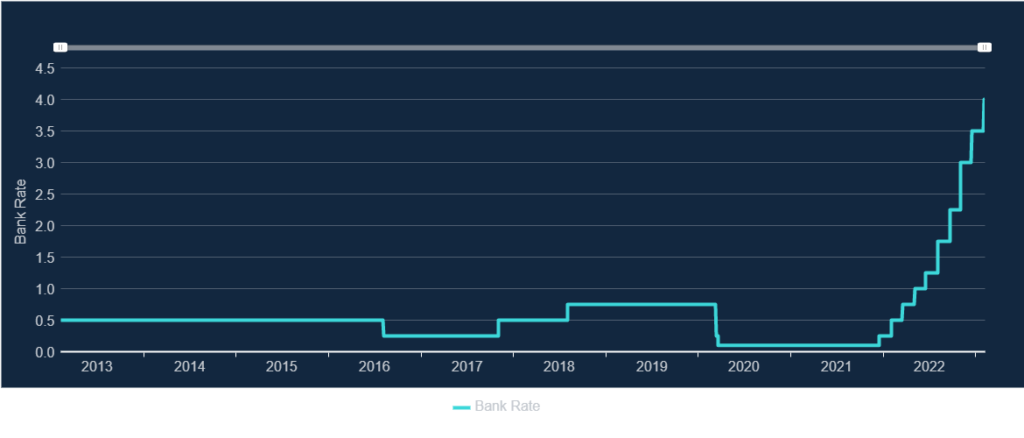

As we arrive at the second day of UCU strike action, we move from the industrial austerity discussed in my last blog to monetary austerity. With the latest rise in the Bank of England Base Rate to 4%, it also seems timely to consider the history of Bank of England independence.

Go to the Bank’s own website and you will find all the presentations from a 20 years on celebration of its independence from 2017. Ian McCafferty, External MPC Member at the Bank of England, gave a speech in 2017 about the circumstances of its introduction. The main reason given for the change was credibility of monetary policy.

But is this history entirely accurate? The Brussels and Genoa economic conferences of 1920 and 1922 (previously referred to here, and, as in the previous piece, the source of most of the next couple of paragraphs is from Clara Mattei’s excellent The Capital Order) first introduced the idea of central bank independence from democratic control as something desirable (before World War I, the Bank operated much more as a commercial bank and was the only limited-liability corporation allowed to issue bank notes, which gradually became a monopoly power). As Ralph Hawtrey, a senior economist at the UK Treasury of the time, said, the Bank of England should follow the precept: “Never explain; never regret; never apologise”.

The main reason formal independence does not appear to have been sought in the UK at the time, was that it was unnecessary. Montagu Norman was Governor of the Bank of England from 1920 until 1944, but was very close ideologically to Basil Blackett and Otto Niemeyer, who effectively ran the Treasury during those years. For example in 1927, the Governor of the Bank of France, Emile Moreau, relayed the opinion of the French Ambassador to London at the time: “Winston Churchill [Chancellor at the time]…isn’t really in control of the Treasury. The man who does in fact control it is Sir Otto Niemeyer, the intimate friend of M. Norman”.

The result of this was technocratic control of monetary policy, with politicians unable or unwilling to challenge the Bank or the Treasury. So, when Neville Chamberlain was Chancellor in March 1921, he said that: “the price of money is wholly outside government action”. Similarly, in March 1925 when Winston Churchill was Chancellor, he said that: “I think it would be an inconvenient practice if the Chancellor of the Exchequer were to set the precedent of expressing approval or disapproval of decisions taken at any time by the Bank of England”.

This was despite what, to at least some technocrats, must have been a terrifying increase in the electorate at the end of World War I – the size of the electorate tripled from the 7.7 million who had been entitled to vote in 1912 to 21.4 million by the end of 1918 as a result of the Representation of the People Act of February 1918. This gave the vote to 8.5 million women for the first time (those aged 30 or above and subject to some property requirements) and extended the male franchise to a further 5.2 million (all men over 21 if they were willing to serve British rule).

Technocratic rule ended following the 1945 General Election, when the new Labour Government nationalised the Bank, and the call for an independent central bank only really gained ground in 1992 when it was included in the Liberal Democrat election manifesto in that year. We might perhaps have expected this to have been brought in earlier alongside the change in direction towards monetarism under Margaret Thatcher in 1979. Milton Friedman was probably the best known advocate of monetarism at the time, but Friedman rejected central bank independence on the basis that it would be a bad idea “in a democracy to have so much power concentrated in a body free from any kind of direct, effective political control”.

So, viewed in that way, central bank independence can be viewed as the normal state of affairs, and the 52 years between 1945 and 1997 as the anomaly. One thing that is clear is that central bank independence makes monetary austerity much easier. As Gerard Vissering said at the Brussels Conference of 1920 about central bank independence: “A national or municipal government might possibly be powerless against such pressure on the part of the employees, because the latter can make their political influence felt on national government.” He went on, “…[a]n independent banking institution need not however allow itself to be led by the nose by any power whatsoever exercised by the employees”.

So central bank independence can be seen to be as much about political control as economic management. As McCafferty says, it was introduced for credibility. But credibility with who? Other governments following the same consensus is one answer and the financial markets probably another. There is also the argument about managing expectations within the domestic economy, another form of credibility – ie if people expect monetary policy to be unbending in pursuit of its inflation target, there is no point hoping that this will not be pursued, and therefore the forces pushing up inflation will dissipate sooner (and therefore, the argument is, you actually need generally lower interest rates to achieve your aim). Let’s call it the crushing of hope policy.

This argument does of course depend on the technocrats knowing best. However, as Martin Wolf wrote in the FT about Gordon Brown in May 2010:

...it is far too easy to blame him alone for the UK’s current plight. The truth, I would argue, is that his biggest error was to believe in the conventional wisdom about the prospects for durable economic stability, the robustness of modern financial markets and, surprisingly perhaps, the strength of the post-Thatcher UK economy.

As Blair Fix has pointed out here, increasing interest rates to control inflation looks more like a faith position than one based on much evidence in many cases. How many politicians would be prepared to die on the monetary austerity hill if the central bank were ever to lose its independence again?

Next time: fiscal austerity.