Another month, another consultation. This time it’s the Pension Protection Fund’s (PPF) turn. I last wrote about their plans five months ago. Since those dark days things seem to have moved on a bit: there is now a proposed model and a timetable for implementation.

And there is much to cheer here. One of the main criticisms consistently levelled at the current system was that it was hard for employers to understand how to improve their score, without handing over money to Dun & Bradstreet (D&B) for reports and fees to advisers to interpret them. Here, at last, is a model which is not owned by the credit agency running it, something I have long argued for. This means that the scores and data underlying them can be monitored by companies much more easily, and in more detail, by a free web-based portal.

Unfortunately the PPF are risking undermining this transparency for large companies by considering a credit rating override, where the insolvency risk would be determined by the company’s credit rating score instead. In my view this idea should be resisted.

Other successes are the moves to stop ABCs from getting too much credit for their complex structures, and the use of past data to review the treatment of Type A contingent assets (although they have chickened out of removing these altogether) and the last man standing levy reduction.

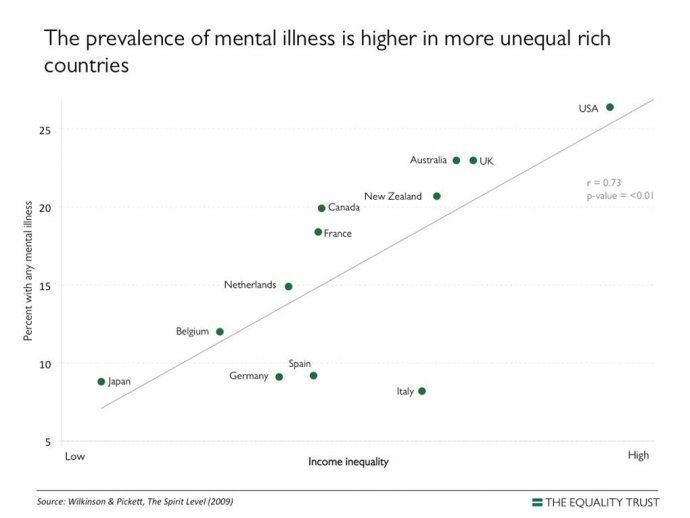

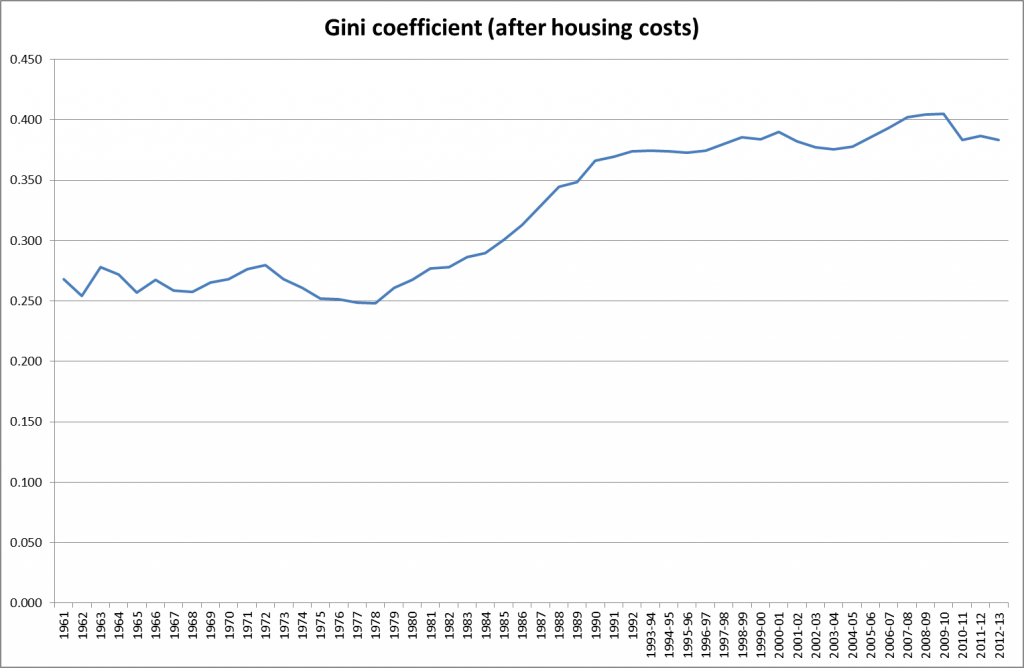

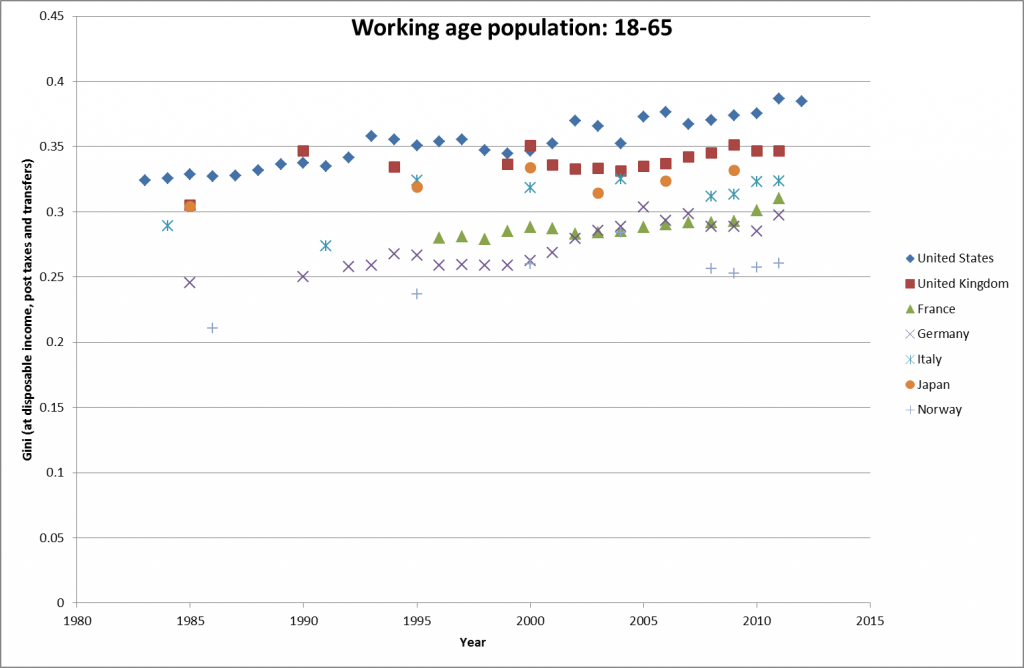

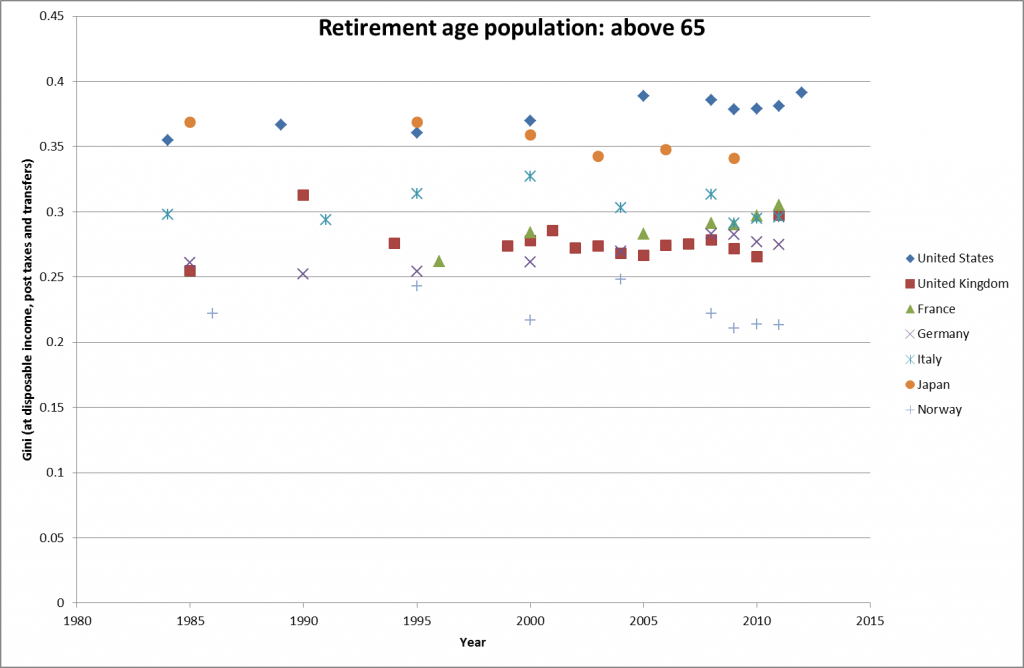

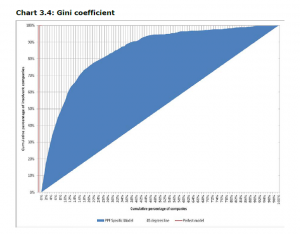

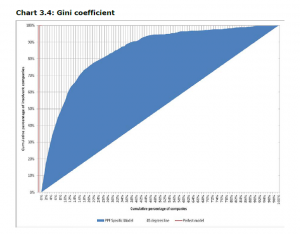

In all there were nine success criteria which were used to make the decision on the model used, but the one given the greatest weighting was “predictiveness”. According to the Oxford English Dictionary this word does not exist, but I take it to mean “degree to which insolvency risk assessed predicts the number of actual insolvencies for a given score”. Of course, it is nothing of the kind that has been assessed. They have taken the last eight years of data and compared the proportion at each score level with the percentage of insolvencies expected (they say “predicted”), and wrapped up the differences in an eye-catching diagram using the Gini coefficient (this is usually used to talk about inequality, when you are looking to minimise it, but here they are trying to allocate levies where the risk lies and therefore trying to maximise the distance from an even distribution).

All a high Gini score means in this context is that the selected model fits well with the actual insolvencies over the last eight years. The danger is that the model has been over-fitted to eight years’ data, a rather untypical period for the economy in many ways and possibly not very indicative for what lies ahead until 2030 (when the levy is supposed to end). Fortunately they are proposing to continue monitoring how well the “predictiveness” works in future.

All a high Gini score means in this context is that the selected model fits well with the actual insolvencies over the last eight years. The danger is that the model has been over-fitted to eight years’ data, a rather untypical period for the economy in many ways and possibly not very indicative for what lies ahead until 2030 (when the levy is supposed to end). Fortunately they are proposing to continue monitoring how well the “predictiveness” works in future.

The other area of the consultation where I take issue is the PPF’s opposition to having a transition period. Their impact assessment shows that 10% of schemes are expected to see an increase of over £50,000 in their levy as a result of these changes, with 200 of them seeing an increase of over £200,000. It therefore seems odd that they should oppose a transition period to allow companies to better cope with the long term move to a fairer allocation of levies. The main argument they give for this is that it would be a cross subsidy. But so is the restriction on the increase in levy by moving down a band to 60%, which I can see much less justification for and which results in bands 2 and 3 underpaying for their insolvency risk and bands 5 and 6 overpaying for it.

But overall a broad welcome, as I will be telling them. Let’s see what survives the consultation (it ends at 5pm on 9 July).

My consultation responses are as follows:

Chapter 2

1. Do you agree that we should seek to maintain stability in the overall methodology for the levy, only making changes where there is evidence to support them?

Yes.

Chapter 3

2. Do you consider that the definition of the variables in the scorecards is sufficiently precise to provide for consistent treatment?

Yes.

3. Do you agree that it is appropriate to re-evaluate the model to ensure that it remains predictive?

Yes.

4. Do you have comments on the design of the “core model” developed by Experian?

Very pleased that the PPF have decided to move away from a proprietary model, where large parts of its operation are kept secret through commercial confidentiality arguments.

5. Do you agree with the success criteria set out by the Industry Steering Group and that the PPF-specific model developed by Experian is a better match with them than Commercial Delphi?

Yes.

6. Do you agree that it is appropriate to use the separate scorecard developed by Experian not-for-profit entities, even though this requires an extension of the data set used to generate the scorecard?

Yes.

7. Do you have comments on the approach to the rating and proposed identification of not-for profit entities, developed by Experian?

No.

8. Are there other public sources of data that Experian should consider extending coverage to?

No.

9. Do you agree with the proposed data hierarchy?

Yes.

Chapter 4

10. Do you favour a credit rating over-ride?

No. This would undermine the gain in transparency offered by the PPF-specific model.

Chapter 5

11. Do you agree with our proposed aims for setting levy rates?

I am concerned about the cross subsidy implicit in the 60% limit on levy differences between adjacent bands.

12. Do you agree it is appropriate to divide the entities with the best insolvency probabilities in to a number of bands, to ensure that the cliff-edges between subsequent bands are limited, or do you favour a broad top band?

Cliff edges are unavoidable with this model. I think there is a strong argument for having slightly fewer slightly bigger ones. This would remove many of the small band movements at the top end, which are relatively unproductive for risk management.

13. Do you agree with the proposed 10 levy bands and rates?

Not completely. Bands 2 and 3 appear to be underpaying for their insolvency risk, and bands 5 and 6 appear to be overpaying.

14. Do you agree that for 2015/16 levy year insolvency probabilities are averaged from 31 October 2014 to 31 March 2015?

Yes.

Chapter 7

15. Do you support transitional protection for those most affected by the move to the new methodology, recovered through the scheme-based levy?

Yes.

Chapter 9

16. Do you agree that the appropriate route to reflecting ABC’s in the levy is to value them based on the lower of the value of the underlying asset (on employer insolvency) after stressing or the net present value of future cashflows?

Yes. I do not accept that ABCs’ primary objective is to reduce risk. The changes proposed appear to ensure that they do not get overly favourable treatment in terms of levy reduction.

17. Do you agree that a credit should only be allowed where the underlying assets for the ABC is UK property? Do you have any comments on the example voluntary form/required confirmations?

Yes.

18. Do you support the proposal to make the certification of contingent assets more transparent, through requiring certification of a fixed amount which the guarantor could pay if called upon?

Yes.

19. Do you have any comments on the proposed revised wording for trustee certification for Type A contingent assets?

The revised wording seems appropriate.

20. Do you agree with our proposals to adjust guarantor scores to reflect the value of the guarantee they are potentially liable for? Do you favour the adjustment being achieved by a factor being applied to the guarantor’s Pension Protection Score or by an adjustment of the guarantor’s levy band?

This looks like a very complicated approach designed to put off sufficient schemes from using Type A contingent assets so that there will not be a very large squeal when they are removed altogether.

21. What other measures do you suggest to ensure that, where a scheme certifies information about a contingent asset to the PPF, any resulting levy reduction is proportionate to the actual reduction in risk?

I think the proposals are complicated enough.

22. Do you agree with the proposed form of confirmation when Last Man Standing scheme structure is selected on Exchange?

Yes.

23. Do you agree with the revised scheme structure factor calculation proposed for associated last man standing schemes?

Yes.