It all began for me on 23 September 1985, the first day in my first graduate role as a management trainee at the home counties factory of a security printing firm. From the beginning I was left in no doubt by my new employers that the fairly powerful print unions at the time (SOGAT and the NGA) were the biggest impediment to the captains of industry within the firm from running the business successfully. Occasionally I was allowed into management meetings, where all of the things we could do if it wasn’t for the unions were discussed endlessly.

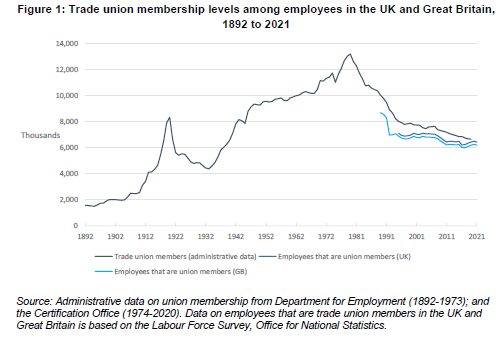

During my time in this first role, the printing industry changed dramatically: the typesetting was computerised, massively reducing the number employed virtually overnight and Rupert Murdoch set up his non-unionised newspaper factories at Wapping. There had already been three pieces of trade union legislation in the 1980s by the time I started work, the latest being the Trade Union Act of 1984, which required secret ballots for union elections and strikes rather than the show of hands which had been possible up until then. The Miners Strike had also only just ended in March 1985, which had a devastating impact on the trade unions more generally.

Further legislation now quickly followed:

- the Public Order Act 1986 (which introduced new offences related to picketing, and increased police powers over protests involving groups of 20 people or more);

- the Wages Act 1986 (which reduced many of the restrictions on employers fining and deducting money from employees’ pay, removed statutory holiday entitlement and reduced state funding for redundancies);

- the Employment Act 1988 (which gave workers the right to not join a union, and trade union members the right to challenge strike ballots);

- the Employment Act 1989 (which restricted trade union officials’ time off for duties and abolished government support for redundancy payments);

- the Employment Act 1990 (which finally removed the closed shop – ie a workplace where union membership was compulsory – and secondary action protection);

- the Trade Union and Labour Relations (Consolidation) Act 1992, which consolidated the legislation of the 80s and 90s, while clarifying that the right to take strike action was protected when it was “in contemplation or furtherance of a trade dispute”; and

- the Trade Union Reform and Employment Rights Act 1993 (which gave trade unions a duty to inform employers of upcoming strikes).

This would appear to have given my first employers everything they could have wanted in terms of containing union power but, after some retrenchment in the 1990s owing to the incoming Labour Government taking the UK back into the Social Chapter of the Maastricht Treaty (which we had originally opted out of in 1992) in 1997, there was further legislation in the form of the Trade Union Act of 2016, which, amongst other measures:

- introduced a new requirement of 50% of union members to vote in a ballot for strike action;

- required that workers in important services (health, school education, fire, transport, nuclear decommissioning and border security) must gain at least 40% support of those entitled to vote in a workplace for a strike to be legal;

- required two weeks’ notice of industrial action to be given to an employer (the employer can agree to one week);

- limited the right to take industrial action after a strike ballot to six months, or nine months if the employer agrees.

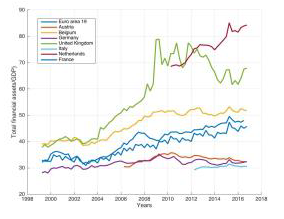

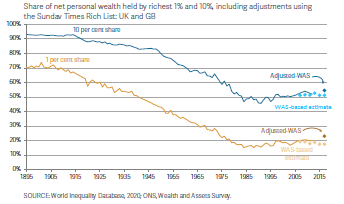

Over the period since 1985, wealth inequality, which had been steadily reducing since at least the end of World War I stalled and has been generally on a slightly increasing trend since:

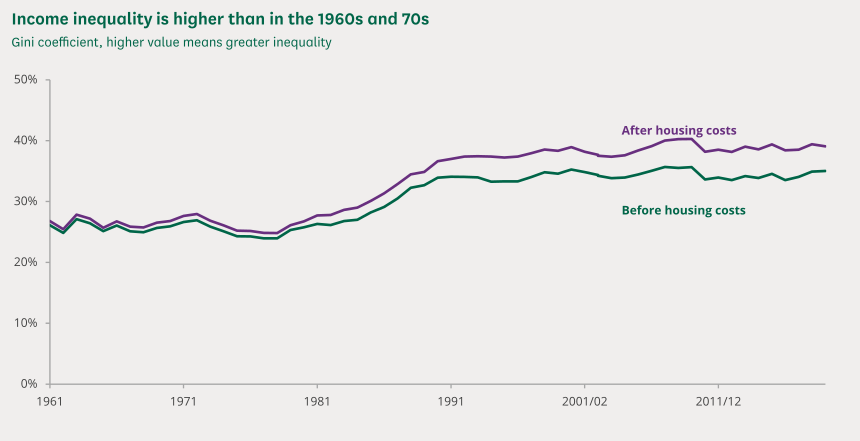

And the position with respect to income inequality is even worse, with the UK having the 9th worst income inequality of the 38 countries in the OECD:

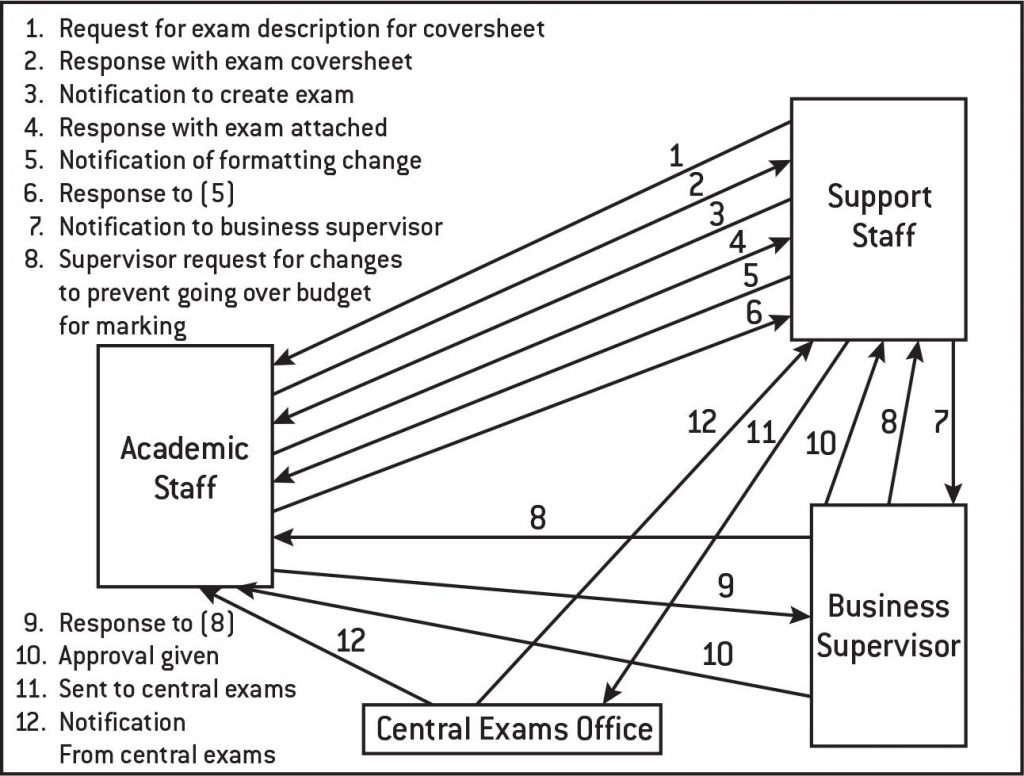

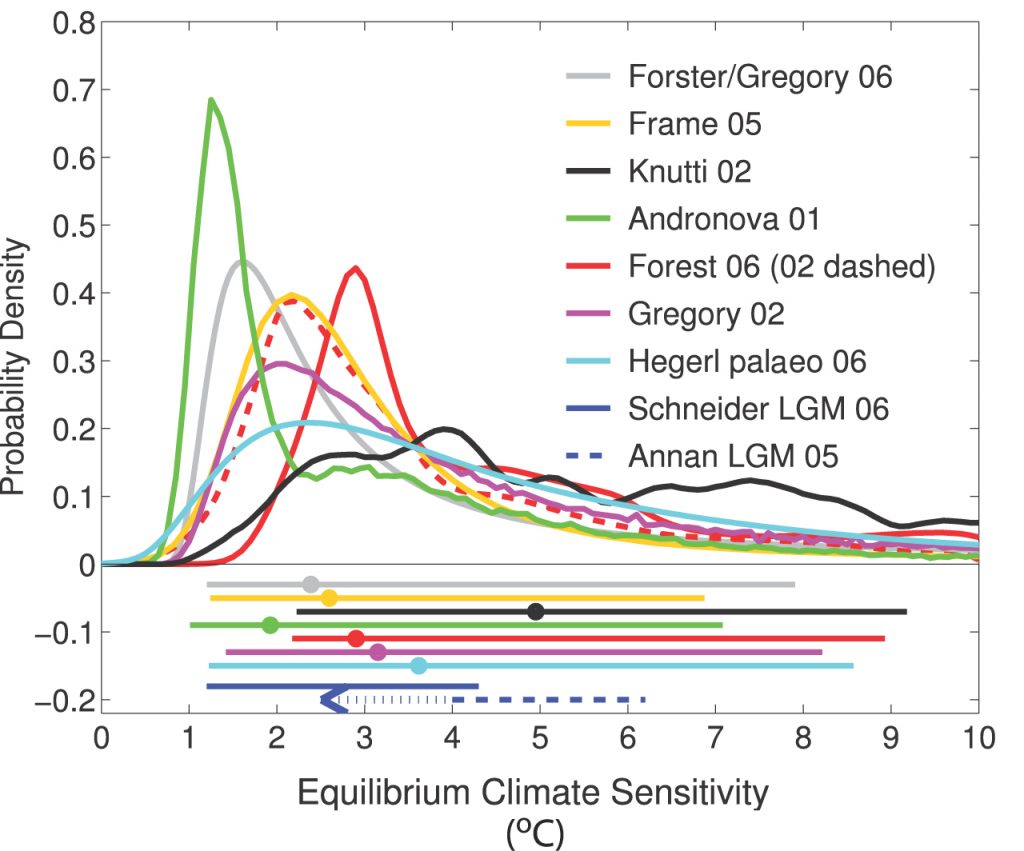

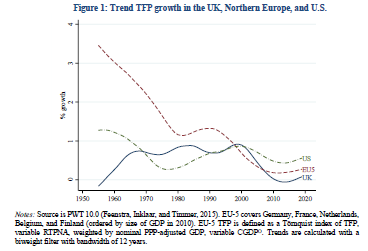

However, perhaps this was a price worth paying, if the forces of creativity and entrepreneurship had at last been allowed full rein, freed from the stifling dead hand of union power? Unfortunately not (TFP stands for total factor productivity in the graph below):

So whatever, the continuing problems of UK PLC, it does not look like union power was ever really one of the major ones. Undeterred, the Government is proposing further restrictions on trade unions and their members, including enforcing minimum service levels during strike action for ambulance staff, firefighters and railway workers and requiring some employees to work during a strike under threat of being sacked if they refuse.

The TUC has made a submission to the International Labour Organisation of the United Nations over what it sees as breaches of Conventions 87 (Freedom of Association and Protection of the Right to Organise) and 98 (Right to Organise and Collective Bargaining). As David Allen Green has blogged:

But regardless of your view on the ultimate rights and wrongs of strikes by public sector and other public service workers, there is something fundamentally objectionable in the current government’s proposals to compel certain “key” workers to attend work when they otherwise would be entitled to strike….Simply prohibiting other key workers from being able to strike, without sufficient alternative entitlements and arrangements to balance this loss of a right, is misconceived and illiberal.

It is an authoritarian gesture, rather than a solution to a problem.

Roy Lilley (at the Institute of Health and Social Care Management) in a postscript to a recent blog, focused on what a strategic failure the proposals represent within the NHS industrial dispute:

HMG plans, to ban strike action by some public workers is a further example of ‘push-back’ management. Push the disputes into the courts instead of dealing with the root-cause of strike action, improve industrial relations and representation.

So what has my part been in the downfall of trade unionism to date? In my first job, other than an abortive attempt to develop a new shift pattern(!) for the security guards in the factory, I had few skirmishes with union leaders compared to those with my management colleagues. In the finance sector, where I spent most of the middle 20 years of my working life, I rarely came across any staff representation at all. As a school teacher I joined the ATL rather than the NUT (they have since merged to form the National Education Union) due to its reputation for being determinedly non-militant. And, in my current role, I rather flounced out of the UCU over a difference of opinion over the pensions dispute raging at the time.

So I have not been a very good supporter of trade unionism over the years. However it now seems clear to me that the industrial austerity (ie the crushing of labour power within the economy, further discussed here) described above during my lifetime has been a political rather than an economic project all along. None of the economic justifications given for it since the 1980s have been borne out and the unopposed rugby of industrial management we have increasingly witnessed since has resulted, in my view, in poorer outcomes than if the 99% had been consulted regularly.

I sense that the current Government will only be satisfied when trade union membership levels fall to zero. So if, like me, you don’t want that to happen, the time to push back against running the economy at all times exclusively in the interests of the owners of capital is now.

I have rejoined the UCU.