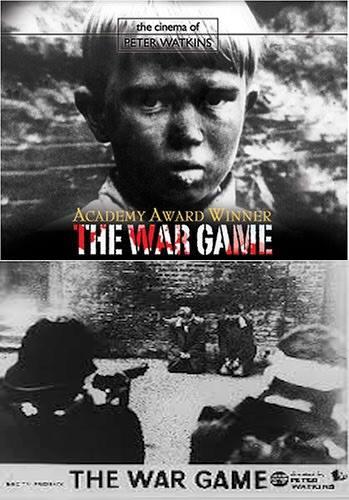

I watched The War Game this week, as it had suddenly turned up on iPlayer and I had not seen it before. It was the infamous film from 1966 on the horrors of a nuclear war in the UK that was not televised until 1985. It has been much lauded as both necessarily horrifying and important over the years, but what struck me watching it was how much it looked back to the period of rationing (which had only ended in the UK 12 years earlier) and general war-time organisation from the Second World War. It would be a very different film if made now, probably drawing on our recent experiences of the pandemic (when of course we did dig huge pits for mass burials of the dead and set up vast Nightingale hospitals as potential field hospitals, before the vaccines emerged earlier than expected).

But what about the threat of nuclear war which still preoccupied us so much in the 1980s but which seems to have become much less of a focus more recently? With the New START treaty, which limits the number of strategic nuclear warheads that the United States and Russia can deploy, and the deployment of land and submarine-based missiles and bombers to deliver them, due to expire on 5 February 5, negotiations between Russia and the United States finally appear to be in progress. However China has today confirmed that it does not want to participate in these.

In Mark Lynas’ recent book Six Minutes to Winter, he points to the Barret, Baum and Hostetler paper from 2013 which estimated the probability of inadvertent nuclear war in any year to be around 1%. This is twice the probability of insolvency we think acceptable for our insurance companies under Solvency II and would mean, if accurate, that the probability of avoiding nuclear war by 2100 was 0.99 raised to the power of 75 (the number of years until 2100), or 47%, ie less than a fifty-fifty chance.

That doesn’t seem like good enough odds to me. As Lynas says:

We cannot continue to run the daily risk of nuclear war, because sooner or later one will happen. We expend enormous quantities of effort on climate change, a threat that can endanger human civilisation in decades, but ignore one that can already destroy the world in minutes. Either by accident or by intent, the day of Armageddon will surely dawn. It’s either us or them: our civilisation or the nukes. We cannot both survive indefinitely.

The Treaty on the Prohibition of Nuclear Weapons (TPNW) was adopted at the UN in 2017 and came into force in 2021. In Article 1 of the Treaty, each state party to it undertakes never to develop, test, produce, possess, transfer, use or threaten to use nuclear weapons under any circumstances. 94 countries have signed the TPNW to date, with 73 full parties to it.

The House of Commons library entry on TPNW poses a challenge:

It is the first multilateral, legally binding, instrument for nuclear disarmament to have been negotiated in 20 years. However, the nuclear weapon states have not signed and ratified the new treaty, and as such, are not legally bound by its provisions. The lack of engagement by the nuclear weapon states subsequently raises the question of what this treaty can realistically achieve.

It then goes on to state the position of the UK Government:

The British Government did not participate in the UN talks and will not sign and ratify the new treaty. It believes that the best way to achieve the goal of global nuclear disarmament is through gradual multilateral disarmament, negotiated using a step-by-step approach and within existing international frameworks, specifically the Nuclear Non-Proliferation Treaty. The Government has also made clear that it will not accept any argument that this treaty constitutes a development of customary international law binding on the UK or other non-parties.

There are 9 nuclear states in the world: China, France, India, North Korea, Pakistan, Russia, Israel, the UK and the United States. Israel recently conducted a 12 day war with Iran to stop it becoming the 10th. Many argue that Russia would never have invaded Ukraine had it kept its nuclear weapons (although it seems unlikely that they would have ever been able to use them as a deterrent for a number of reasons). So the claims of these nuclear states that they are essential to their security are real.

But is the risk that continued maintenance of a nuclear arsenal poses worth it for this additional security? For the security only operates at the deterrence level. Once the first bomb lands we are no more secure than anyone else.

Which makes it all the more concerning when Donald Trump starts saying things like this (in response to a veiled threat by the Russian Foreign Minister about their nuclear arsenal):

“I have ordered two Nuclear Submarines to be positioned in the appropriate regions, just in case these foolish and inflammatory statements are more than just that. Words are very important, and can often lead to unintended consequences, I hope this will not be one of those instances.”

But with a probability of avoiding “unintended consequences” less than fifty-fifty by 2100? That really doesn’t feel like good enough odds to me.