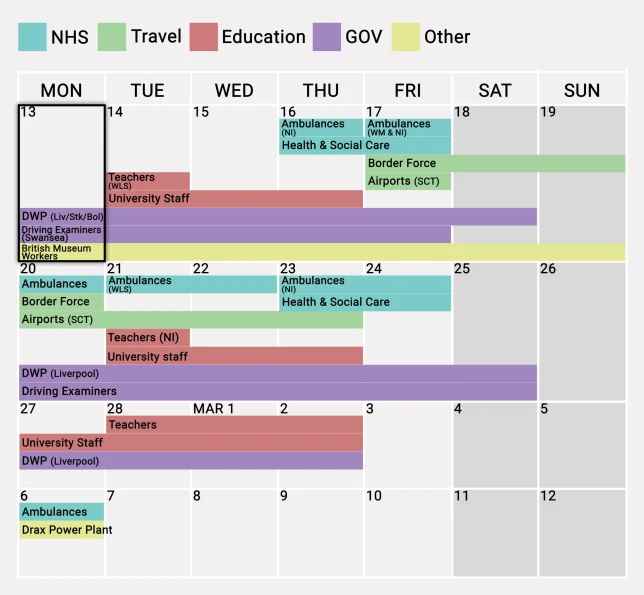

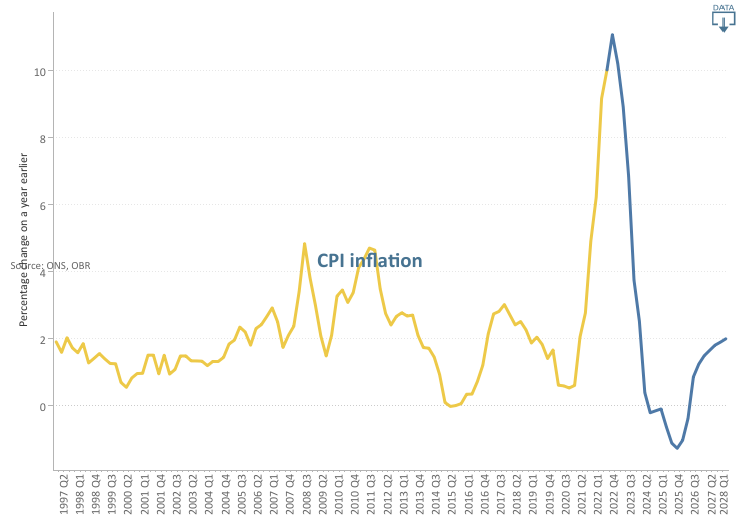

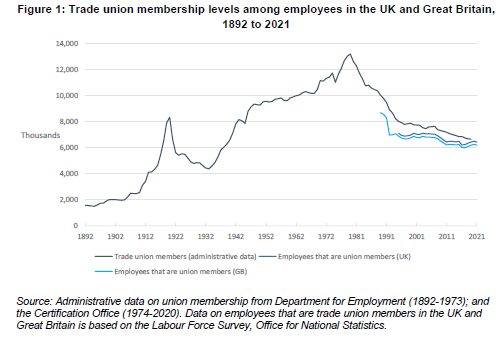

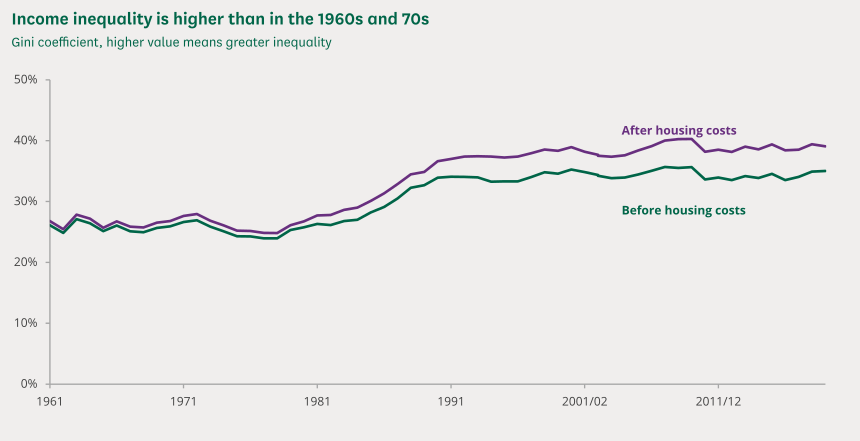

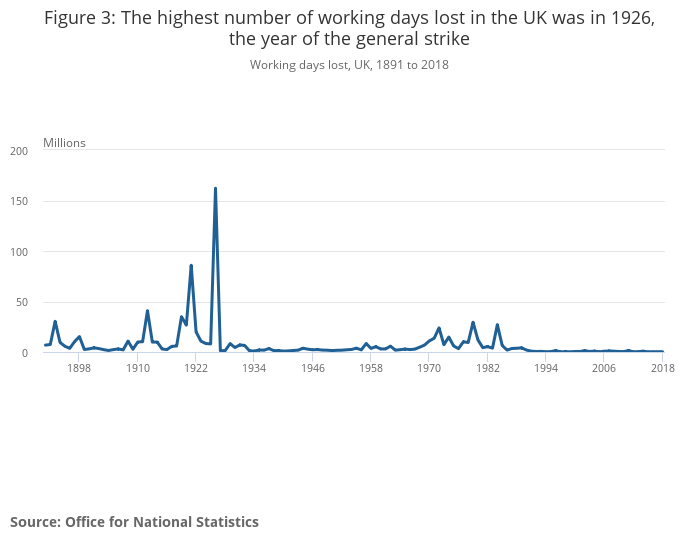

From the column inches expended on the recent industrial unrest, you could be forgiven for thinking that we were in the middle of an unprecedented time of strikes. More working days were lost to strike action in 2022 than at any time since 1989. However, as the graph above shows, and the accompanying ONS release details, what is in fact unprecedented is the degree of industrial peace we have had in the UK since 1985 when the miners’ strike was violently suppressed. The number of strike days lost in 2022 was 2.4 million, which sounds a lot until you realise that there were almost 30 million lost in the so-called winter of discontent in 1979 and the highest year for strikes was 1926, the year of the general strike, when 162 million days were lost.

Between 1919 and 1921 the number was above 25 million for all three years (peaking at 86 million in 1921, the second highest strike year on record). In 1919, an average of 100,000 workers were on strike every day: coal miners, railway workers, transport workers, dockers, police officers, soldiers, ex-servicemen, journalists, painters, teachers, farm workers, cotton spinners and many others. Yes, that’s right – police officers and soldiers were striking! This led to the Police Act of 1919 which established the Police Federation. As David Allen Green has pointed out, this has led to the seeming paradox of a group with no right to strike appearing to have some of the strongest employment protections.

And the soldiers? As John Westmoreland has written in Counterfire, this is even more interesting.

On 3 January 1919 2,000 soldiers in Folkestone refused to board troop ships bound for France to be deployed against the Russian Bolsheviks on the side of the White Russians. They refused orders and led a march of 10,000 through the town. They then formed a Soldiers’ Union. Despite a media blackout, there were around 50 mutinies across the UK and one particularly shocking one of the 13th Battalion of the Yorkshire Light Infantry at Archangel in Northern Russia in February 1919.

A very successful Hands Off Russia campaign increased the pressure on the Government, who were eventually forced to demobilise the troops. The mutineers largely escaped punishment, when mutiny was normally punishable by death (and General Haig indeed advocated shooting the strikers). The Government was forced to meet many of their demands. Demobilisation, which had been slow up until then because of the Russian military campaign planned, sped up considerably. British forces shrank from about 3.8 million at the Armistice to around 900,000 in late 1919 and down to 230,000 by 1922. Demobilising so many men in such a short space of time increased unemployment markedly, from just 1% of the labour force in May 1920 to 23% by May 1921.

Meanwhile, the Spanish flu pandemic, which claimed its first victim in May 2018, swept across the globe, infecting around 500 million people and killing around 50 million of them in the absence of treatments for flu or antibiotics to treat complications like pneumonia. This compares with the 756 million cases of Covid-19 recorded by the WHO to date, from which there have been 6.8 million deaths.

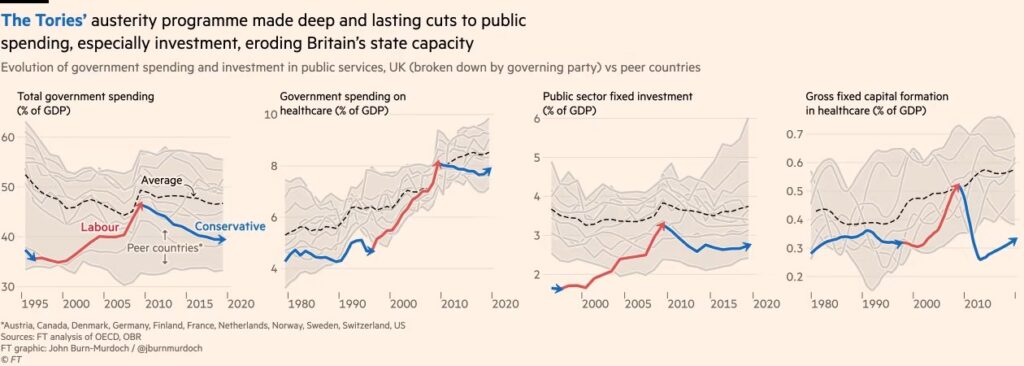

The strikes of 2023 are not extreme by historical standards at all. However, attempts by the Government to further muzzle the rights of people to withdraw their labour certainly are.