Fiscal space is defined as the difference between a nation’s sovereign debt-to-GDP ratio and the limit beyond which the nation will default unless policymakers take fiscal steps that are outside of anything they have done historically. That limit is sometimes referred to as the fiscal cliff, just to ram home the imagery of fixed physical limits beyond which disaster beckons.

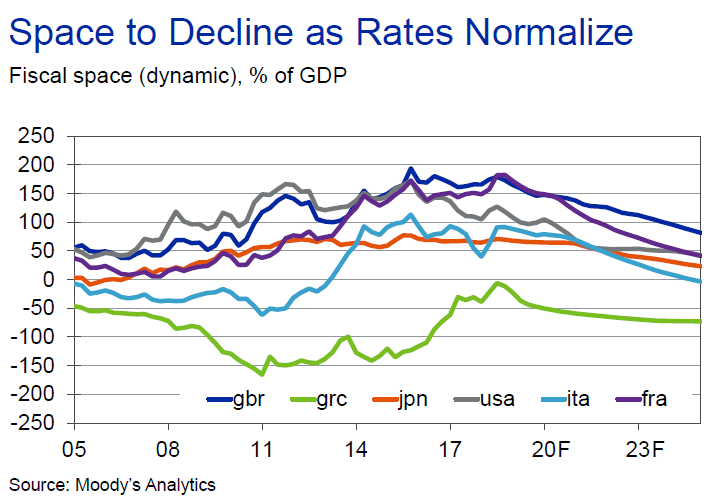

How much fiscal space does the UK have? Moody’s have an answer, which depends most heavily on when you ask the question. In September 2019 it was as follows:

This shows the UK with a fiscal space (the “dynamic” means they assume interest rates increase as borrowing does, due to “crowding out” arguments – ie government borrowing pushing up the price of borrowing for everyone – so beloved of most economists) of around 175% of GDP, with this then projected to fall over the following 5 years as rates “normalized”. While the cost of borrowing seems to be dynamic, the actual borrowing itself is not allowed to be in these calculations – it is assumed that they just add to debt without increasing the revenue components of the primary balance.

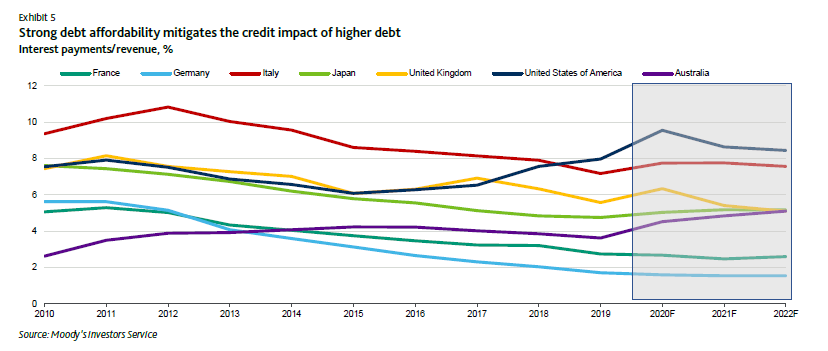

Well of course then we had 2020, at which point (June 2020) Moody’s appear to have stopped talking about fiscal space and instead are now focusing on something called “debt affordability”. What happened to dynamism and crowding out? Not explained:

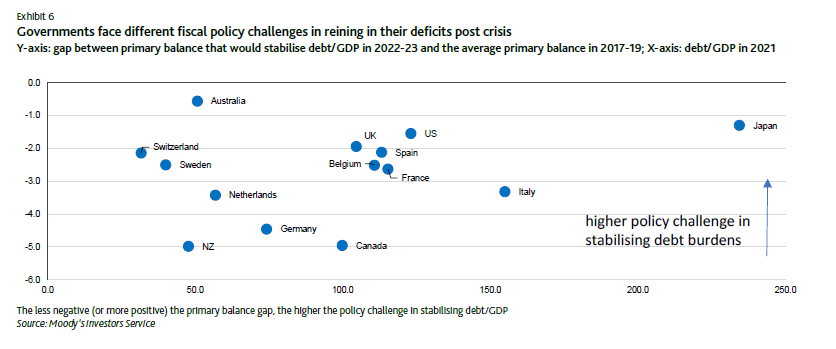

However despite this triumph of debt affordability, they then produce another graph to indicate that governments still need to be bearing down on debt to GDP ratios:

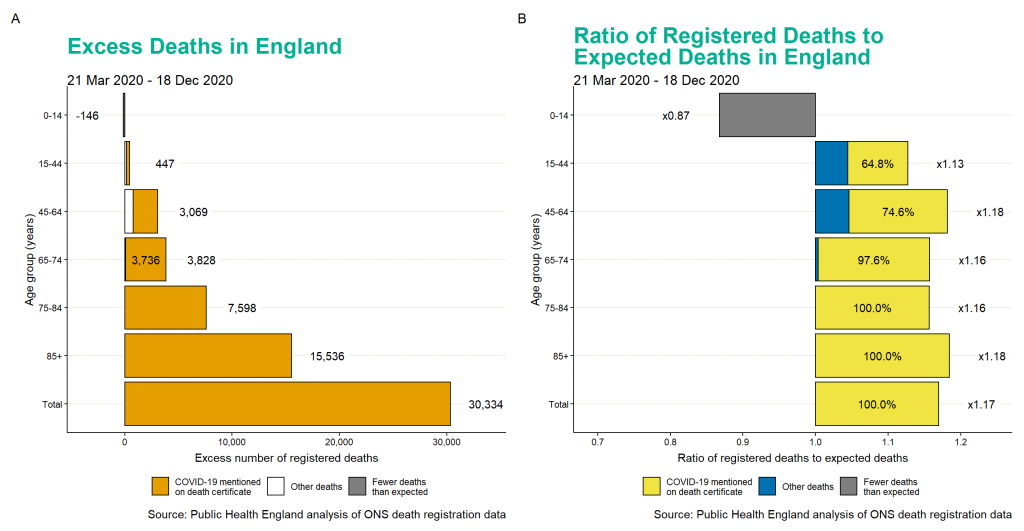

As they say in the document “rating implications will depend on governments’ ability to reverse debt trajectories ahead of potential future shocks”. Remember this was in June 2020. Let’s also remind ourselves of another graph:

Requiring governments to reverse debt trajectories in this environment is insane and likely to result in more deaths if not ignored. However as recently as last month in their issuer comment for the UK they said:

However, compared to the government’s March budget (that was quickly overtaken by events), there are some initial signs that fiscal policy outside of investment is likely to be less expansive than previously announced. What remains unclear is whether this ambition will be able to withstand the political pressures that seem to be inevitable given the government’s previous commitments. Even before the Spending Review, longer-term spending commitments for health, education, and defence had already been announced. Together, these three areas account for around 60% of total expenditure.

I have been hard on Moody’s in this piece, they are most certainly not alone. But this attempt to divorce sovereign debt levels from what is actually going on in countries needs to stop as does the constant discounting of the value of any government spending at all. Political pressures to spend more on health and education are not always things that governments need to “withstand” in order to look good in a Moody’s graph. There are far more important things at stake.