In my last post I referred to Dan Wang’s excellent new book, Breakneck, which I have now read at (for me) breakneck speed, finishing it in a week. It has made me realise how very little I knew about China.

Wang makes the point that China today is reminiscent of the US of a century ago. However he also makes the point that parts of the US were terrible to live in then: from racist segregation and lack of representation, to massive industrial pollution and insensitive planning decisions. As he says of the US:

The public soured on the idea of broad deference to US technocrats and engineers: urban planners (who were uprooting whole neighborhoods), defense officials (who were prosecuting the war in Vietnam), and industry regulators (who were cozying up to companies).

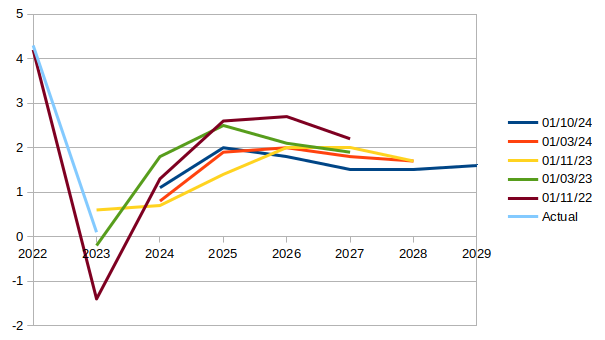

China meanwhile has a Politburo stuffed with engineers and is capable of making snap decisions without much regard to what people want. There is a sense of precarity about life there, with people treated as aggregates rather than as individuals. The country can take off in different directions very quickly and often does – there is a telling passage about the totally different life experiences of someone born in 1959 compared to someone born in 1949 (the worst year to be born in China according to Wang) – and even the elites can be dealt with brutally if they fall out of line with the current direction of travel. But they have created some impressive infrastructure, something which has become problematic for the US. Only around 10% of its GDP goes towards social spending, compared to 20% in the US and 30% amongst some European states, so there is no effective safety net. Think of the US portrayed in (as Christmas is fast approaching) “It’s a Wonderful Life” – a life that is hard to the point of brutality with destitution only one mistake away. And there is a level of social control alien to the west, controlling where people can live and work and very repressive of ethnoreligious minorities. And yet there is a feeling of progress and forward momentum which appears to be popular with most people in China.

As Wang notes at the end of his introduction:

“Breakneck” is the story of the Chinese state that yanked its people into modernity – an action rightfully envied by much of the world – using means that ran roughshod over many – an approach rightfully disdained by much of the world. It is also a reminder that the United States once knew the virtues of speed and ambitious construction.

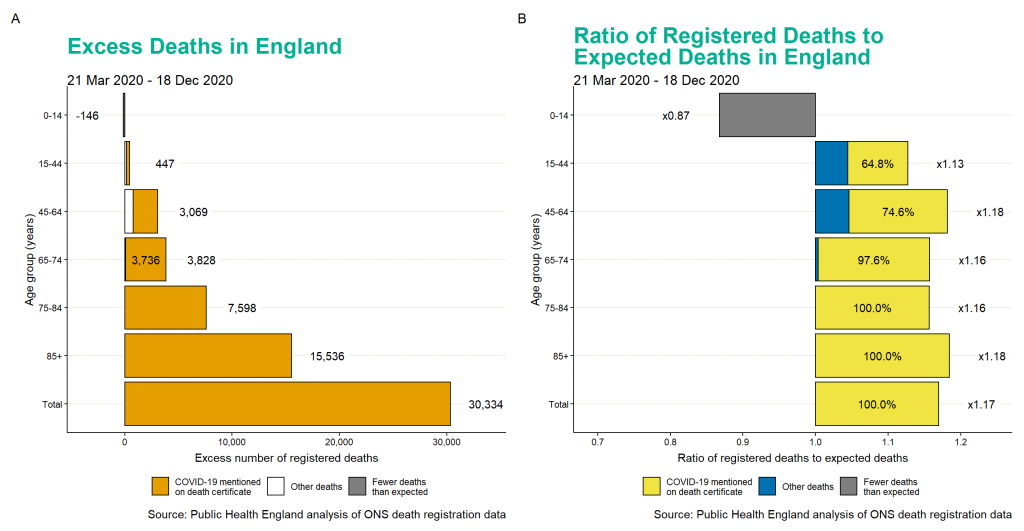

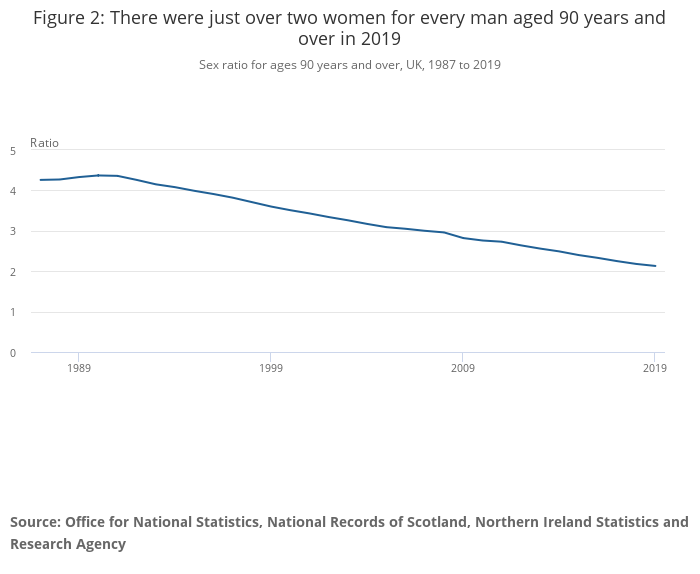

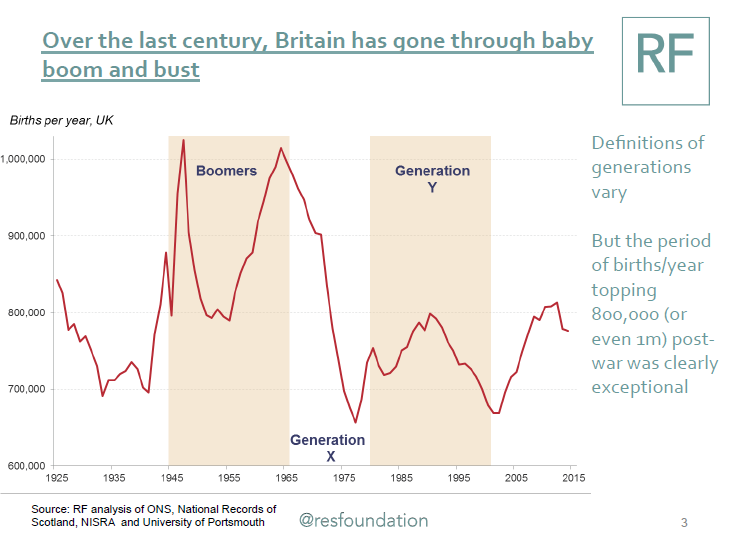

The chapter on the one child policy, which ran for 35 years, is particularly chilling (China announced its first population fall in 2023 and its population is projected to halve to 700 million by 2100), and now the pressure is on women to have more children again. There is also a chapter on how China dealt with Covid – Wang experienced this first hand from Shanghai for 3 years – which made me understand perhaps why we wasted so much money in the UK on Track and Trace. You would need to be an engineering state to see it through successfully, and China ended up taking it too far in the end.

The economics of China is really interesting. As Wang notes:

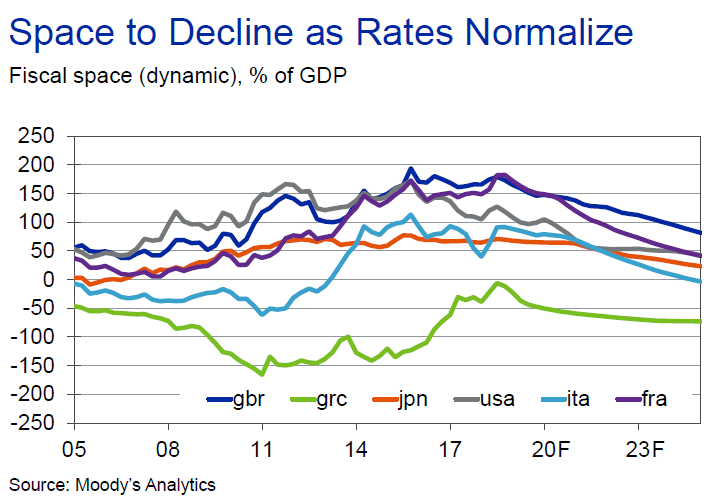

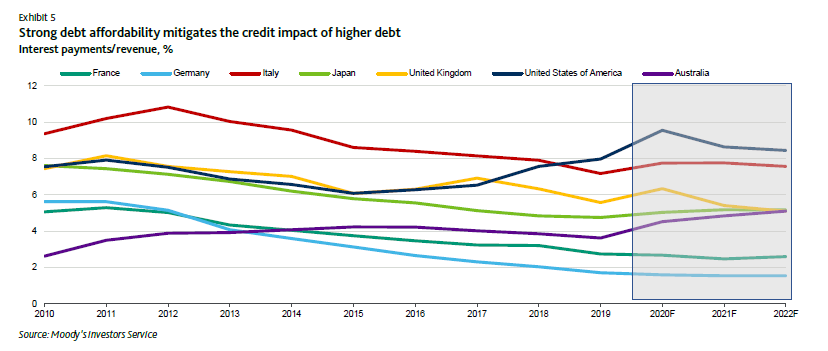

China’s overbuilding has produced deep social, financial and environmental costs. The United States has no need to emulate it uncritically. But the Chinese experience does offer political lessons for America. China has shown that financial constraints are less binding than they are cracked up to be. As John Maynard Keynes said, “Anything we can actually do we can afford.” For an infrastructure-starved place like the United States, construction can generate long-run gains from higher economic activity that eventually surpass the immediate construction costs. And the experience of building big in underserved places is a means of redistribution that makes locals happy while satisfying fiscal conservatives who are normally skeptical of welfare payments.

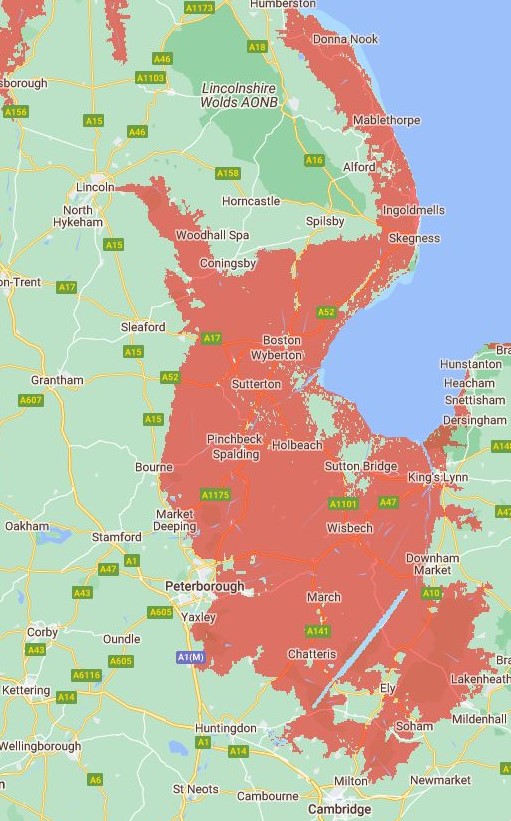

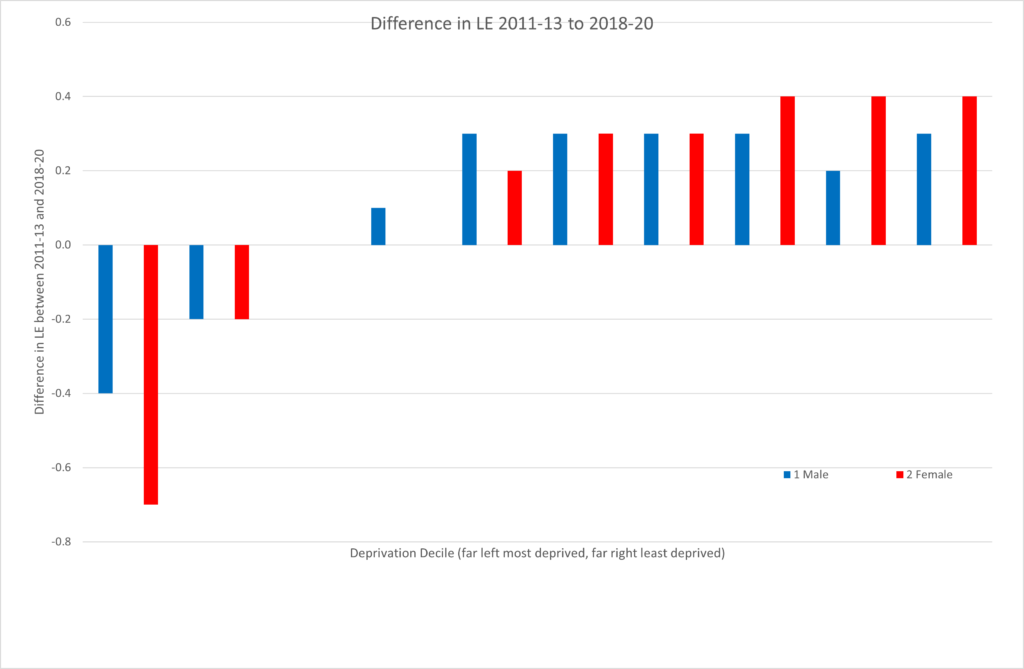

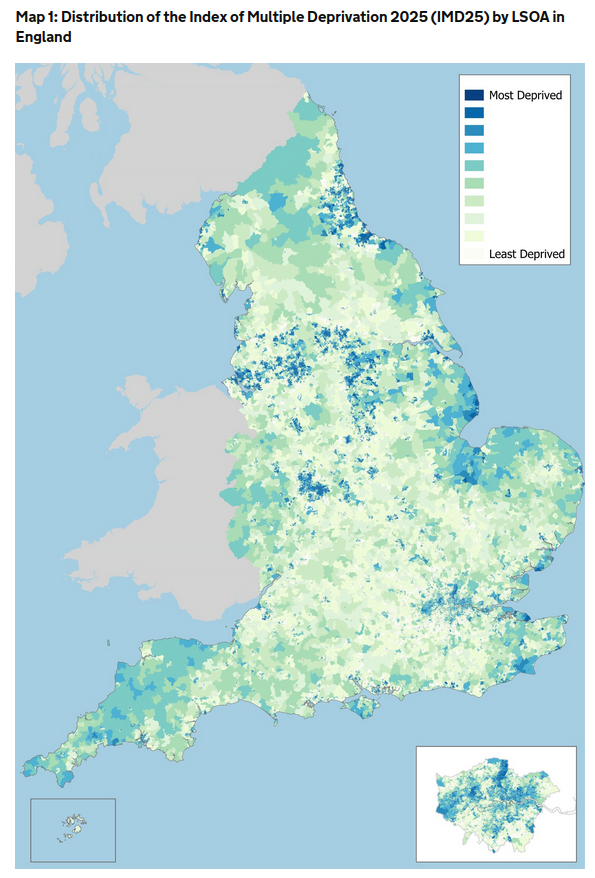

This goes just as much for the UK, where pretty much everywhere outside London is infrastructure-starved (and, as Nicholas Shaxson and John Christensen show here in their written evidence to a UK Parliamentary Committee, even where infrastructure is built outside London, the financing of it sucks money away from the area where the infrastructure is being built and towards finance centres, predominantly in London), but there is also strong resistance from all the main parties to significant redistribution via the benefit system. This results in inequalities which even the FT feels moved to comment on and a map of multiple deprivation in England which looks like this:

The good news is that it doesn’t have to be this way in the UK, there are prominent examples of countries operating in a different way, eg China. The bad news is that China is not doing it because of economics. They are doing it because the state was set up to build big from the beginning. It is in its nature. The lesson of China is that it will keep doing the same things whatever the situation (eg trying to fix the population fall caused by an engineering solution with another engineering solution). Sometimes the world economy will reward their approach and sometimes it will punish it, but that will not be the primary driver for how they behave. I think this may be true of the US, the EU states and the UK too.

Daniel Kahneman showed us in Thinking Fast and Slow, how most of our mental space is used to rationalise decisions we have already taken. One of the places where I part company with Wang is in his reverence for economists. He believes that the US should listen more to both engineers and economists to challenge the lawyerly society.

In the foreword for The Principles of Economics Course from 1990 by Phillip Saunders and William Walstad, Paul Samuelson, the first person from the US to win the Nobel Memorial Prize in Economic Sciences in 1970, wrote:

“Poets are the unacknowledged legislators of the World.” It was a poet who said that, exercising occupational license. Some sage, it may have been I, declared in similar vein: “I don’t care who writes a nation’s laws—or crafts its advanced treaties—if I can write its economic textbooks.” The first lick is the privileged one, impinging on the beginner’s tabula rasa at its most impressionable state.

My view would be that the economists are already in charge.

As a result, my fear is that economics is now used for rationalising decisions we have already made in many countries now, including our own. We are going to do what we are going to do. The economics is just the fig leaf we use to rationalise what may otherwise appear unfair, cruel, divisive and hope-denying policies. The financial constraints are less than they are cracked up to be, but they are a convenient fiction for a government which lacks any guiding principles for spending and investment otherwise and therefore fears that everyone would just be asking for more resources in its absence, and they would have no way of deciding between them.