Mark Blyth wrote a great book about how it was a dangerous idea; Simon Wren Lewis described it as a con; Stephanie Kelton defined it as the “deliberate infliction of harm upon society in the presence of alternatives”; Frances Coppola wrote about its terrible price; Steve Keen described it as naive; Mariana Mazzucato, Robert Skidelsky, Ann Pettifor, David Blanchflower and others wrote in the New Statesman on why the UK should not impose it in response to higher debt following the pandemic; and Richard Murphy gave the possible reasons for imposing it as “ignorance, dogmatism and spite”.

What are all of these economists talking about? Austerity. And nearly all of the criticism thrown at this “dangerous” idea is that it does not work economically (ie it will not bring down government debt levels or boost economic growth, the usual justifications given for pursuing it): a criticism for which there is a large and ever growing data set in support.

Now there are any number of Four Yorkshiremen out there to say that this thing we’re calling austerity is luxury and that we are all snowflakes to complain about it, so let’s be clear about what is meant here. Clara Mattei, in her excellent new book The Capital Order, describes the three forms of austerity policies: fiscal, monetary and industrial, usually used in combination. Fiscal austerity (reducing public spending, particularly on health, education and benefits and increasing the burden of taxation) and monetary austerity (reductions in the money supply and increases in interest rates) are familiar to most of us and normally the only elements of austerity discussed in the media. To these Mattei adds the idea of industrial austerity, which includes (often described as supply side policies, with the connotation of getting the economy fit to compete in world markets) policies aimed at reducing the negotiating power of workers, from anti-union legislation, to reductions in unemployment benefits, minimum wage levels and wage levels and job security within the public sector.

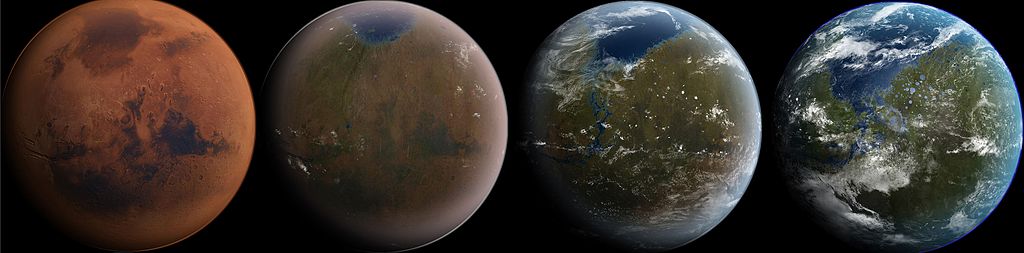

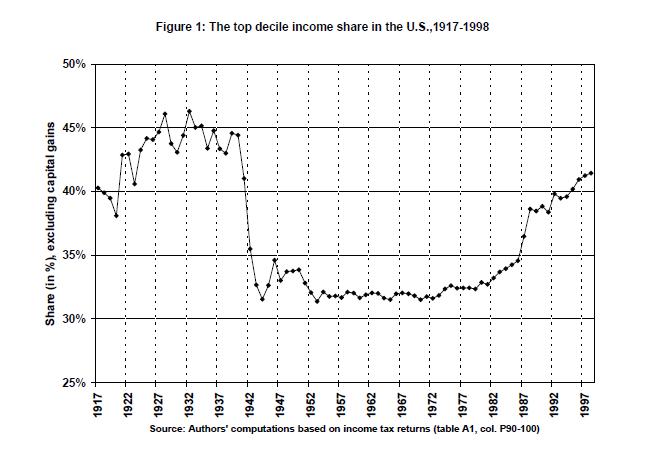

The contention of The Capital Order is that the reason that austerity has been used again and again in the last 100 years, despite repeatedly failing to achieve the economic goals used to justify it, is that its goals have not been economic but political. The political goal of austerity policies is to defend capitalism whenever events make it seem likely that people will look for alternatives (think World War I or the socialism following World War II or the 2008 crash, or now, the pandemic). Whenever government intervention in the economy has been needed on a sufficient scale to demonstrate that economies can strike a different balance between capital accumulation and labour power, austerity has been brought out immediately afterwards to put labour power back in its box, by making nearly everyone too poor, too busy and too regulated to be able to protest about it.

If this premise is accepted, and I think Mattei makes a convincing case in her analysis of post-World War I austerity policies in Italy and the UK, then the implications are profound. Rather than repeated wrong-headed economic policies by people who do not understand economics, we would instead have deliberate political policies by people who completely understand what they are trying to achieve by them.

The other part of the strategy, via the first international financial conferences in Brussels and then Genoa, in 1920 and 1922 respectively, was to establish an international consensus for policies where “individuals had to work harder, consume less, expect less from the government as a social actor, and renounce any from of labour action that would impede the flow of production.” Lord Chalmers, former permanent secretary at the UK Treasury, summarised this approach as: “work hard, live hard, save hard”. The aim was to return to a pre World War I economic orthodoxy and therefore remove what would be very painful economic measures for most people from the political sphere and into the sphere of “economic science”.

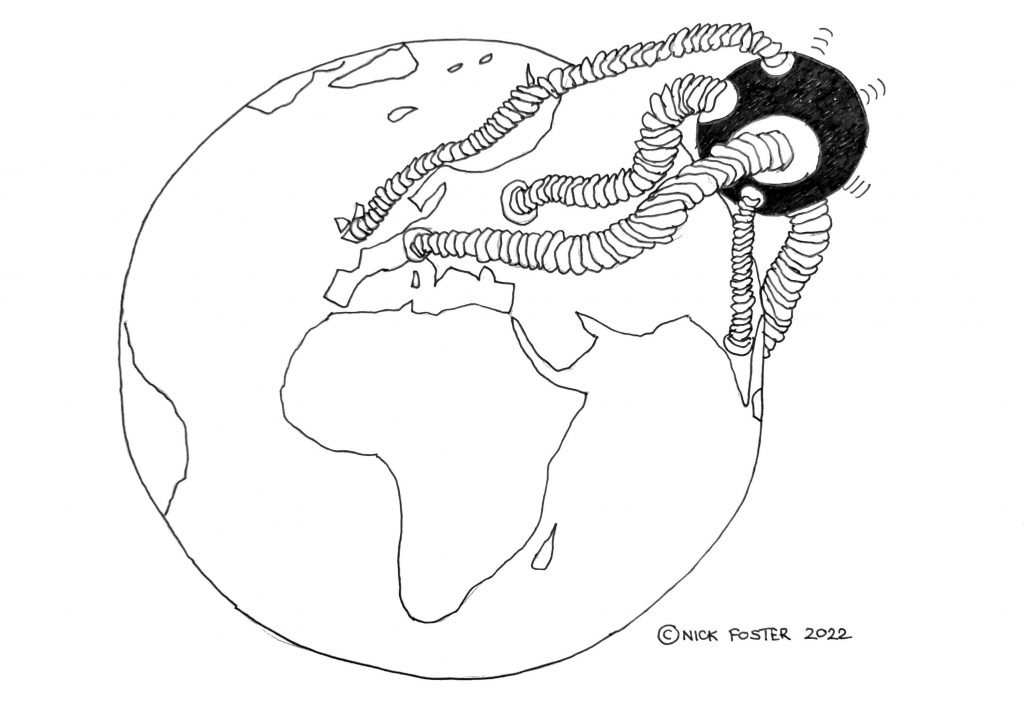

A quotation from the League of Nations in 1920 sums up the how important it was that such a consensus be achieved, to make it extremely difficult for any country to stand against it:

This principle must be clearly brought home to the peoples of all countries; for it will be impossible otherwise to arouse them from a dream of false hopes and illusions to the recognition of hard facts.

These “hard facts” then become the justification for sticking with economic policies, however discredited they might be economically, and buttress them: against alternative economic views (the effective shutdown of the New Approaches to Economic Challenges (NAEC) unit of the OECD being the most recent high profile example) and against popular pressure to change course (eg through such measures as central bank independence from government control over monetary austerity or proposed legislation to limit the scope of political protest).

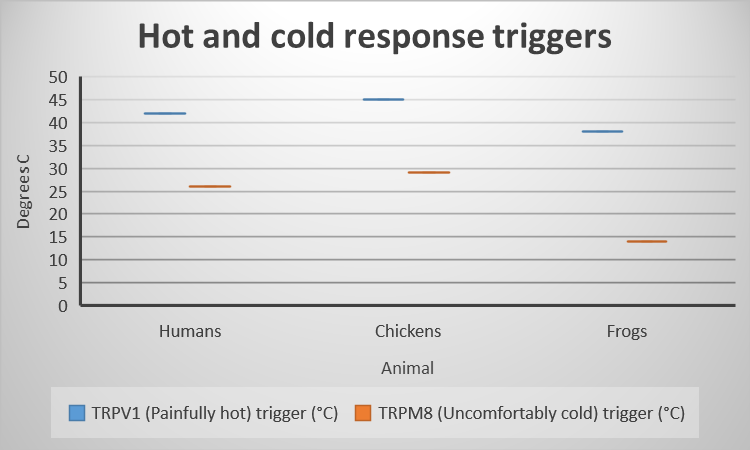

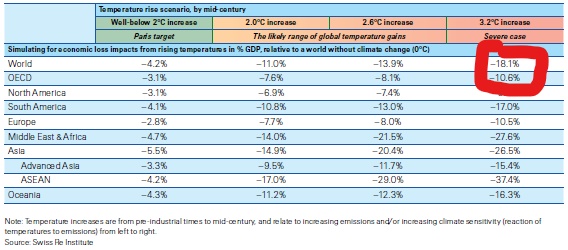

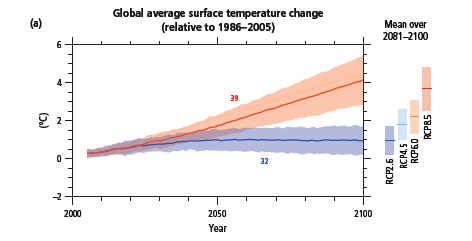

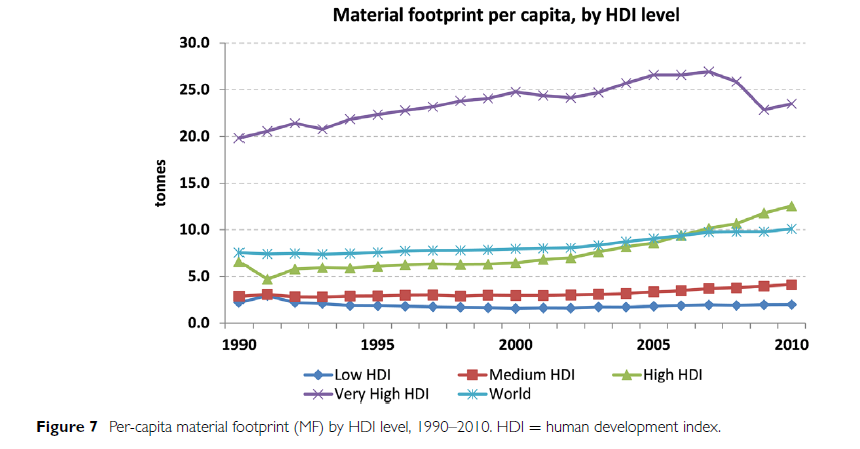

And of course this effective outlawing of alternative schools of economic thought has other implications too. For example, as Steve Keen has shown, the potential impact of climate change in economic models to date has been disastrously underestimated, allowing fossil fuel lobbyists to delay climate action as a result.

We have all three types of austerity in play at the moment in the UK: monetary, fiscal and industrial. We can either believe that this is designed to force our compliance with the mantra to “work hard, live hard, save hard” even if we do not want to, or that it is for the economic reasons given. The former option requires us to believe that the elites in nearly every government in the world are committed to defending capitalism at all costs and that, if we want to contest this, we will have the political battle of our lives on our hands with the odds steadily more stacked against us with every new piece of legislation passed; the latter requires us to believe that our governments are economically ignorant, dogmatic and spiteful. All our current problems and our solutions to them: from the economic crisis, to the ecological crisis and the increasing political crises globally (what Adam Tooze calls the polycrisis) – depend on what we decide to believe.