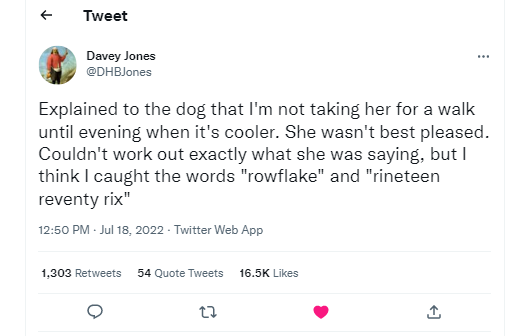

Three months ago, there was a lot of talk about 1976. My favourite tweet from the July heatwave was this one:

By contrast, 1976 seems to have disappeared from my Twitter feed altogether now, which is a shame because it was a time when a very different type of UK Government was trying to deal with some very familiar issues.

For instance:

- Worries about the exchange rate. This is what effectively precipitated the International Monetary Fund (IMF) crisis, with the pound having fallen from the $1.77 level which the Bank of England had been defending with interest rates and reserve purchases ($400 million in September alone) between July and September 1976 to $1.63, with predictions of $1.50 being possible (although $1.63 turned out to be the low point).

- Worries about the current account deficit, ie the fall of exports relative to imports. Import deposits, where importers needed to put up cash in advance, were being proposed as a possible measure, finally averted as part of the IMF deal.

- Worries about deficits – cutting the Public Sector Borrowing Requirement or PSBR (what is now called the Public Sector Net Cash Requirement or, more commonly, just the budget deficit) by £1 billion pa was the UK Government’s negotiating position, although less than the IMF wanted.

- Worries about fuel poverty – cabinet papers from Barbara Castle as the Secretary of State for Social Services in 1975 and 1976 focus on this a lot, with detailed discussion papers about the options for helping different sections of the population. This was also when the first winter fuel allowance was proposed.

- Cost of living crisis – there were also cabinet papers concerning how to operate price restraint schemes in the wake of a white paper from 1975 called The Attack on Inflation, which involved agreements industry by industry on price increase limits with the CBI, the Retail Consortium and the unions, including specific limits for each of the nationalised industries.

According to Goodbye Great Britain, by Kathleen Burk and Alex Cairncross, published in 1992 about the 1976 IMF crisis, the IMF were partly being used by the US Treasury and other bodies connected with the US administration to force a change in UK economic policy in a way that they would not be able to do directly. There were concerns in the US that the UK would turn its back on the IMF, introduce foreign exchange controls, freeze convertibility, perhaps even default on its loans. Indeed Brent Scowcroft, the US President’s National Security Advisor at the time, said that:

I spent more time on this matter during those weeks than anything else. It was considered by us to be the greatest single threat to the Western world.

That was not the only reason for the IMF to negotiate hard. The 1968 Basle Arrangement on funding sterling balances following the sterling devaluation in 1967 was felt by many countries to have been unduly preferential to the UK compared to how other countries had been treated. The IMF itself was therefore also under scrutiny.

So this was the background to a crisis which seems to have been less about the money (the endorsement of the IMF for its economic policies was more important to the UK for calming the currency markets than the loan according to some accounts, whereas the Under-Secretary for Monetary Affairs at the US Treasury, Edwin Yeo, said that they had “put up the money [for the IMF loan] ‘for the bait’ – ie to hook the UK economy into IMF control when it had to be repaid.”) than about who ran the economy. Andrew Graham, a member of the Prime Minister’s (then Harold Wilson) Policy Unit in 1974 and 1975, remembered the fear of union strength amongst some during that period, with Labour people in Whitehall and Westminster asking each other which side of the barricades they would join – the miners’ or the army’s.

Certainly a year after the agreement the economic crisis seemed to be over. The pound was rising again (it eventually reached $2.40 by October 1980) and reserves increased rapidly. Denis Healey, the Chancellor of the Exchequer at the time, claimed that, if the forecasts he had received had been more accurate, the UK would never have had to go to the IMF, although I do wonder whether another reason would have been found given the concerns of the US Treasury in particular.

However the solution to the economic crisis created a political crisis. In March 1977, the loss of support amongst Labour backbenchers following the Public Expenditure White Paper of 1976 led to an agreement with the Liberal Party (the Lib-Lab Pact) to keep the Government in power and, according to Burk and Cairncross, “one incomes policy too many” led to the Winter of Discontent in the winter of 1978-9, when more than 2,000 workers went on strike in the Liverpool and Merseyside area – rubbish was left uncollected, hospital services were reduced, and bodies went unburied. This was what led to Margaret Thatcher’s election in 1979 and Conservative Government’s and Oppositions and their supporters have continued to refer to this ever since as the consequences of Labour economic policy, rather than the IMF crisis itself.

Yet it was the IMF crisis which seems to have been more formative for Labour. Jim Callaghan made a speech in September 1976, in the middle of the crisis, in which he said the following:

For too long, perhaps ever since the war, we postponed facing up to fundamental changes in our society and in our economy. That is what I mean when I say we have been living on borrowed time…We used to think that you could spend your way out of a recession and increase employment by cutting taxes and boosting Government spending. I tell you in all candour that that option no longer exists, and that insofar as it ever did exist, it only worked on each occasion since the war by injecting a bigger dose of inflation into the economy, followed by a higher level of unemployment as the next step.

This statement seems to me to underpin every similar Labour Party statement since, from Liam Byrne’s “I’m afraid there is no money” to Keir Starmer’s recent promise that “there will be no magic money tree economics with us”. It is as if the Labour Party has never stopped trying to prove its credentials to some imaginary IMF mission ever since. The ghosts of 1976 remain with us.