Source: https://unsplash.com/photos/g0b_tx3i0_8. This image is from Unsplash and was published prior to 5 June 2017 under the Creative Commons CC0 1.0 Universal Public Domain Dedication

Catch 22 can in no way be compared to actuarial practice. One puts its characters in impossible positions, with constantly shifting targets, rewards often inversely proportional to the social usefulness of the characters’ actions and against a backdrop inordinately preoccupied with death. The other has recently been on our TV screens directed by George Clooney.

The most recent link between the two was provided by John Taylor’s excellent Institute and Faculty of Actuaries (IFoA) presidential address last month. He encouraged us all to look at Jimmy Reid’s 1972 speech at Glasgow University (an extract showing the passion with which it was delivered can be seen here). So I did. John picked out the following passage:

I am convinced that the great mass of our people go through life without even a glimmer of what they could have contributed to their fellow human beings. This is a personal tragedy. It’s a social crime. The flowering of each individual’s personality and talents is the precondition for everyone’s development.

Inspiring as that is, my eye was drawn to a different passage of Jimmy Reid’s speech:

Society and its prevailing sense of values leads to another form of alienation. It alienates some from humanity. It partially dehumanises some people, makes them insensitive, ruthless in their handling of fellow human beings, self-centred and grasping. The irony is, they are often considered normal and well adjusted. It is my sincere contention that anyone who can be totally adjusted to our society is in greater need of psychiatric analysis and treatment than anyone else.

They remind me of the character in the novel, Catch 22, the father of Major Major. He was a farmer in the American Mid West. He hated suggestions for things like Medicare, social services, unemployment benefits or civil rights. He was, however, an enthusiast for the agricultural policies that paid farmers for not bringing their fields under cultivation. From the money he got for not growing alfalfa he bought more land in order not to grow alfalfa. He became rich. Pilgrims came from all over the state to sit at his feet and learn how to be a successful non-grower of alfalfa. His philosophy was simple. The poor didn’t work hard enough and so they were poor. He believed that the good Lord gave him two strong hands to grab as much as he could for himself. He is a comic figure. But think, have you not met his like here in Britain? Here in Scotland? I have.

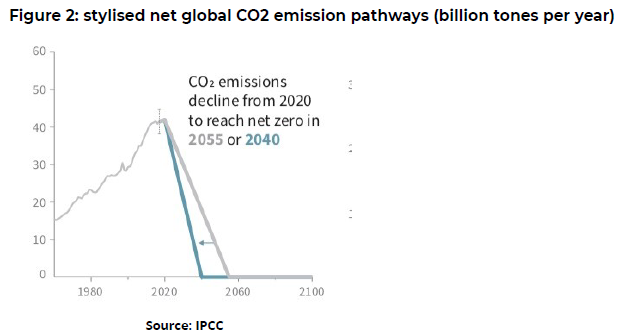

This got me thinking about the investment requirements of the Green New Deal, as this would need to be a huge programme of work to transform our infrastructure and economy away from the carbon-burning planet-trashing Doomsday machine it currently is, which in turn would need huge levels of investment.

I have previously written about some of the views about how we might reduce our current reliance on carbon: the one with the most coherence in my view being the Green New Deal.

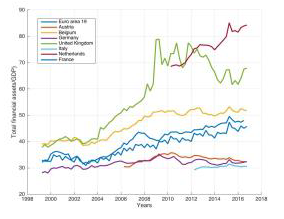

However there is a problem. Since our current system, the one which needs to be transformed, is currently predominantly doing the financial sector’s equivalent of rewarding people for not growing alfalfa (for example the misallocation costs estimated by SPERI at £2.7 trillion between 1995 and 2015 from having too large a financial sector here), any Green New Deal spending, at least to start with, is going to have to come from the Government.

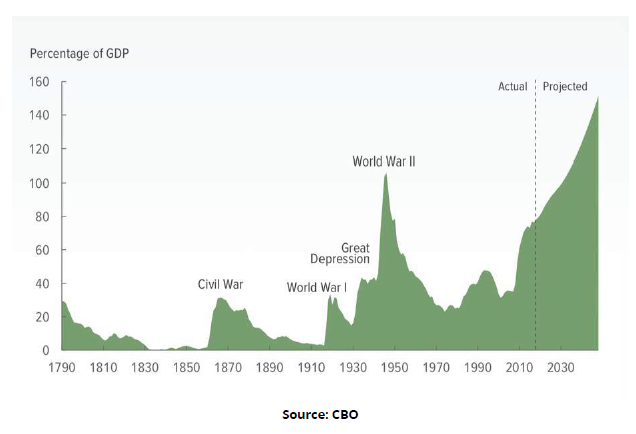

The authors of the latest report from the New Economics Foundation anticipate that the massive increase in public spending required to make it happen would be between £20 billion and £40 billion a year. This level of public spending is inconsistent with our current ways of measuring fiscal space, or the room for additional Government spending. Government borrowing is normally expressed in terms of a percentage of GDP and has historically been around 1.3% pa in normal times (ie other than wartime or bailing out the banks). They therefore suggest:

- The development of a new framework, defined in terms of the threshold beyond which there is a significant risk of adverse economic effects. This would have prevented the damaging austerity policies since 2010, for instance.

- The parallel development of a tool which would allow policymakers to accurately assess the implications of holding back fiscal space compared with the implications of borrowing for investment, and therefore allow politicians to come to an informed view on the best combination of fiscal intervention or fiscal prudence at a given point in time, including with respect to climate related risks.

- More explicit cooperation between the Bank of England and the Treasury, including the use of a new public investment bank (or network of banks) such as a green national investment bank (GNIB) – to increase commercial lending to green industries.

A particular interesting aspect of the GNIB is the proposal to make it independent of political interference. In the same way as those economists who argue for independent central banks so that governments don’t pursue damaging monetary policy in particular for electoral gain, some advocates of the GNIB believe it could be used as a backstop against governments underusing fiscal space for ideological reasons.

Richard Murphy points out that https://www.gov.uk/government/

Simon Wren Lewis, in his discussion of the many of the arguments around the Green New Deal and how it should be funded, makes the following excellent point (amongst many others):

No one in a 100 years time who suffers the catastrophic and (for them) irreversible impact of climate change is going to console themselves that at least they did not increase the national debt. Humanity will not come to an end if we double debt to GDP ratios, but it could come to an end if we fail to combat climate change.

The Catch 22 of the title originally described the catch which kept pilots flying highly dangerous missions in World War 2 – they could only get out of them by being certified insane, but the very fact of trying to get out of them showed that they were in fact sane and therefore they had to keep flying. If we want far fewer actuaries to be employed in not growing alfalfa in the future and far more working on making the finance structures of our economy work better, whether to support a Green New Deal or more generally, we first need to embrace the idea that our current economic priorities are indeed insane.