Milan Kundera wrote his The Book of Laughter and Forgetting in 1979, a few years after moving to France and the same year he had his Czech citizenship revoked. His books had all been banned in Czechoslovakia in 1968, as most of them poked fun at the regime in one way or the other. The Book of Laughter and Forgetting was no exception, focusing, via seven stories, on what we choose to forget in history, politics and our own lives. One of the themes is a word which is difficult to translate into English: litost.

Litost seems to mean an emotional state of feeling of being on your own suddenly brought face to face with how obvious your own hopelessness is. Or something to that effect. Kundera explored several aspects of litost at length in the novel. However, for all the difficulties of describing it exactly, litost feels like a useful word for our times, our politics and our economics.

I want to focus on two specific examples of forgetting and the sudden incidents of litost which have brought them back into focus.

The first, although not chronologically, would be the pandemic. There are several articles around suddenly about the lessons we have not learnt from the pandemic, to mark the fifth anniversary of the first lockdown. Christina Pagel, backed up by module 1 of the Covid-19 Inquiry, reckons:

Preventing future lockdowns requires planning, preparation, investment in public health infrastructure, and investment in testing, virology and medical research…

She takes issue with some of the commentary as follows:

But the tenor of reporting and public opinion seems to be that “lockdowns were terrible and so we must not have lockdowns again”. This is the wrong lesson. Lockdowns are terrible but so are unchecked deadly pandemics. The question should be “lockdowns were terrible, so how can we prevent the spread of a new pandemic so we never need one again?”.

However the stampede to get back to “normal” has mitigated against investing in infrastructure and led to a massive reduction in testing and reporting, and the Covid-19 Inquiry has given the government cover (all questions can just be responded to by saying that the Covid Inquiry is still looking at what happened) to actively forget it as quickly as possible. Meanwhile the final module of the Covid-19 Inquiry is not due to conclude until early 2026, which one must hope is before the next pandemic hits. For which, as the former Chief Scientific Adviser and other leading experts have said, we are not remotely prepared, and certainly no better prepared than we were in 2020.

It is tempting to think that this is the first major recent instance involving the forgetting of a crisis to the extent that its repetition would be just as devastating the second time. Which is perhaps a sign of how complete our collective amnesia about 2008 has become.

Make no mistake, 2008 was a complete meltdown of the core of our financial system. People I know who were working in banks at the time described how even the most experienced people around them had no idea what to do. Alistair Darling, Chancellor of the Exchequer at the time, claimed we were hours away from a “breakdown in law and order”.

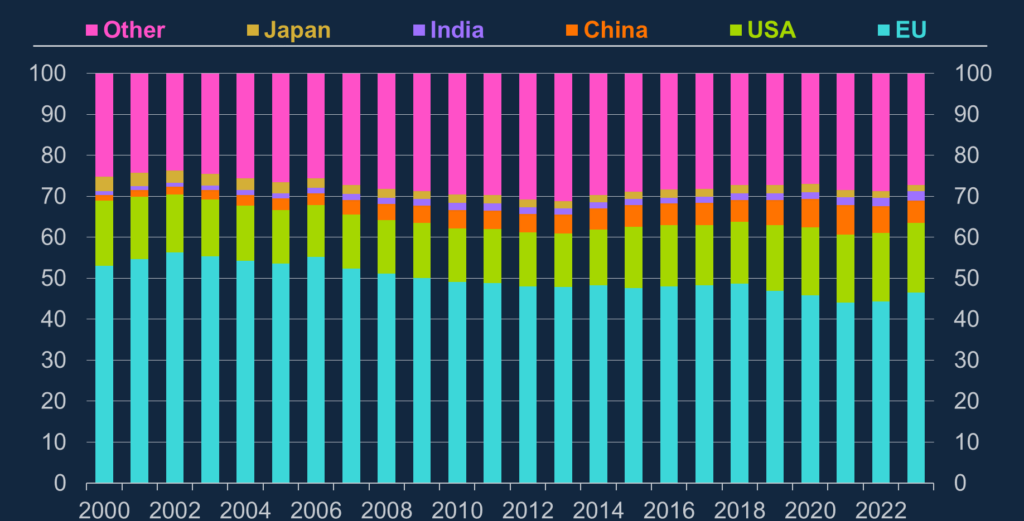

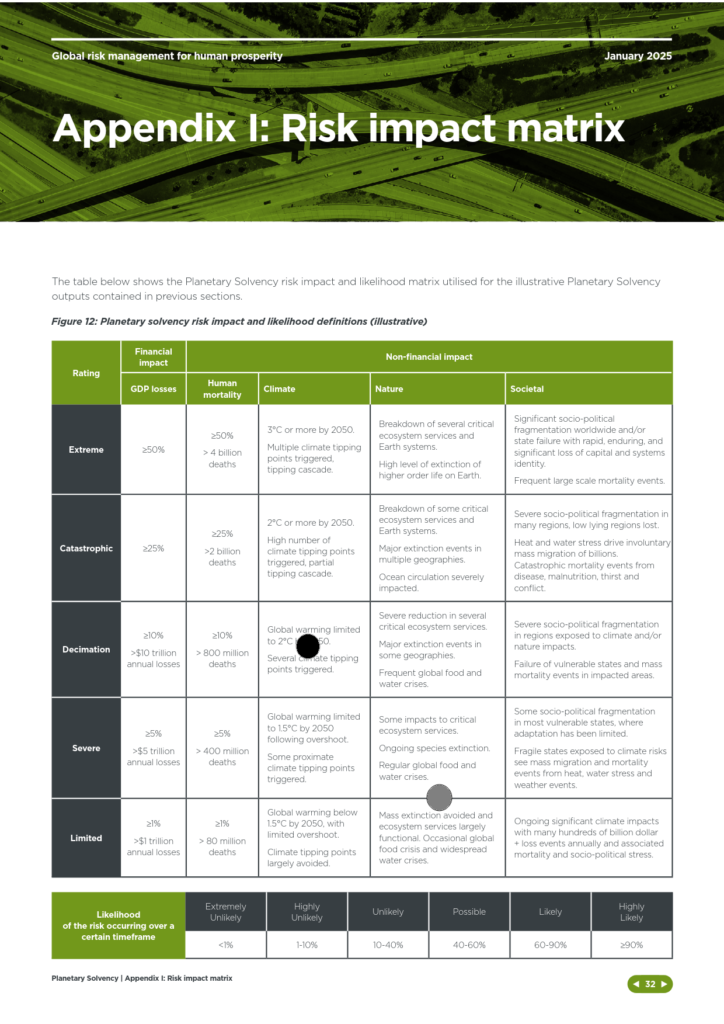

According to the Commons Library briefing note from October 2018, the Office for Budget Responsibility (OBR) estimates that, as at the end of January 2018, the interventions had cost the public £23 billion overall. The net balance is the result of a £27 billion loss on the RBS rescue, offset by some net gains on other schemes. Total support in cash and guarantees added up to almost £1.2 trillion, including the nationalisation of Northern Rock (purchased by Virgin Money, which has since been acquired by the Nationwide Building Society) and the Bradford & Bingley (sold to Santander) and major stakes in RBS (now NatWest) and Lloyds. Peak government ownership in these banks is shown below:

If you read the Bank of England wacky timeline 10 years on from 2018, you will see a lot about how prepared they are to fight the last war again. As a result of this, cover has been given to actively forget 2008 as quickly as possible.

Except now various people are arguing that the risks of the next financial crisis are increasing again. The FT reported in January on the IMF’s warnings (from their Global Financial Stability Report from April 2024) about the rise in private credit bringing systemic risks.

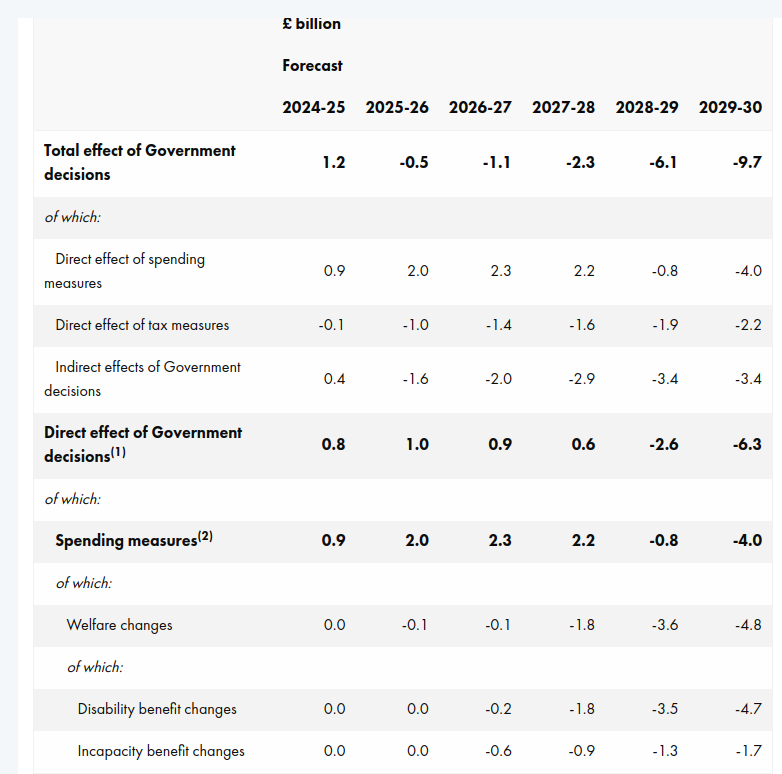

Meanwhile Steve Keen (one of the very few who actually predicted the 2008 crisis) in his latest work Money and Macroeconomics from First Principles, for Elon Musk and Other Engineers has a whole chapter devoted to triggering crises by reducing government debt, which makes the following point:

A serious crisis, triggered by a private debt bubble and crash, has followed every sustained attempt to reduce government debt. This can be seen by comparing data on government and private debt back to 1834.

(By the way, Steve Keen is running a webinar for the Institute and Faculty of Actuaries entitled Why actuaries need a new economics on Friday 4 April which I thoroughly recommend if you are interested)

Which brings us to the Spring Statement, which was about (yes, you’ve guessed it!) reducing government debt (or the new formulation of this “increasing OBR headroom”) and boosting GDP growth. Watching the Chief Secretary to the Treasury, Darren Jones, and Paul Johnson from the IFS nodding along together in the BBC interviews immediately afterwards, you realised how the idea of allowing the OBR to set policy has taken hold. Johnson’s only complaint seemed to be that they appeared to be targeting headroom to the decimal point over other considerations.

I have already written about the insanity of making OBR forecasts the source of your hard spending limits in government. The backdrop to this Statement was already bad enough. As Citizens Advice have said, people’s financial resilience has never been lower.

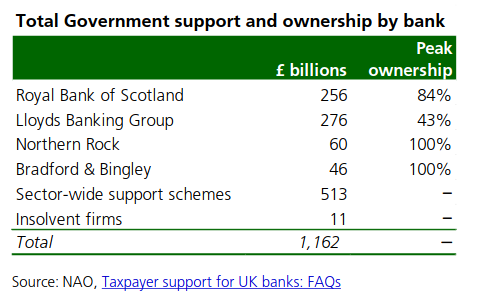

But aside from the callousness of it all, it does not even make sense economically. The OBR have rewarded the government for sticking to them so closely by halving their GDP growth projections and, in the absence of any new taxes, it seems as if disabled people are being expected to do a lot of the heavy lifting by 2029-30:

Part of this is predicated on throwing 400,000 people off Personal Independence Payments (PIPs) by 2029-30. According to the FT:

About 250,000 people, including 50,000 children, will be pushed into relative poverty by the cuts, according to a government impact assessment.

As Roy Lilley says:

We are left standing. Abandoned, to watch the idiocy of what’s lost… the security, human dignity and wellbeing of our fellow man, woman and their family… everything that matters.

As an exercise in fighting the last war, or, according to Steve Keen, the wars successive governments have been fighting since 1834, it takes some beating. It was litost on steroids for millions of people.

So what does the government think these people are going to fill the income gap with? It will be private debt of course. And for those in poverty, the terms are not good (eg New Horizons has a representative APR of 49% with rates between 9.3% APR and maximum 1,721% APR).

And for those who can currently afford a mortgage (from page 47 of the OBR report):

Average interest rates on the stock of mortgages are expected to rise from around 3.7 per cent in 2024 to a peak of 4.7 per cent in 2028, then stay around that level until the end of the forecast. The high proportion of fixed-rate mortgages (around 85 per cent) means increases in Bank Rate feed through slowly to the stock of mortgages. The Bank of England estimates around one-third of those on fixed rate mortgages have not refixed since rates started to rise in mid-2021, so the full impact of higher interest rates has not yet been passed on.

So, even before considering the future tax increases the FT appears to be expecting, the levels of private debt look like they will shoot up very quickly. And we all know (excluding the government it seems) where that leads…