businesses which need to be at monopoly scale to work at all? Water, for instance. That sounds like an unanswerable case for nationalisation to me. Perhaps assuming that dominant private companies are bound to be harmful needs to come back into fashion.