We do it all the time. We assume that the animals around us experience the world as we do, with our obsession with the visual sense. We are used to anthropomorphising animals in our cartoons, but it goes much further than that: for instance if, like a dog, your sensory world or Umwelt is primarily based on smell rather than sight, then that daily walk you take with your dog has very different highlights and notable features (amazingly the slits on the side of a dog’s nostrils allow it to smell on out-breaths as well as in-breaths). We have sayings based on these anthropomorphisms: for example, the “unconcerned” frog in the water as it is heated to boiling (cited by Emily Maitlis in her recent speech in Edinburgh) may not be unconcerned at all, merely showing its distress by filling the air with smells like peanut butter, cashew nuts or curry rather than via the reactions we would expect from a human.

Our vision is not even all that extraordinary compared to some other animals. Mantis shrimps have more classes of photoreceptors covering the ultraviolet spectrum than we have in total. They are the only animals who can detect circular polarization, where the plane in which the light is polarized also rotates. However they are much worse than us at telling our visual range of colours apart and may not even have a conception of colour as we know it at all. We don’t know.

We are not even sure how many senses there are. Aristotle said there were five (sight, hearing, smell, taste and touch), but missed our senses of proprioception (ie awareness of your own body) and equilibrioception (ie sense of balance). There are also animals who have a secondary system for detecting odours, or who detect the body heat of their prey via their brain’s visual centre or have sensors which both detect electric fields and pressure. How should we categorise these and does a clear division between senses make any sense? We don’t know.

Elephants can hear each other several miles apart just after sunset, but we don’t know what they are listening for. Beaked whales have a range of crests, ridges and bumps on their skulls which are not outwardly visible other than via the echolocation they use, but we don’t know why.

And finally, for now, the cuttlefish of the title. When cuttlefish sense sharks, who have passive electroreception (ie the ability to detect electric fields in other animals), they stop moving, hold their breath and cover their gill cavities to reduce the voltage of their electric fields by up to 90%. I could go on, but all of this and so much more is contained in Ed Yong’s masterful An Immense World, which I could not recommend more highly, not only for the content but also for the wonderful joyful writing throughout (AC/DC’s Rock and Roll Ain’t Noise Pollution even gets a mention!).

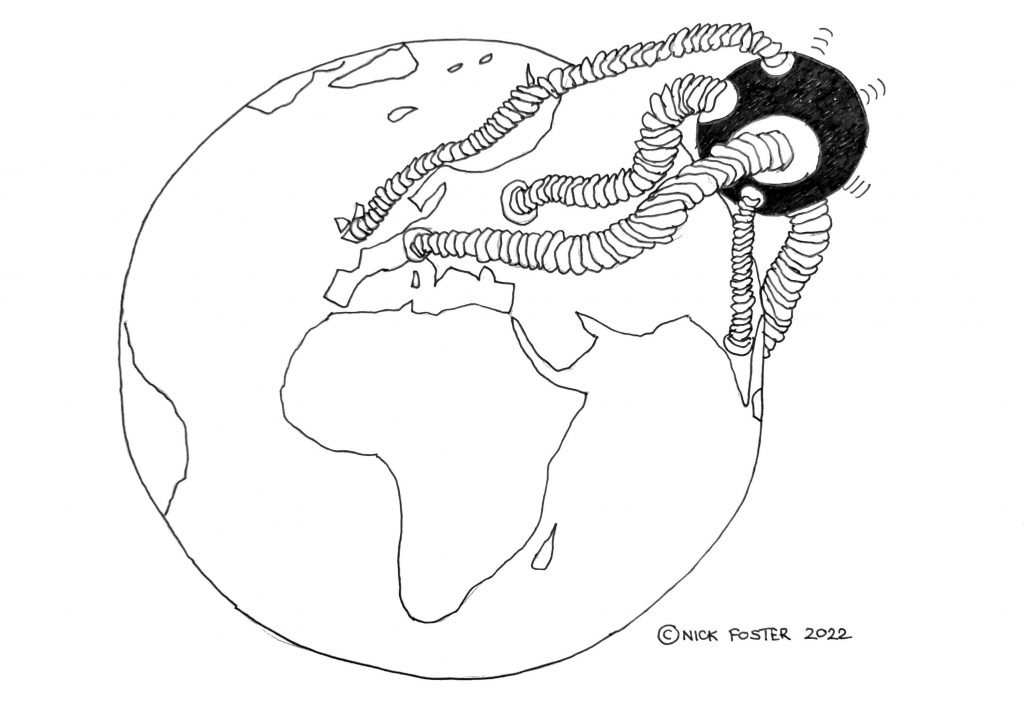

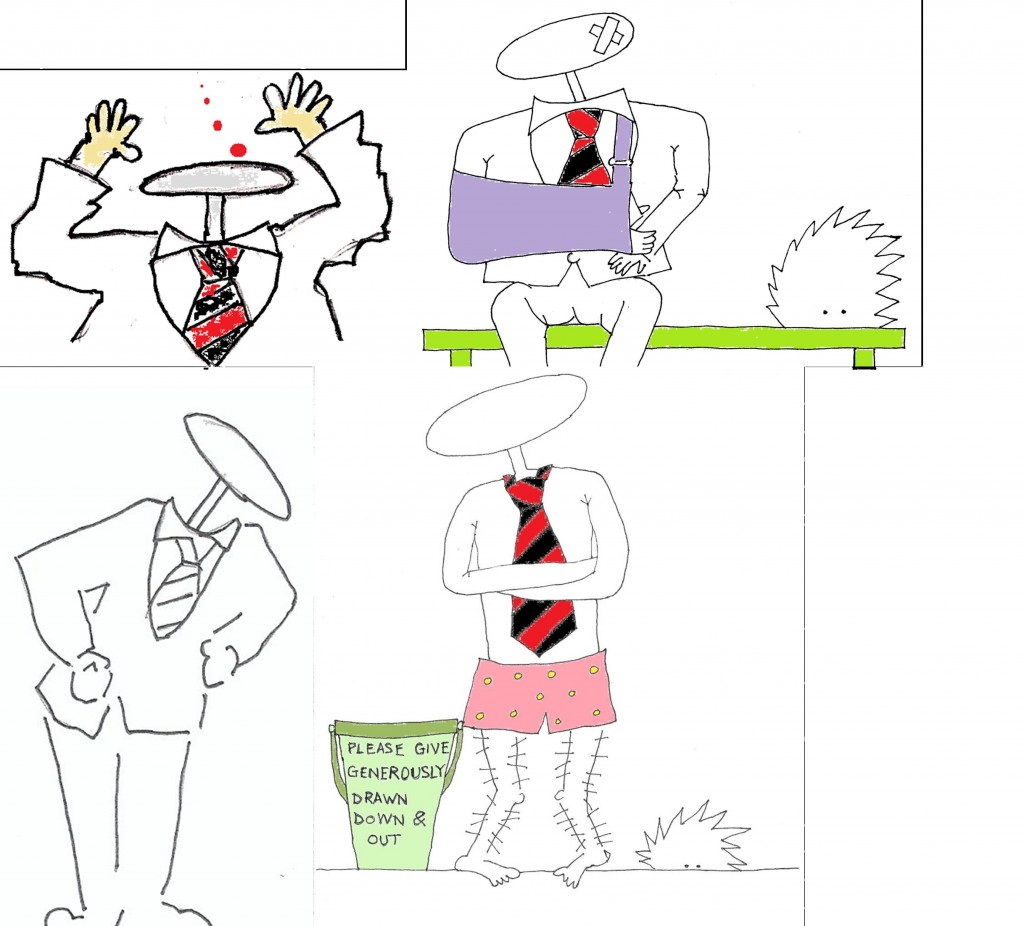

The recurring theme for me is how much we still don’t know about all of these animals, and the amazing new discoveries which are being made every year. Every animal perceives a different world from the one we think we are living in, many of these perceptions currently (and in some cases perhaps permanently) impossible for us to understand. It takes an extraordinary level of anthropomorphic arrogance for us to convert all of those strange and wonderful lives into the concept of natural capital.

The Institute and Faculty of Actuaries’ Biodiversity and Natural Capital Working Party defined natural capital in their paper from April 2021 (which acknowledges the concerns I am raising here and those raised by others) as follows:

The concept of ‘natural capital’ therefore aims to recognise nature as an asset and aims to ensure that

the goods and services offered by nature become a part of decision making by governments,

businesses, and individuals regarding resource allocation, growth and development.

The Dasgupta Review has gone further, focusing on the economics of diversity. As it acknowledges:

The Review has developed the economics of biodiversity by viewing Nature in anthropocentric

terms. That is an altogether narrow viewpoint, but it has a justification. If, as we have shown in

Part I, Nature should be protected and promoted even when valued solely for its uses to us, we

would have even stronger reasons to protect and promote it if we were to acknowledge that it

has intrinsic value.

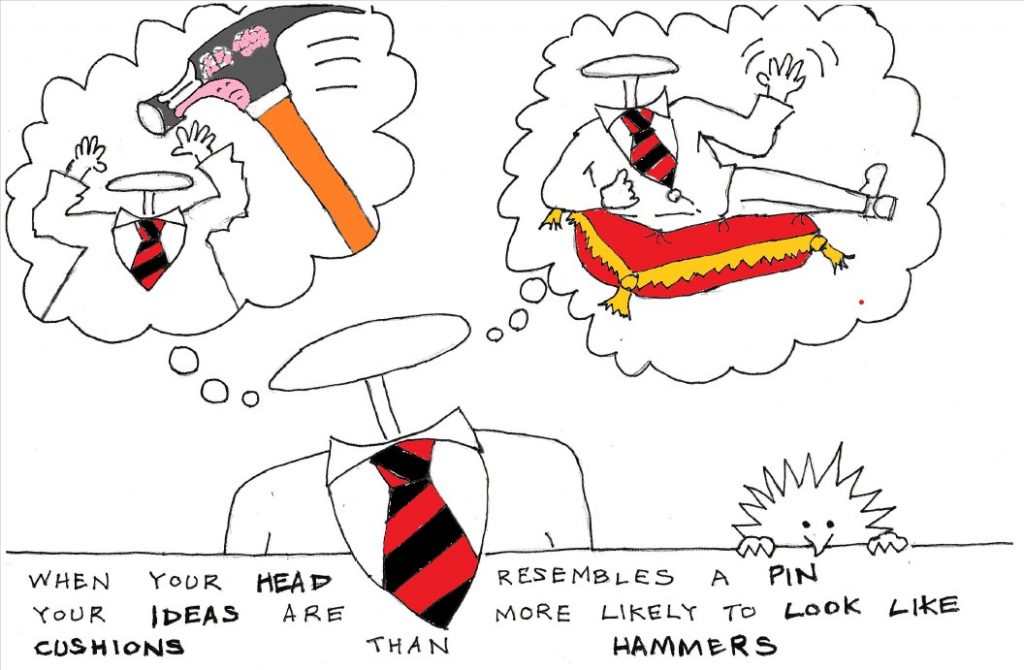

I strongly disagree. As George Monbiot pointed out several years ago, markets change the meaning of the things we discuss, replacing moral obligations with commercial relationships. The latest article in The Actuary magazine on natural capital discusses ecosystem collapse in its final paragraph in terms of how it would “negatively impact GDP” and “economic value”.

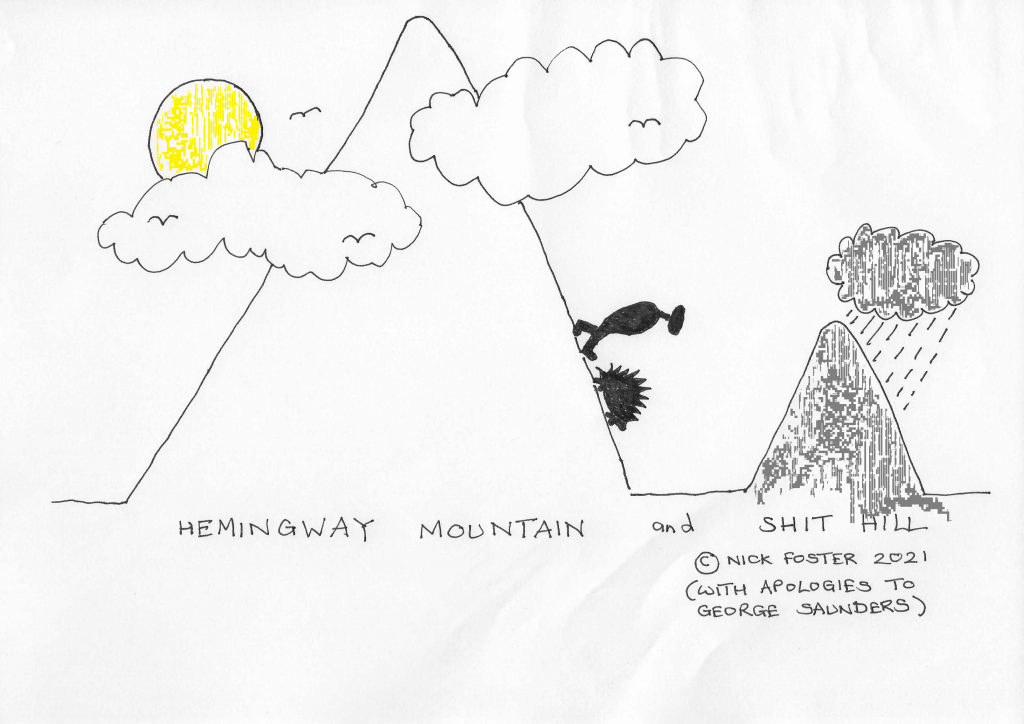

Once the diversity of nature can be reduced to a monetary amount or metric value, it can obviously be modelled much more easily but, as we have seen again and again within the finance sector and elsewhere, that is at the expense of consideration of any other aspect of our relationship with it.

Perhaps cuttlefish do dream of the passive electroreception of sharks. If they only knew what we were up to, they might instead have nightmares about their balance sheet entries in our spreadsheets.