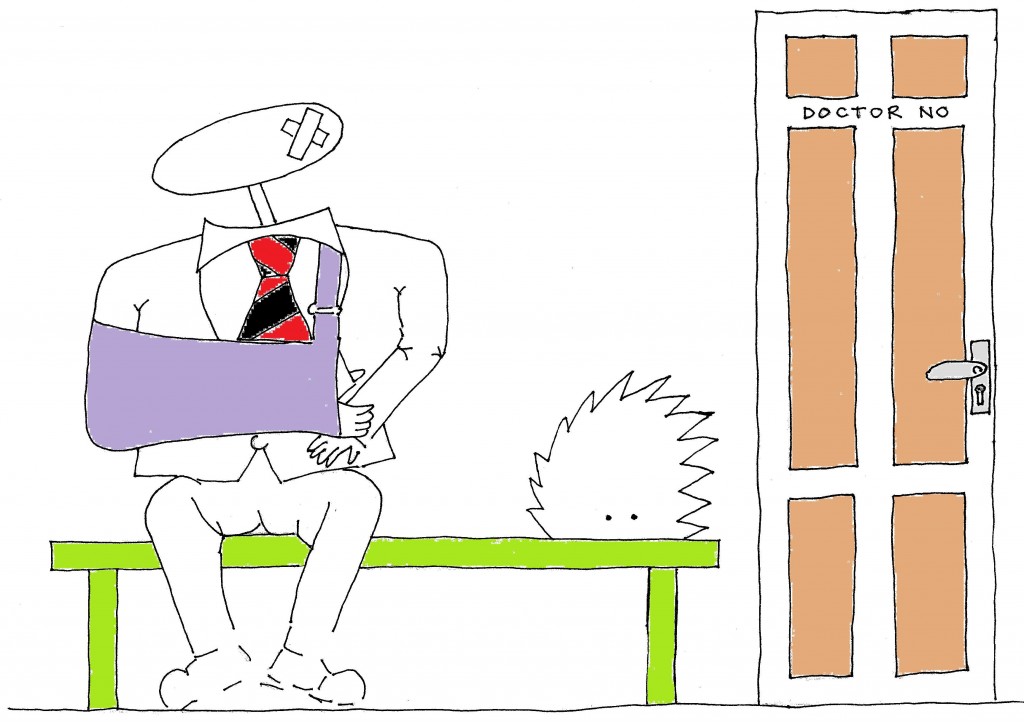

Imagine a super-hero who could not be killed. No I don’t mean Deadpool. A more apt name for our super-hero would be Deadmeat. Deadmeat is empirically dead, but, rather like the Monty Python parrot, is being energetically kept alive by the pretence of its continued existence amongst all of those around it. So much so that it becomes impolite to expose the pretence and point out that Deadmeat is in fact dead. If you really push, and someone likes you enough to want to give you an explanation, you will have a hand put on your shoulder and be led away to a corner to have the pretence explained to you. What that explanation turns out to be is something like this. Deadmeat is of course the Paris climate agreement from 2015 which committed 193 countries plus the EU to “pursue efforts” to limit global temperature rises to 1.5C, and to keep them “well below” 2.0C above those recorded in pre-industrial times.

Deadmeat, it turns out, wasn’t shot. Deadmeat was overshot. Under overshoot, we bring the terrible thing back under control after it has done the damage and hope we can fix the damage at a later date. It’s a bit like the belief in cryopreservation or uploading our brains into cyberspace in the hope that we can have our bodies fixed with future medicine or be provided with artificial bodies. It means relying on science fiction to save us.

Andreas Malm and Wim Carton have considered this approach and how we got here in their latest book Overshoot. For me there are two big ideas in this book, although the account of how things definitively got away from us immediately post pandemic and exactly how that played out is mesmerising too. I thoroughly recommend a read.

The first big idea is the problem with the justification for overshoot in the first place, which is that at some point in the future we will be so much richer and more technologically advanced that it will be much easier to bring carbon dioxide levels down to sustainable levels than to try and stay within sustainable levels now. In what they call “The Contradiction of the Last Moment” Malm and Carton show how an intense fresh round of fossil fuel investment is almost certain to occur close to a temperature deadline (ie fossil fuel companies rushing to build more infrastructure while it is still allowed), whether it is 1.5 or 2 degrees or something higher. Then, as they put it “the interest in missing it will be overwhelmingly strong”. If an investment is 40 or 50 years old, then it might not be so disastrous to have it retired, but if a fossil fuel company has invested billions in the last few years in it? They will fight tooth and nail to keep it open and producing. And by prolonging the time until the retirement of fossil fuel infrastructure, the capital which has used the time to entrench its position and now owns a thousand new plants rather than a few hundred will be in a much stronger position to dictate policy. The longer we leave it, they argue, the harder it will become to retire fossil fuels, not easier.

The second big idea explains why, despite the enormous price collapse of solar power in particular, there is no Big Solar to compete with Big Oil. As they put it “there was no Microsoft or Apple or Facebook. More broadly, there was no Boulton & Watt of the flow, no Edison Machine Works, no Ford factories, no ascendant clusters of capital accumulation riding this wave.” The only remotely comparable company would be Tesla, but they produced cars. Why is this?

Malm and Carton talk about “the scissor”, the difference between the stock of the fossil fuel industry and the flow of renewable power. Fossil fuel’s “highly rivalrous goods: the consumption of one barrel of oil or one wagon-load of coal means that no one can ever consume it again. Every piece of fossil fuel burns once and once only. But supplies of sunlight and wind are in no way affected by any one consumer’s use.”

And this is the key I think. What economists call “public goods”, goods which are non-rivalrous (ie your use of the sun’s energy does not stop somebody else’s unless you put them in the shade) and non-excludable (ie you cannot easily stop someone else from using it, in this case by sticking a solar panel on their roof), are very difficult if not impossible to make a profit from. Private markets will therefore not provide these goods, possibly at all without extremely artificial regulation (something we have probably had enough of with our utilities in the UK) and certainly not in the quantity that will be required.

In Postcapitalism, Paul Mason discussed the options when the price mechanism disappears and additional units of output cannot be charged for. As he put it:

Technologically, we are headed for zero-price goods, unmeasurable work, an exponential takeoff in productivity and the extensive automation of physical processes. Socially, we are trapped in a world of monopolies, inefficiency, the ruins of a finance-dominated free market and a proliferation of “bullshit jobs”.

This also ties in with my own experience and others I have spoken to over the years about how hard it is to invest outside of fossil fuels and make a return.

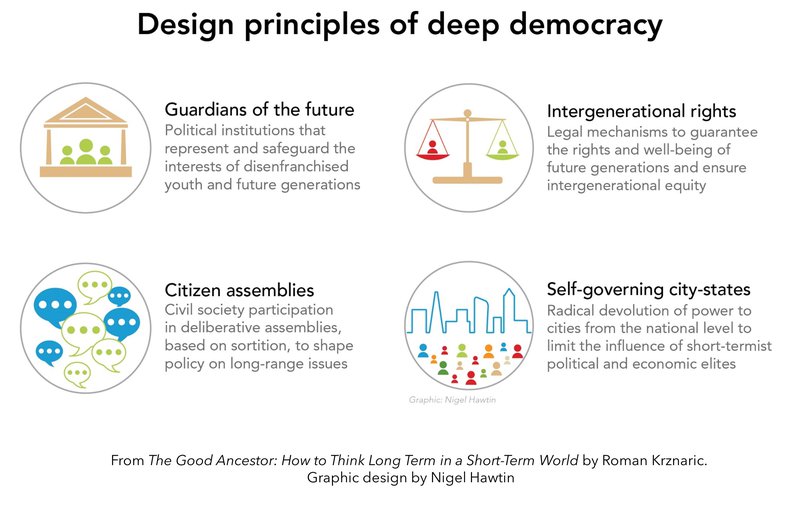

Therefore if the private sector will not provide public goods and renewable power is predominantly a public good, then it follows that renewable power needs to be in public ownership. And if the climate crisis requires all power to be renewable and zero carbon, which it does, then it also follows that the entire power sector ultimately needs to be in public ownership too.

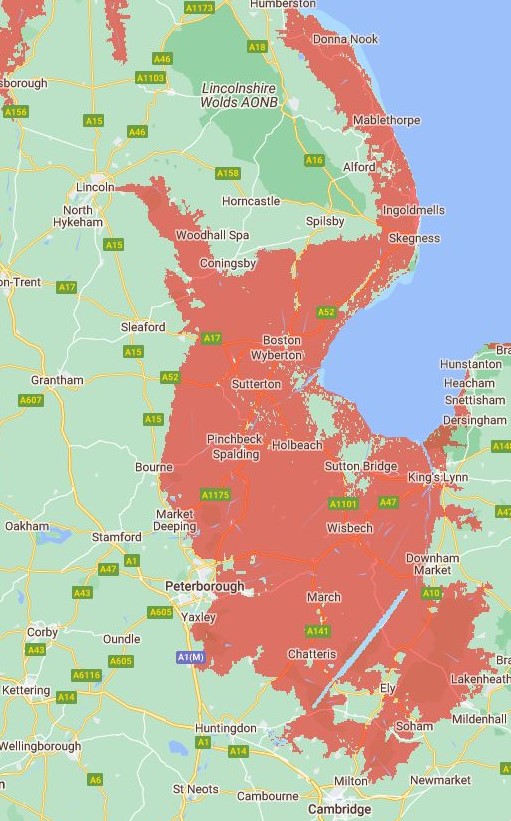

And then the motivation for overshoot becomes clear and how high the stakes are: not just the proceeds of the sale from one dead parrot as it turns out, but the future of private power generation. My fear is that the Deadmeat franchise may end up having as many sequels as Godzilla (38 and counting). With the potential to do rather more damage in the process.