When I started writing this blog in April 2013, one of its main purposes was to highlight how poor we are at forecasting things, and suggest that our decision-making would improve if we acknowledged this fact. The best example I could find at the time to illustrate this point were the Office of Budget Responsibility (OBR) Gross Domestic Product (GDP) growth forecasts over the previous 3 years. They do not appear to have improved much since then.

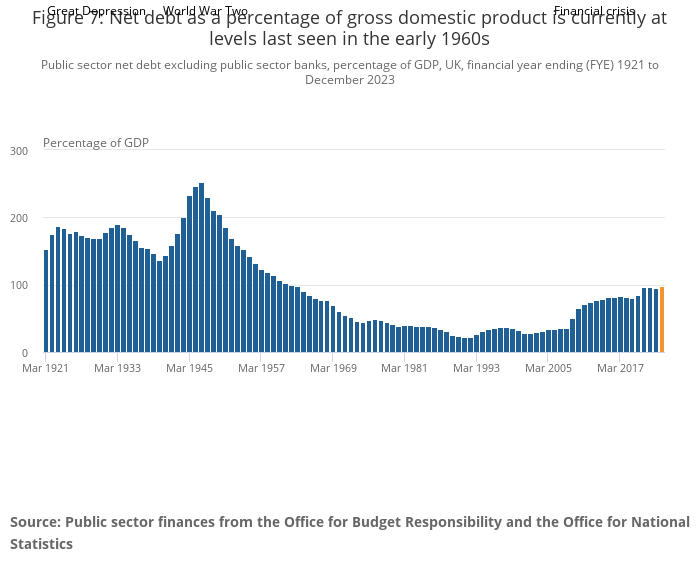

Fast forward to 2025 and apparently we have a crisis. Rachel Reeves has been forced to defend her budget following rises in 10 year gilt yields to levels not seen since the financial crisis and the Prime Minister has been forced to say that she will stay in post for the rest of Parliament. Everyone has piled in, from the former Deputy Governor of the Bank of England to the Institute for Fiscal Studies. So is there in fact a crisis? Well no, not really. As an opinion piece in the FT has pointed out, the drivers of the latest rate rise are not really UK-specific at all. Another piece in the FT puts the gilt yield “crisis” into yet further perspective. Finally, there is the comparison with the US gilt market, which moved above its 2008 level in 2022.

The reason for all of the hype of course is the totally self-constructed cul-de-sac that the Government has built around its economic policy options. Tiny movements in government debt or CPI or GDP or indeed gilt yields have been given heightened significance by being explicitly tied to how much the Government will allow itself to spend on its various programmes. As stated in the FT:

Only the OBR can accurately predict how much headroom the Treasury has against its fiscal rules, the Treasury insisted on Wednesday. “Anything else is pure speculation,” it added.

I refer back to the aforementioned forecast history of the OBR and ask how we ever got in a situation where their forecasts would determine how the UK government behaved. As the recent essay by Stefan Eich (on Adam Tooze’s Chartbook) points out, Keynes said:

“Our power of prediction is so slight, our knowledge of remote consequences so uncertain that it is seldom wise to sacrifice a present benefit for a doubtful advantage in the future.” It was consequently rarely right to sacrifice the well-being of the present generation for the sake of a supposed millennium in the remote future.

Meanwhile we are now doing precisely this on the basis of OBR forecasts. As Rachel Reeves set out at the start of her chancellorship in July, in a precise inversion of Keynes:

Because if we cannot afford it, we cannot do it.

Unfortunately for the government, while they spend all of their time trying to solve this imaginary problem they have created for themselves, there are actual real problems that do need to be addressed, and which are currently being drowned out by the noise of political commentators with too little of substance to talk about apparently.

So Sir Michael Marmot, author of the landmark Institute of Health Equity reports on health inequalities in 2010 and 2020 and the recent report on the role of the property sector in improving health, referred to the maintenance of the two child benefit cap as “almost a form of eugenics”.

The Trussell Trust reports that:

A record 9.3 million people face hunger and hardship across the UK. This includes 6.3 million adults and 3 million children. This represents one in seven (14.0%) people across the UK, and one in five (20.9%) children. Current levels are more than a third higher than they were 20 years ago, when 6.7 million people faced hunger and hardship.

And a group from the Institute and Faculty of Actuaries, in partnership with Prof Tim Lenton and his team from the University of Exeter, set out in a report today (Guardian summary here, Planet Critical discussion here) the dangers of the current massive underestimation of climate change risk. As Tim Lenton says:

The choice is simple: continue to be surprised by rapidly escalating and unexpected climate and nature-driven risks, or implement realistic Planetary Solvency risk assessments to build resilience and support ongoing prosperity. We urge policymakers to work with scientists and risk professionals to take this forward before we run the ship of human progress aground on the rocks of poor risk management.

The part which really stood out for me (in such contrast to the equally massively exaggerated risks ascribed to movements in bond markets this week) was on the inadequacy of global risk management practices:

- Policymakers often prioritise the economy, with their information flows focused on this. But our dominant economic model doesn’t recognise a dependence on the Earth system, viewing climate and nature risks as externalities.

- Climate change risk assessment methodologies understate economic impact, as they often exclude many of the most severe risks that are expected and do not recognise there is a risk of ruin. They are precisely wrong, rather than being roughly right.

- The degradation of natural assets such as forests and soils, or the acidification and pollution of the ocean, act as a risk multiplier on the impacts of climate change and vice versa. Traditional risk management techniques typically focus on single risks in isolation, missing network effects and interconnections, underestimating cascading, compounding risks.

- Current risk management approaches fall short of the RESILIENCE principles detailed in this report for realistic and effective risk management. Consequently, policymaker risk information is likely to significantly understate the potential impact of climate and nature risks, weakening the argument for urgent action.

- These limitations mean that policymakers are likely to have accepted much higher levels of risk than is commonly realised.

If policymakers judged these risks on the same calibration scale as they current view the knockabout on financial markets I doubt we would ever hear about the intricacies of the 10 year gilt yield or the decimal places of CPI ever again. Similarly, if the societal impact of prolonged policies targeting the poor was included (perhaps in the form of meaningful measures of poverty based on the work of the Social Metrics Commission), rather than the level of the FTSE 100, we might start to make inroads into the current dire statistics.

We have hard problems to solve which require a serious government prepared to be bold, do big things and take the political risk of doing so (because the political risks are so tiny compared to the actual risks the population face), not one so focused and constrained by minutiae that it defeats itself.