Day 3 of the UCU strike and we move onto fiscal austerity. This is the type of austerity we normally think of – increasing taxes and reducing government spending – and the most prevalent feature of all the UK governments we have had since 2010, with the cumulative lack of investment in the economy which is the underlying cause of most of the industrial action now taking place all around us. People are not just upset that their pay has not kept pace with inflation for 12 years, it is also the cumulative degradation of the conditions under which they work, seek healthcare, seek education for their children, travel anywhere or don ‘t travel anywhere that has enraged so many.

Rishi Sunak says he would love to give nurses a “massive” pay rise, but insists the money needs to be prioritised in other areas of the health service. Jeremy Hunt insists that his priority is tackling inflation and that public sector pay rises cannot be allowed to jeopardise this. Health secretary Steve Barclay hints that striking NHS staff could be offered a better pay deal from April – if unions accept “productivity and efficiency” reforms in return.

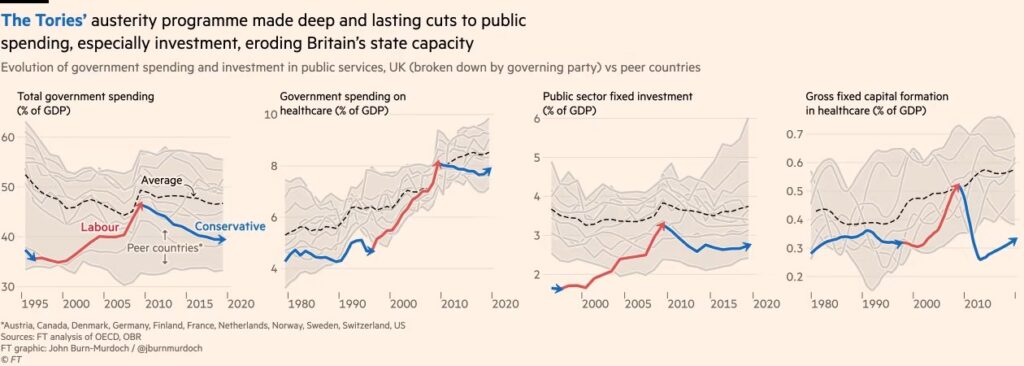

But improving productivity at work requires investment in where you work, as numerous studies have confirmed (one example here). Whereas, as the FT has shown recently, the UK has done the following since 2010:

And what about Jeremy Hunt’s reasons for keeping pay reducing in real terms in the public sector year after year? That paying an inflation matching increase would in some way “lock in” inflation. As Blair Fix tweeted recently:

Most economists accept that a wage-price spiral is possible, leading to runaway inflation. But why isn’t an interest-price spiral also possible? Interest and wages are just two forms of income. So why is one spiral ‘obvious’ while the other is blasphemy?

It doesn’t make sense until you realize that mainstream economists are in the business of legitimizing capitalist income. Wages can drive inflation (bad workers!) … but capitalist income is always productive.

He has also written about the problems caused by following economic theories treating inflation as a single value, when it is of course an average (or in fact usually at least an average of an average, sometimes switching between arithmetic and geometric averages in the process) taken of a highly volatile underlying data set. It is often said that inflation is redistributive: benefitting borrowers at the expense of lenders. However, one of the insights from Fix’s piece, drawing on Nitzan’s and Bichlar’s work in the 90s, is that big business also benefits from inflation: large corporations and oligopolies are raising prices the fastest at the expense of smaller businesses. Why do we never hear that this is driving inflation?

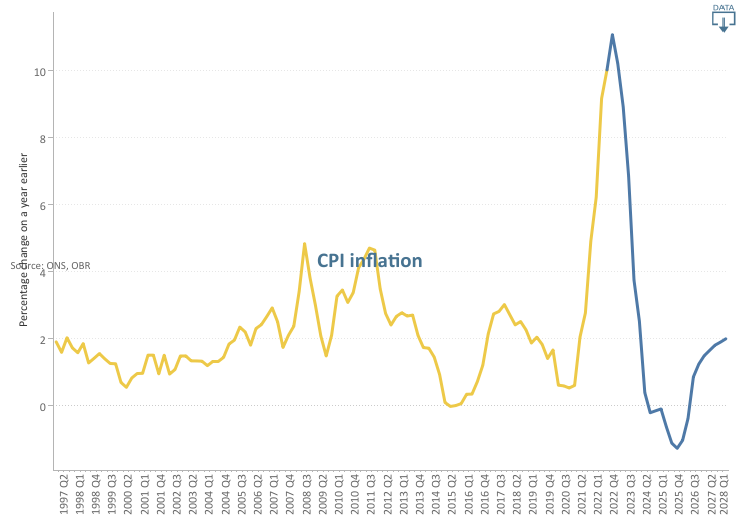

Because capitalist income is, in their view, “always productive”, you won’t hear about rent-price spirals or profit-price spirals from the current Government. Instead we will hear about how inflation needs to be reduced and this can only be done by further depressing the real value of all of our incomes for another year. This is what the Office for Budget Responsibility (OBR) has to say about CPI:

Following the Russian invasion of Ukraine, we now expect CPI inflation to peak in the fourth quarter of 2022 at its highest rate in around 40 years. The increase is driven primarily by higher gas prices feeding into sharp rises in domestic energy bills, alongside higher fuel prices and global goods inflation. Inflation then falls rapidly, and temporarily goes negative in mid-2024 as energy bills fall back and some global supply pressures reverse.

On nominal wage growth and its contribution to Real Household Disposable Income (RHDI) they have this to say:

Nominal wage growth is also high in 2022 and 2023, although not high enough to prevent real wages from falling significantly. The contribution of labour income to annual RHDI growth then settles at an average of 2 percentage points a year over the remainder of the forecast.

Since one of the original motivations for starting this blog was the poor forecasting ability of the OBR, I am not going to set too much store on these forecasts, other than to point out the confidence it has that labour income demands will be thwarted and we will all see our real wages fall significantly over the next year. All in pursuit of a policy for which the expected value appears to be 6 months of deflation.

Deflation would be a disaster, As Frances Coppola has written:

Those who have money are happy because they are becoming wealthier. But someone, somewhere, is going hungry.

As she concludes:

So I’d rather money wasn’t deliberately kept scarce to placate savers. Let the supply of money respond to demand for it. When everyone wants to save in the form of money, you need to produce more of it so those who need to spend money don’t starve. Obviously, we don’t want to create so much money that it becomes worthless. But it is better to risk waking the demon of inflation than to deny people the means to live.

So when the Government says that they need to repress my pay in order to avoid locking in inflation, it reminds me of this paragraph from Catch 22:

Morale was deteriorating and it was all Yossarian’s fault. The country was in peril; he was jeopardizing his traditional rights of freedom and independence by daring to exercise them.

A Government intent on crushing real wage growth or even the hope of it while explicitly targeting deflation within the next two years; an extreme assymetry of power between wage earners on the one hand and lobbying corporations and asset owners on the other. This is why so many of us are exercising our traditional rights today.