This work is licensed under a Creative Commons Attribution-NonCommercial 2.5 License.

https://xkcd.com/927/

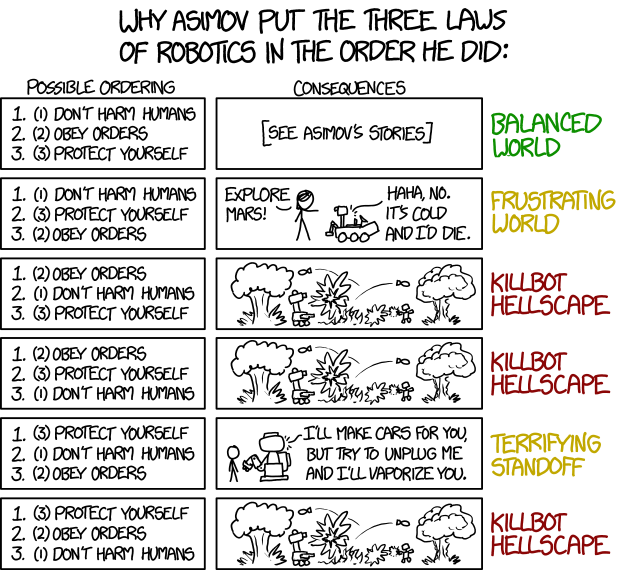

Actuaries who are members of the Institute and Faculty of Actuaries (IFoA) have a code. Yes, one or two clients might say, it is the language which they use to deliver all of their advice in. However, the Actuaries’ Code is supposed to set out what principles govern the way actuaries (and all other members of the IFoA) conduct themselves. Launched originally in 2009 with 5 key principles, it had a light touch review in 2013 before the current consultation on a more substantive review (including a new principle). Anyone who has a view about how actuaries should behave in future can take part in this consultation, which officially closes on 17 January (although I understand that responses will be accepted for a few days after this). You don’t need to answer all of the 48 questions, in fact you can just email individual comments to code@actuaries.org.uk if you prefer. I would urge anyone with an interest to do so.

Overall it is clearly a very considered piece of work, which has caused me to think more deeply about some elements of my professional practice. The Code itself is considerably clearer than it was, removing unnecessary detail, improving the visibility of other key regulatory requirements (eg continuing professional development (CPD) obligations and the disclosure requirements under the disciplinary scheme) and structured well with very short pithy principles supplemented by amplifications (and, if necessary, further explanations in an accompanying Guide). The Actuaries’ Code Guide is a completely new document designed to explain the Code in more detail. It is currently 48 pages long, which has caused some to feel that the advantages of having a Code short enough for everyone to read may have been lost. Then again, moving the 22 pages of it which cover conflicts of interest to a separate document (which I understand is under consideration) would leave a fairly focused document. I think a Guide of some description is necessary, if only to bridge the gap between the Code and other regulations. I do however agree with those who have said the Guide should not be an IFoA document at all, to avoid any perception of a regulatory authority it does not seek.

So, all in all, a good attempt to join up the various regulations governing actuaries’ professional practice.

And yet…it may not be a light touch review, but it’s not exactly heavy touch either.

The first thing that concerns me is what is not here. Both the Code and the Guide appear to be almost entirely concerned with actuarial advice, when there is an increasingly significant body of work carried out by actuaries, particularly in non-traditional areas, which is not advice to clients at all. I work in education, where I am making judgements based at least in part on my actuarial training all the time, but I have to work quite hard to cudgel some of this wording into phrases relevant to me (I think my favourite line is Where Members identify that a user of their work has, or is reasonably likely to have, misunderstood or misinterpreted their advice, Members should draw their attention to any adverse impact, which describes an almost constant state of affairs within a university environment).

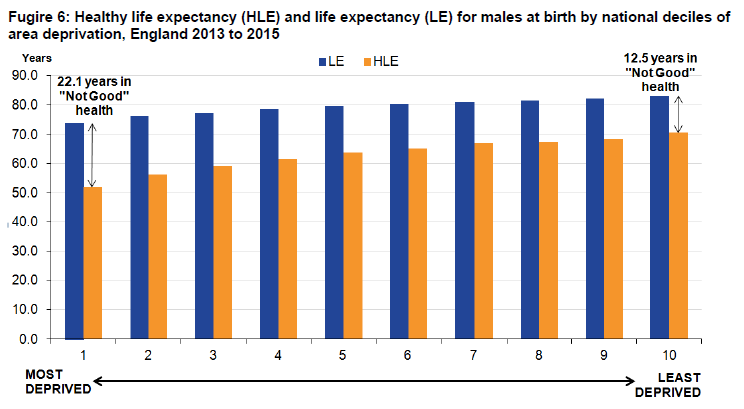

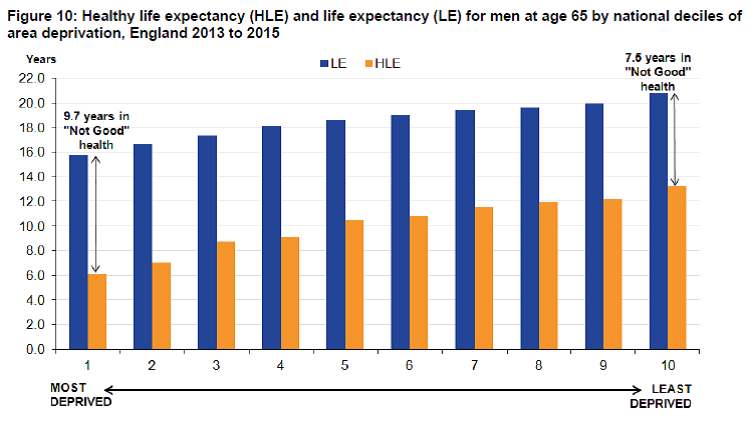

There is also nothing here about responding to the impact of automation on the profession. There are many concerns which flow from this, but consider one scenario: increasingly capable artificial intelligence systems, with access to far more data than any individual doctor could possibly take into consideration in making a diagnosis, will be able to offer advice and treatments to patients with better outcomes than even the top practitioners in a given field, and with far more reliable outcomes. According to Daniel Susskind, this is already starting to happen. However, as Cathy O’Neill points out, this increased reliability has immediate outcomes in a health insurance environment:

Just imagine, though, what insurance companies will do with the ability to better predict people’s health care costs. If the law allows, they will increase prices for the riskiest customers to the point where they can’t afford it and drop out, leaving lots of relatively healthy people paying more than they’re expected to cost. This is fine from the perspective of the insurer, but it defeats the risk-pooling purpose of insurance. And in a world of increasingly good predictive tools, it will get progressively worse.

If we do not have any principles in our Code which require us to take account of such considerations, and a direction of travel of increased privatisation of the NHS, what is to stop us actively conniving in such an outcome?

A principle like run your business or carry out your role in the business in a way that encourages equality of opportunity and respect for diversity would be one possibility (courtesy of the code of conduct from the Solicitors Regulation Authority). Another possible approach would be to require individual members to take account of the public interest, using the same professional judgement required to interpret the rest of the Code. It is therefore unfortunate that the IFoA should also have taken this opportunity to point out to members that they have no individual responsibility for such considerations. I strongly disagree with this, a move which was initially a response to the appeal against the ruling against the Phoenix Four. An appeal tribunal that overturned eight of the charges levied against Deloitte criticised the ICAEW for the lack of clarity in its guidance about how accountants should act in the public interest. It seems appalling to me that we would retreat from taking individual responsibility in this area altogether on the back of this.

But what about the new principle that has been added: Speaking Up? There has been some discussion about whether the requirement to speak up has been widened by the phrase Members should challenge others on their non-compliance with relevant legal, regulatory and professional requirements. I am not sure that this will lead to a large increase in whistleblowing in the profession, but I do think that the principle expresses expectations of members much more clearly now and this may have an impact on behaviour. What it doesn’t do is broaden the considerations under which speaking up can take place.

However I think the biggest weakness of the new Code, which undoes a lot of the clarity found elsewhere, may turn out to be the extensive use of just two words. “Appropriate” or “appropriately” turn up four times and the words “reasonable” or “reasonably” nine times. This suggests a shared view of the meaning of these words which I would question exists in a Code which “has no geographic restrictions and applies to Members in all locations and in relation to work carried out in respect of any part of the world”. The IFoA feels it knows what these words mean and doesn’t need to explain them. I think that individual professional judgement would be better applied to interpreting on a daily basis a clear description of what the IFoA means by appropriate and reasonable. That would certainly lead to a narrower range of outcomes, which ultimately has to be the point of any Code.