I have spent many days in rooms with groups of men (always men) anxious about their future income, where I advised them on how much to ask their companies for. Most of my clients as a scheme actuary were trustees of pension schemes of companies which had seen better days, and who were struggling to make the necessary payments to secure the benefits already promised, let alone those to come. One by one, those schemes stopped offering those future benefits and just concentrated on meeting the bill for benefits already promised. If an opportunity came to buy those benefits out with an insurance company (which normally cost quite a bit more than the kind of “technical provisions” target the Pensions Regulator would accept), I lobbied hard to get it to happen. In many cases we were too late though, the company went bust and we moved it into the Pension Protection Fund instead. That was the life of a pensions actuary in the West Midlands in the noughties. I was often “Mr Good News” in those meetings, the ironic reference to the man constantly moving the goalposts for how much money the scheme needed to meet those benefits bills. I saw my role as pushing the companies to buy out funding if at all possible. None of the schemes I advised had a company behind them which could sustain ongoing pension costs long term. I would listen to the wishful thinking and the corporate optimism, smile and push for the “realistic” option of working towards buy out.

Then I went to work at a university, and found myself, for the first time since 2003, a member of an open defined benefit pension scheme. It was (and still is) a generous scheme, but was constantly complained about by the university lecturers who comprised most of its membership. I didn’t see any way that it was affordable for employers which seemed to struggle to employ enough lecturers, were very reluctant to award anything other than fixed term contracts, and had an almost feudal relationship with their PhD students and post docs. Staff went on strike about plans to close the scheme to future accrual and replace it with the most generous money purchase scheme I had ever seen. I demurred and wrote an article called Why I Won’t Strike. I watched in wonder when even actuarial lecturers at other universities enthusiastically supported the strike. However, over 10 years later, that scheme – the UK’s biggest – is still open. And I gained personally from continued active membership until 2024.

Now don’t get me wrong, I still think the UK university sector is wrong to maintain, unique amongst its peers, a defined benefit scheme. The funding requirement for it has been inflated by continued accrual over the last 8 years and therefore so has the risk it will spike at just the time when it is least affordable, a time which may soon be approaching with 45% of universities already reporting deficits. However the strike demonstrated how important the pension scheme was to staff, something the constant grumbling before the strike had led university managers to doubt. And, once the decision had been made to keep the scheme open to future accrual, I had no more to add as an actuary. Other actuaries had the responsibility for advising on funding, in fact quite a lot of others as the UCU was getting its own actuarial advice alongside that the USS was getting, but my involvement was now just that of a member, just one with a heightened awareness of the risks the employers were taking.

The reason I bring this up is because I detected something of the same position as my lonely one from the noughties amongst the group of actuaries involved in the latest joint report from the Institute and Faculty of Actuaries and the University of Exeter about the fight to maintain planetary climate solvency.

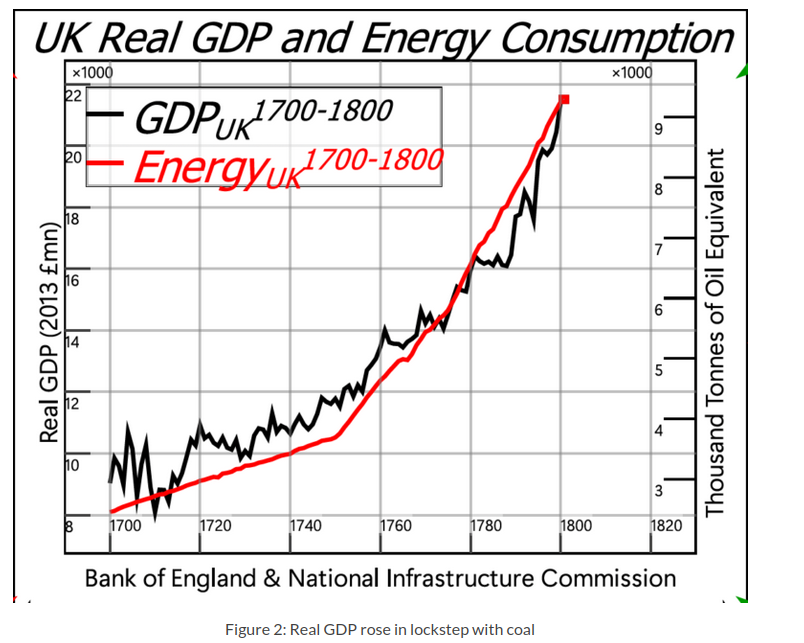

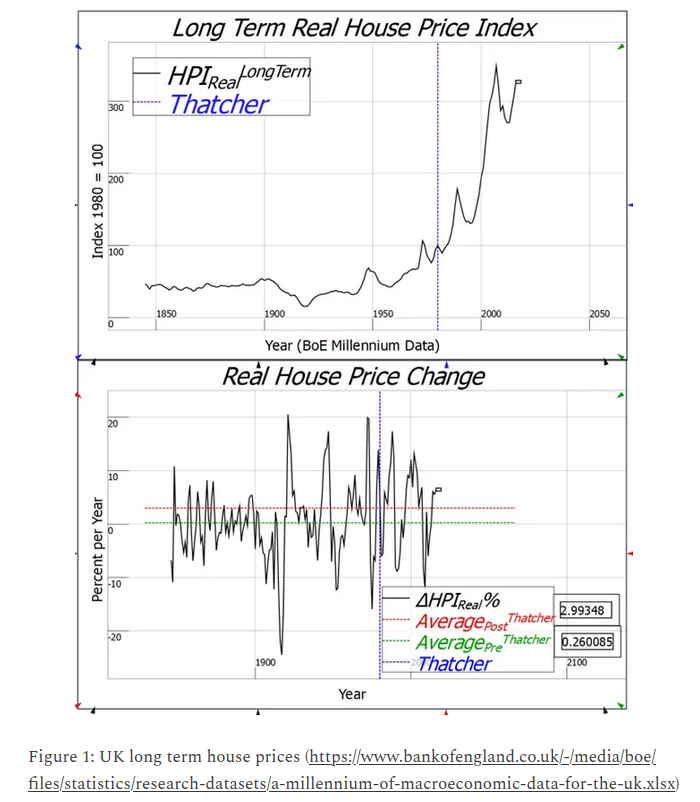

It very neatly sets out the problem, that the whole system of climate modelling and policy recommendations to date has been almost certainly underestimating how much warming is likely to result from a given increase in the level of carbon dioxide in the atmosphere. Therefore all the “carbon budgets” (amount we can emit before we hit particular temperature levels) have been assumed to be higher than they actually are and estimates for when we exhaust them have given us longer than we actually have. This is due to the masking effects of particulate pollution in the air, which has resulted in around 0.5C less warming than we would otherwise have had by now. However, efforts to remove sulphur from oil and coal fuels (themselves important for human health) have acted to reduce this aerosol cooling effect. The goalposts have moved.

An additional reference I would add to the excellent references in the report is Hansen’s Seeing the Forest for the Trees, which concisely summarises all the evidence to suggest the generally accepted range for climate sensitivity is too low.

So far, so “Mr Good News”. And for those who say this is not something actuaries should be doing because they are not climate experts, this is exactly what actuaries have always done. We started the profession by advising on the intersection between money and mortality, despite not being experts in any of the conditions which affected either the buying power of money or the conditions which affected people’s mortality. We could however use statistics to indicate how things were likely to go in general, and early instances of governments wasting quite a lot of money without a steer from people who understood statistics got us that gig, and a succession of other related gigs over the years ahead.

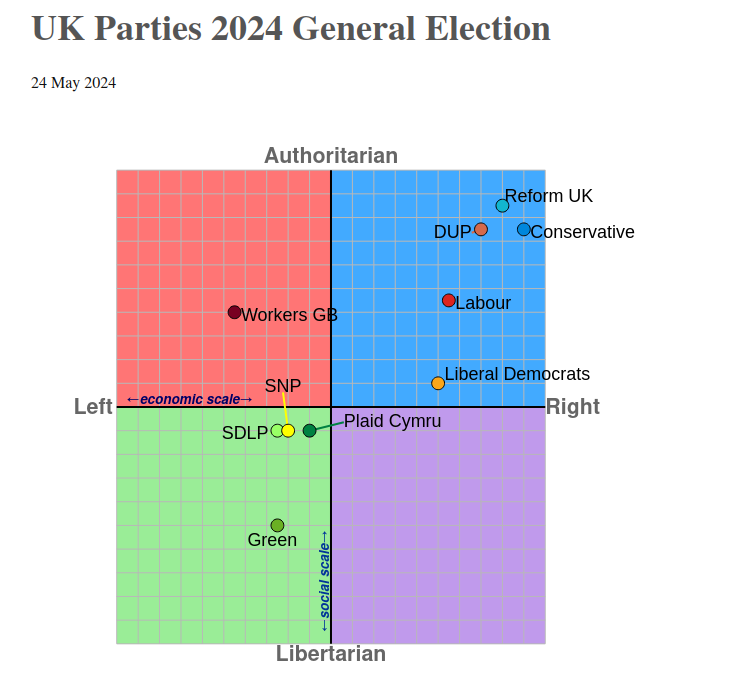

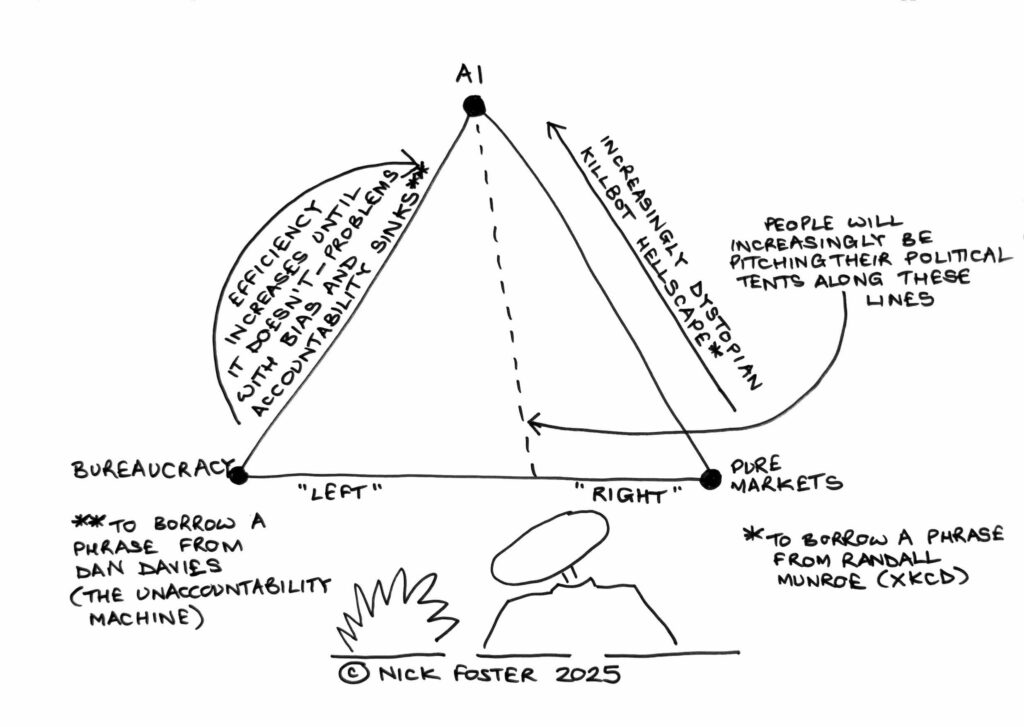

The difficult bit is always deciding what course of action you want to encourage once you have done the analysis. This was much easier in pensions, as there was a regulatory framework to work to. It is much harder when, as in this case, it involves proposing changes in behaviour which are ingrained into our societies. If university lecturers can oppose something that is clearly not in the long term financial interests of their employers and push for something which makes their individual employers less secure, then how much more will the general public resist change when they can see no good reason for it.

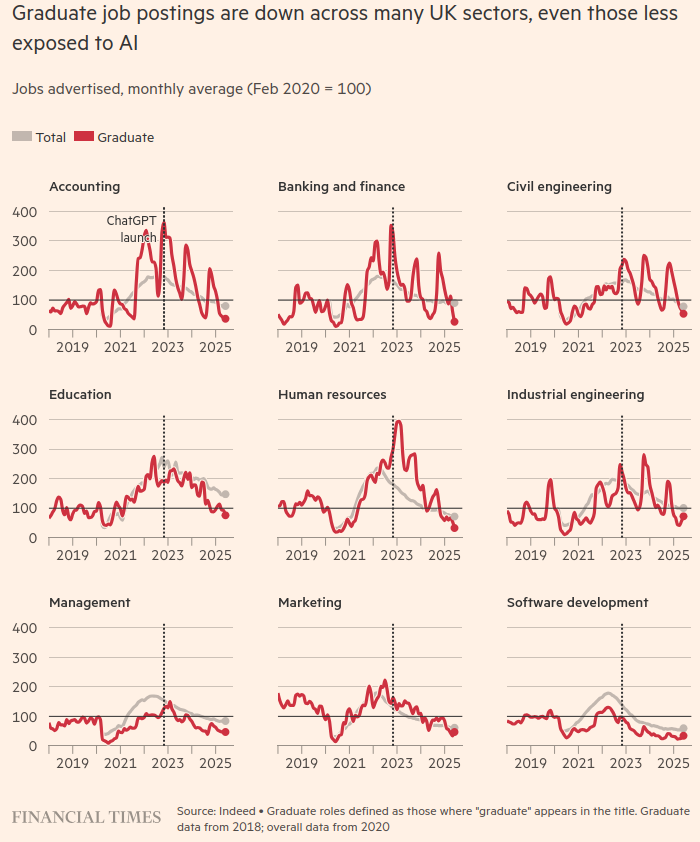

And in this regard this feels like a report mostly focused on the finance industry. The analogies it makes with the 2008 financial crash, constant comparisons with the solvency regulatory regimes of insurers in particular and even the framing of the need to mitigate climate change in order to support economic growth are all couched in terms familiar to people working in the finance sector. This has, perhaps predictably, meant that the press coverage to date has mostly been concentrated in the pension, insurance and investment areas:

However in the case of the 2008 crash, the causes were able to be addressed by restricting practices amongst the financial institutions which had just been bailed out and were therefore in no position to argue. Many of those restrictions have been loosened since, and I think many amongst the general public would question whether the decision to bail out the banks and impose austerity on everyone else is really a model to follow for other crises.

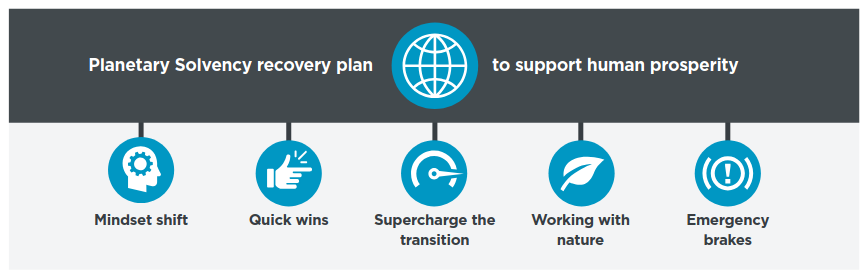

The next stage will therefore need to involve breaking out of the finance sector to communicate the message more widely, perhaps focusing on the first point in the proposed Recovery Plan: developing a different mindset. As the report says:

This challenge demands a shift in perspective, recognising that humanity is not separate from nature but embedded in it, reliant on it and, furthermore, now required to actively steward the Earth system.

To maintain Planetary Solvency, we need to put in place mechanisms to ensure our social, economic, and political systems respect the planet’s biophysical limits, thus preserving or restoring sufficient natural capital for future generations to continue receiving ecosystem services…

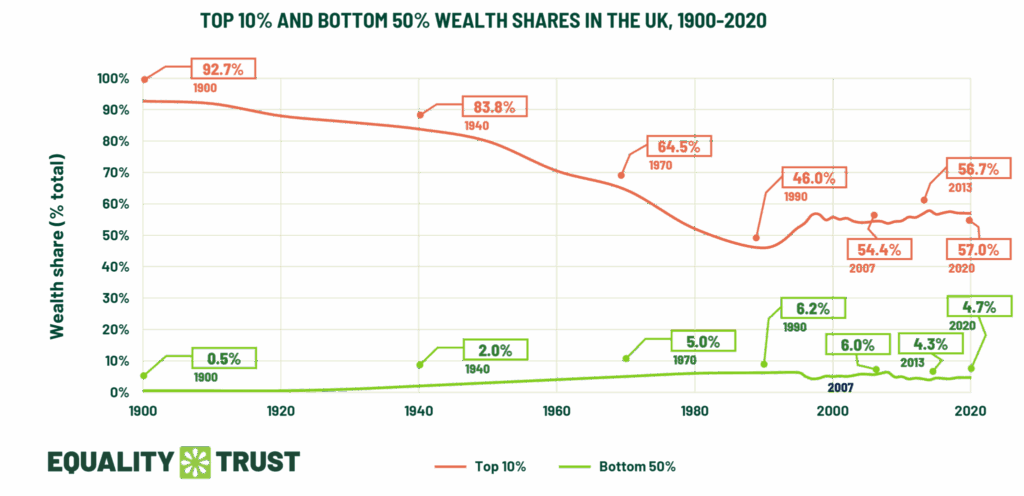

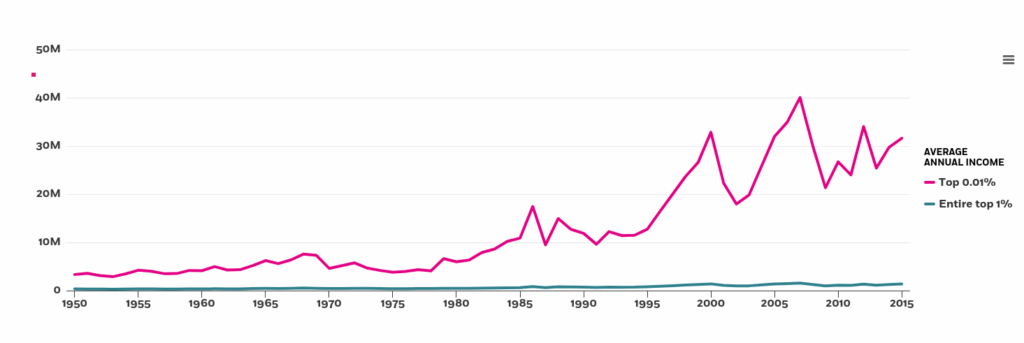

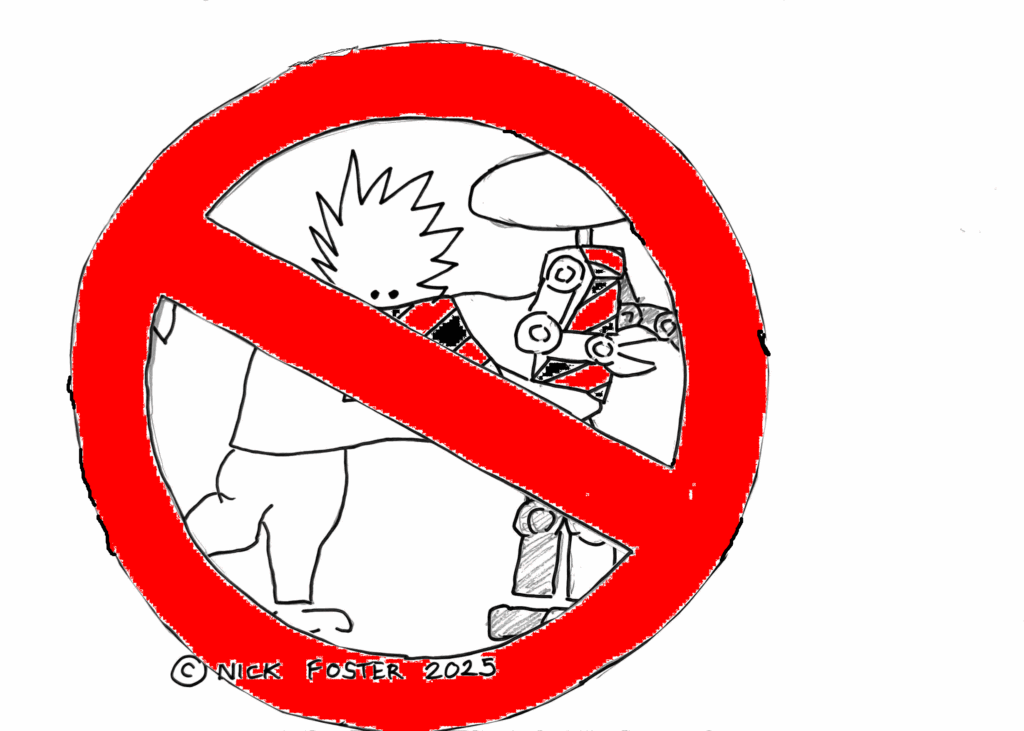

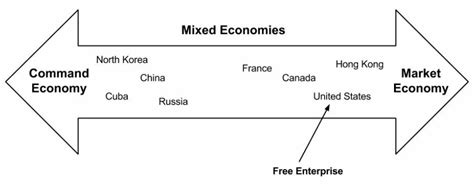

…The prevailing economic system is a risk driver and requires reform, as economic dependency on nature is unrecognised in dominant economic theory which incorrectly assumes that natural capital is substitutable by manufactured capital. A particular barrier to climate action has been lobbying from incumbents and misinformation which has contributed to slower than required policy implementation.

By which I assume they mean this type of lobbying:

And this is where it gets very difficult, because actuaries really do not have anything to add at this point. We are just citizens with no particular expertise about how to proceed, just a heightened awareness of the dangers we are facing if we don’t act.

But we can also, as the report does, point out that we still have agency:

Although this is daunting, it means we have agency – we can choose to manage human activity to minimise the risk of societal disruption from the loss of critical support services from nature.

This point chimes with something else I have been reading recently (and which I will be writing more about in the coming weeks): Samuel Miller McDonald’s Progress. As he says “never before have so many lives, human and otherwise, depended on the decisions of human beings in this moment of history”. You may argue the toss on that with me, which is fine, but, in view of the other things you may be scrolling through either side of reading this, how about this for a paragraph putting the whole question of when to change how we do things in context:

We are caught in a difficult trap. If everything that is familiar is torn down and all the structures that govern our day-to-day disintegrated, we risk terrible disorder. We court famines and wars. We invite power vacuums to be filled by even more brutal psychopaths than those who haunt the halls of power now. But if we don’t, if we continue on the current path and simply follow inertia, there is a good chance that the outcome will be far worse than the disruption of upending everything today. Maintaining status-quo trajectories in carbon emissions, habitat destruction and pollution, there is a high likelihood of collapse in the existing structure anyway. It will just occur under far worse ecological conditions than if it were to happen sooner, in a more controlled way. At least, that is what all the best science suggests. To believe otherwise requires rejecting science and knowledge itself, which some find to be a worthwhile trade-off. But reality can only be denied for so long. Dream at night we may, the day will ensnare us anyway.

One thing I never did in one of those rooms full of anxious men was to stand up and loudly denounce the pensions system we were all working within. Actuaries do not behave like that generally. However we have a senior group of actuaries, with the endorsement of their profession, publishing a report that says things like this (bold emphasis added by me):

Planetary Solvency is threatened and a recovery plan is needed: a fundamental, policy-led change of direction, informed by realistic risk assessments that recognise our current market-led approach is failing, accompanied by an action plan that considers broad, radical and effective options.

This is not a normal situation. We should act accordingly.