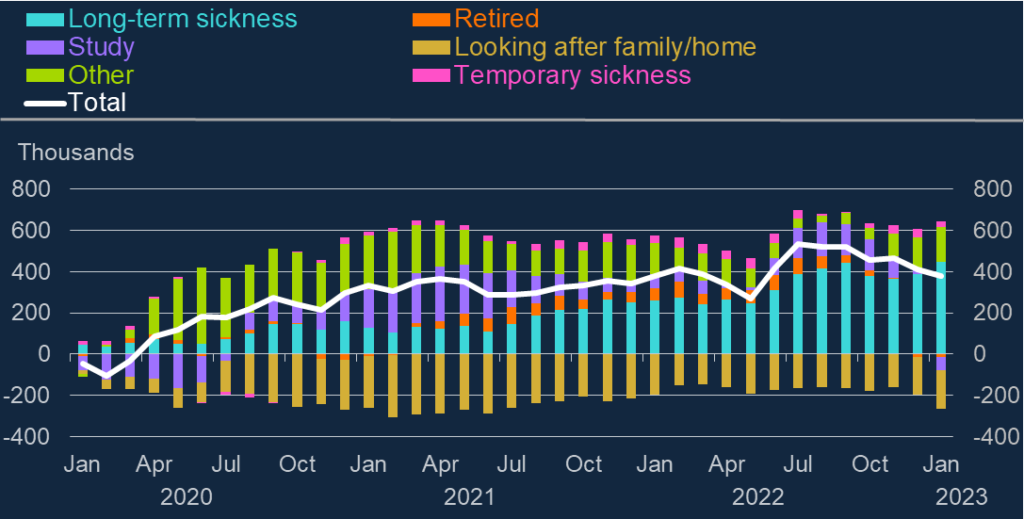

I am returning to the scene of my crime cartoon, which did not really deal with what the Governor of the Bank of England was saying as it was more a criticism about how he was saying it. However in response to a comment on my piece, I also realised that I was critical of what he was saying too. My criticism centres on the following graph:

As Andrew Bailey’s speech acknowledges:

“As you can see in blue…, long-term sickness has driven much of the persistent rise in inactivity amongst 16 to 64 year olds since the start of the pandemic. That is a striking fact.”

This is backed up by recent research carried out by LCP, whose conclusions included the following:

- The rise in working age inactivity is not purely amongst those over 50; at the time of the Autumn Statement, nearly half the increase had come from the under 50s, with a big rise in the number of students a major factor;

- Data on flows into and out of long-term sickness show that persistently high inflows into long-term sickness are a key problem; one growing group is those who flowed into long-term sickness having been previously categorised as ‘short-term sick’; this suggests that failure to address short-term sickness, including through clinical intervention, could have contributed to the increase in long-term sickness;

- Amongst the entire economically inactive population of working age, very few of those who are retired say they ‘want a job’, whereas over 600,000 of the long-term sick say they would like to work if they could; this suggests that policies designed to help the long-term sick are ‘pushing at an open door’ in terms of supporting people who would actually go back to work given the right opportunities and treatment;

The “striking fact” for me is that the Governor of the Bank of England, faced with very similar data to LCP, instead concluded the following:

…the rise in economic inactivity is a change to the supply of labour, independent of demand, in particular by older workers. If those workers have accumulated enough savings to sustain a desired level of consumption much like the one they had before their early retirement, at least for a while, aggregate demand will not have fallen by as much as aggregate supply. We should expect this to put upward pressure on inflation in a way that would call for a higher level of interest rates to dampen demand.

But this is a comment on a dataset which shows most new inactivity is in the over 50s (which it isn’t) and that there is no large group of people currently economically active who wish to return to work given the right levels of support (there are 600,000 of the long-term sick in this category). What the LCP report concludes plausibly from the data is that policies designed to help the long-term sick who want to go back to work given the right opportunities and treatment and those designed to support the NHS to increase its capacity in primary care and mental health services in particular, would have much more impact on the number of people defined as economically inactive. As the LCP report says:

Clearly, a range of policy initiatives will be required to tackle economic inactivity, and these will include measures to reduce the ‘inflow’ into inactivity (eg people currently in work retiring or going off sick), but in terms of measures designed to increase the ‘outflow’ from inactivity, doing more for the long-term sick is likely to be far more effective than concentrating on those people who have already retired.

Meanwhile, the Governor of the Bank of England has an interest rate hammer for a tool and he therefore needs the problems he is addressing to look as much like a nail as possible (my explanations in non-italics):

So while population ageing is very likely to pull long-run R* down (this is the long-run average real equilibrium interest rate, net of inflation, averaged over the economic cycle), as I discussed earlier, the effects on shorter-run r* (which is the theoretical equilibrium rate of interest at a given point in the economic cycle) from a change in labour force participation are harder to assess. In the shorter run, by reducing the productive capacity of the economy, the rise in inactivity driven by early retirement (which is virtually non-existent as his own graph shows) seems likely to have contributed to a rise in cyclical r*. This is part of the reason why we have had to raise Bank Rate by as much as we have.

But what about a rise in inactivity caused by long-term sickness? Interestingly, Jonathan Haskel, another MPC member who also voted for the latest rate rise, recently presented some fascinating work with Josh Martin on long-term sickness and labour market outcomes. Amongst the implications of the rapid rise in long-term sick amongst the UK’s economically inactive population are:

• Long-term sickness is more than just a reason for economic inactivity – many in-work are long-term sick;

• The out of work long-term sick have high rates of wanting jobs, but less success in getting them, which suggests cultural or structural barriers.

Making their lives more difficult by interest rate rises which increase their living costs and reduce the security of any employment they may already have seems an odd way to solve either of these problems.